Join our Telegram channel to stay up to date with the latest news

Bitcoin seeks to reclaim $90,000 as US President Donald Trump dropped his tariff threats and ruled out seizing Greenland by force from an ally.

Trump’s theatrics and resulting tensions kept markets on edge this week, prompting investors to take the latest developments with a pinch of salt, although relief was palpable.

BTC edged up a fraction of a percentage to trade at $89,955 as of 1:19 a.m. EST, with an intraday low of $87,304 and a high of $90,295, according to Coingecko data.

The crypto market also increased its market capitalization to $3.13 trillion. As a result, total liquidations in the crypto market amounted to $605 million.

Trump renounces EU tariffs and markets rise

Crypto investors returned to risk after President Donald Trump took a calmer tone on Greenland and pointed to a path toward a deal that took some heat off markets.

According to Trump, he had reached the “framework for a future agreement” involving NATO on Greenland and indicated that he would delay the tariff threat.

JUSTIN: Trump says the United States has outlined a framework for a future deal involving Greenland after a meeting with NATO Secretary General Mark Rutte.

Fares scheduled for February 1 have been postponed.

Negotiations will be led by Vice President JD Vance and Secretary of State Marco Rubio…-Laura Shin (@laurashin) January 21, 2026

“It’s a long-term deal. It’s the ultimate long-term deal. It puts everyone in a great position, especially when it comes to security and minerals,” Trump told reporters.

During his speech at the World Economic Forum in Davos, Trump said he would not impose tariffs and ruled out the use of force in the conflict over Danush territory.

“I will not do that,” the US president said in Davos about an attack aimed at securing Greenland.

“Okay? Now everyone says, ‘Oh, good,’ that’s probably the most important statement I made because people thought I would use force. I don’t need to use force, I don’t want to use force, I won’t use force.”

Trump’s remarks came as markets waited to see the full extent of the EU’s trade retaliation over the Greenland issue.

As crypto markets have risen, gold price remained largely stable after hitting a record high near $4,900 an ounce in the previous session.

Silver prices rose 1% to $94.03 an ounce, just below the record high of $95.89/ounce reached earlier this week.

Bitcoin Price Set for a Return Above $100,000

Bitcoin Price is currently consolidating near the $89,000-$90,000 region, holding just above short-term support around $87,000-$88,000, which buyers have been defending after the heavy selling since November highs.

This consolidation comes after a sharp decline from the $115,000 zone, where selling pressure accelerated and forced the BTC price to enter a corrective phase. Demand moved closer to the $82,000 zone. The rebound in this area suggests that the bearish momentum has slowed in the long term.

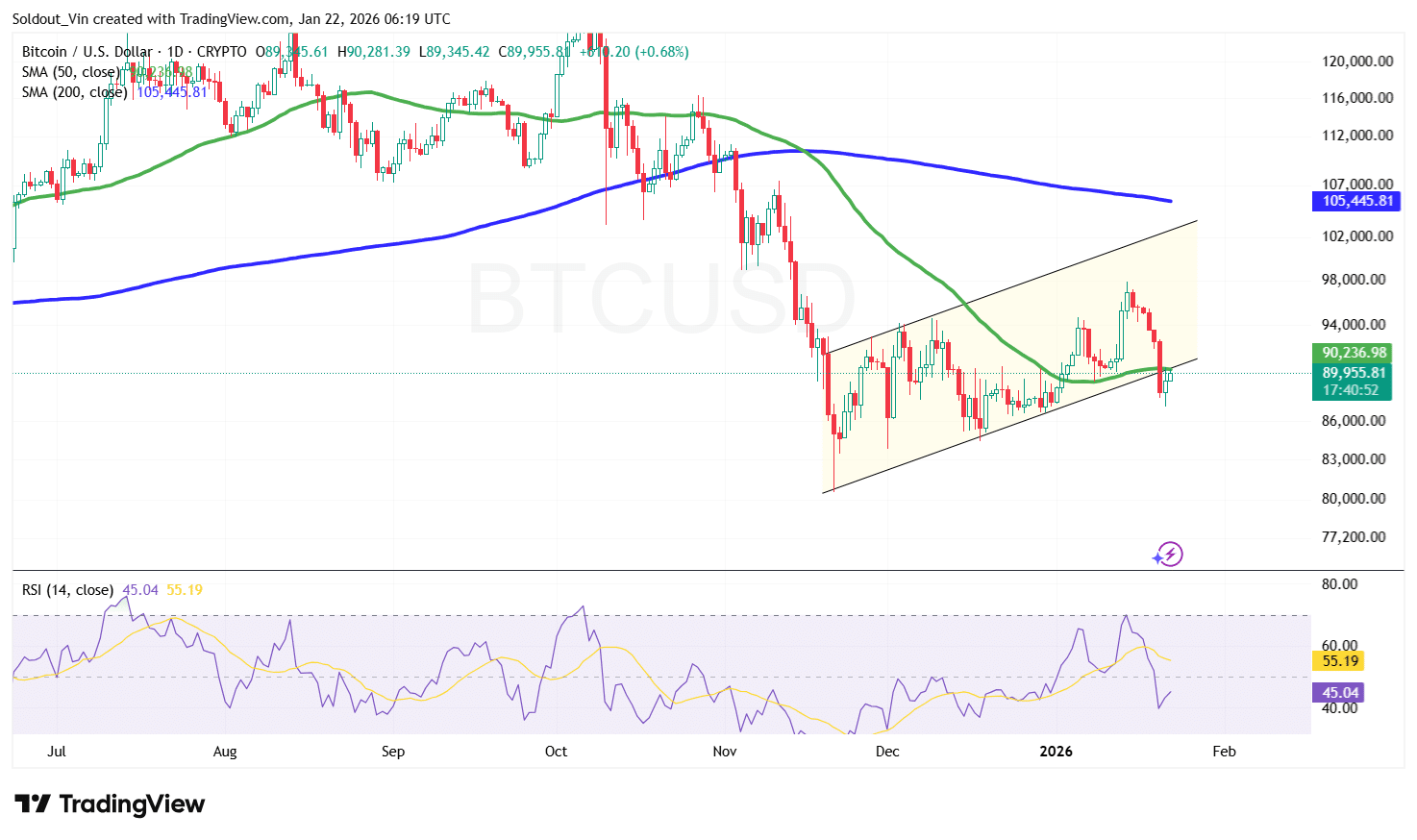

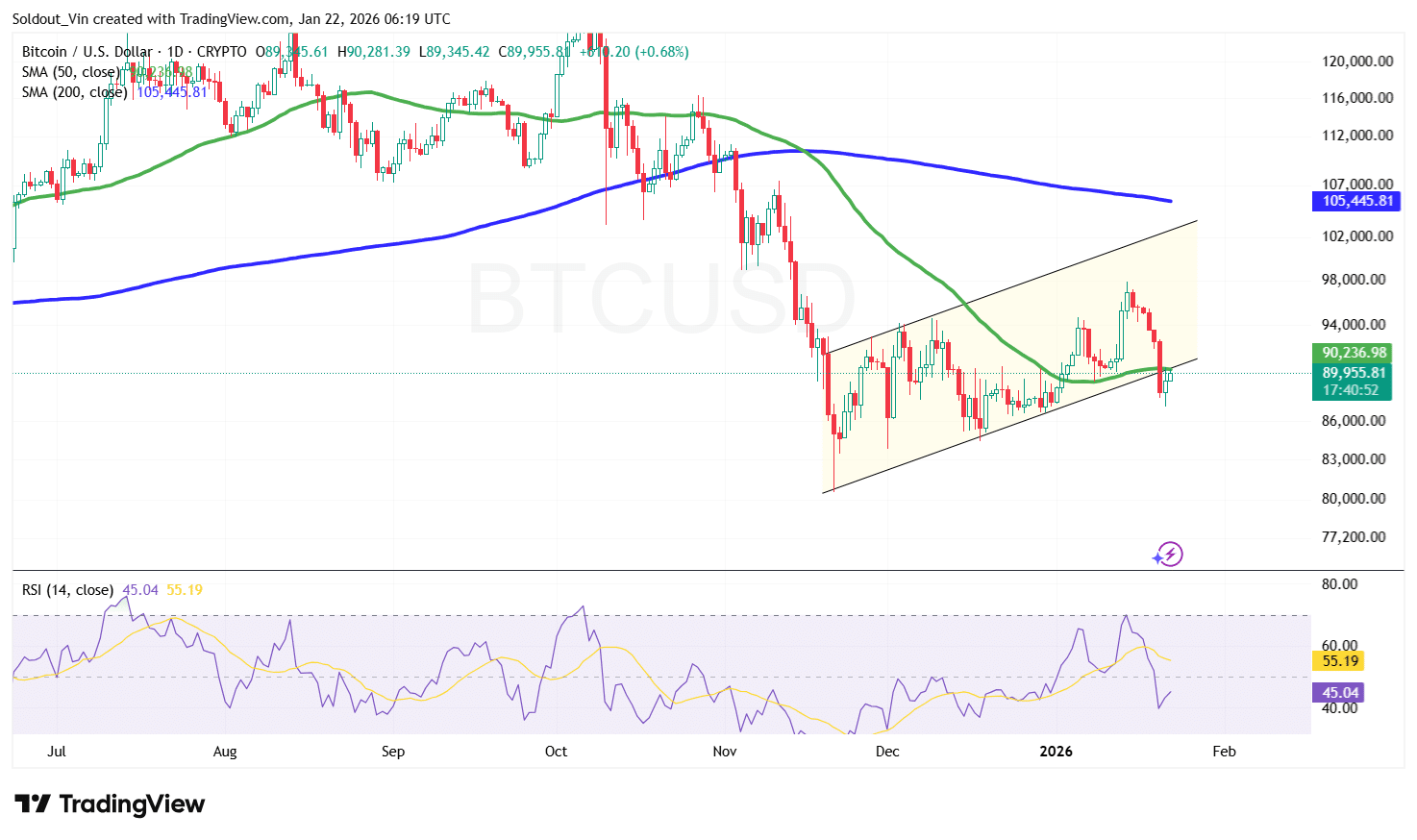

Bitcoin is trading around the 50-day simple moving average (SMA) near $90,200, but remains well below the 200-day simple moving average (SMA) around $105,000, which continues to provide major resistance to the upside.

The downward slope of the 200-day SMA indicates that the broader trend remains bearish unless Bitcoin manages to reclaim this level and hold above it.

Bitcoin’s relative strength index (RSI) is hovering around 45, hovering below the neutral mark of 50. This suggests momentum remains weak, but not oversold, leaving room for an attempted recovery if buying pressure increases.

According to the BTC/USD 1-day chart, Bitcoin price is trading in an ascending channel after the sell-off. This structure often represents a bearish continuation trend, with price currently trading between channel support and resistance. A move towards the $94,000-$98,000 resistance zone is possible, where the upper boundary of the channel aligns with previous rejection levels.

A clear break above $98,000, followed by a recovery of the 200-day SMA near $105,000, would be the first significant signal of a trend reversal.

For Bitcoin to realistically aim for a sustainable return above $100,000, it would require a confirmed trend change, which could require a close above the $95,000 area.

Conversely, failure to breach channel resistance could trigger another pullback, with $88,000 serving as initial support, followed by the $85,000 demand zone if selling pressure returns.

Related news:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news