Ethereum is struggling to regain higher price levels as persistent resistance continues to dampen bullish momentum. After several failed recovery attempts, ETH remains locked in a fragile structure that reflects broader uncertainty in the crypto market. While analyst opinions remain divided on the near-term outlook, a growing majority are increasingly speaking out about the risk of a broader bear market emerging in 2026, citing weakening momentum, deteriorating sentiment and diminishing liquidity as key warning signs.

In this difficult context, on-chain activity has received renewed attention. Data tracked by Arkham shows that a high-profile Bitcoin OG – known for successfully shorting the market during the October 10 sell-off – has made a significant move involving a substantial position in Ethereum. The scale and timing of this activity has not gone unnoticed, especially given the trader’s track record and influence on market sentiment.

The transaction fueled speculation about intentions. Some market participants interpret the move as a defensive repositioning amid growing downside risk, while others see it as a calculated adjustment in anticipation of increased volatility. Regardless of interpretation, large transfers from well-known entities tend to have signaling value, particularly when they occur during periods of technical fragility.

As Ethereum remains stuck below key resistance levels, the market is now watching closely to see if this on-chain development portends further selling pressure or signals a more complex positioning shift. With sentiment already tense, the next few sessions could prove crucial for Ethereum’s mid-term direction.

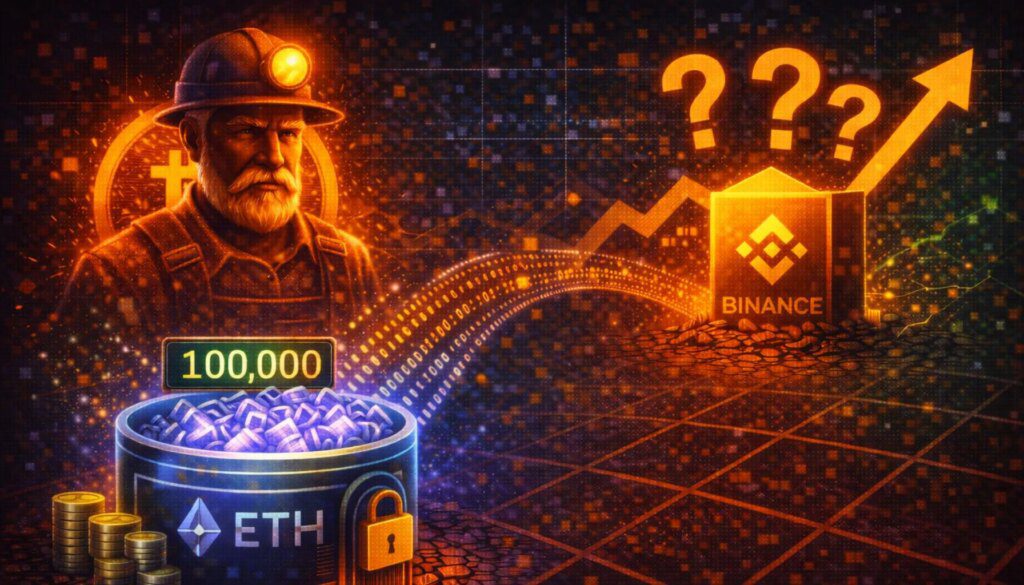

Ethereum Whale Transfer Sparks Positioning Speculation

On-chain data shared by Lookonchain signaled a major move from the so-called Bitcoin OG, a trader known for running a massive $717 million long exposure across Bitcoin, Ethereum, and Solana. The wallet associated with this entity deposited 100,000 ETH, worth approximately $292 million, into Binance, immediately attracting the attention of investors and analysts.

Given the scale of the transfer and the trader’s prior influence in the market, the transaction is widely seen as a potential signal rather than routine activity.

Several scenarios appear to be the most plausible explanations. The simplest is risk management. Transferring ETH to an exchange allows the holder to reduce their exposure, either by selling ETH for spot or opening hedges via derivatives to protect an existing long portfolio amid increased volatility. Another possibility is collateral management. Large traders often move assets to exchanges to meet margin requirements or rebalance leverage, especially during periods of falling prices.

Less bearish interpretations also remain on the table. The deposit could be part of a short-term tactical transaction, allowing rapid execution without signaling an intention to completely unwind the position. In some cases, large holders move their assets between custodians or exchanges for operational reasons, although the timing makes this less likely.

Ultimately, the filing does not confirm the sale outright. However, this suggests that the trader is actively managing risks. As Ethereum remains under technical pressure, markets will be closely watching whether this ETH transfer precedes a subsequent distribution or proves to be a temporary adjustment as part of a broader long-term strategy.

Price Holds Long-Term Support

Ethereum is trading near the $2,930 level on the weekly chart, consolidating after a sharp pullback from highs of $4,800-$5,000 set earlier in the cycle. Even though prices remain well above long-term macroeconomic support, the recent structure reflects a clear loss of momentum. ETH has moved from a strong impulsive advance into a corrective phase, marked by lower highs and increasing selling pressure at key resistance areas.

From a trend perspective, Ethereum is now hovering around its medium and long-term moving averages. The loss of the faster weekly moving average marked the start of the correction, while price is currently testing the area around the 200-week average, which has historically acted as a critical inflection point during major market transitions. This area now functions as a battleground between long-term buyers and sellers defending their previous gains.

Price behavior over the past few weeks suggests indecision rather than capitulation. The large bearish candles were followed by smaller candles, indicating that the aggressive selling has slowed, but buyers have not yet regained control. The volume supports this interpretation, with high activity during the initial sale and more moderate participation during the consolidation.

Structurally, the $2,800-$3,000 range is crucial. Maintaining this zone preserves Ethereum’s broader bull market structure. A sustained breakdown below would likely confirm a deeper corrective move, while a stabilization could allow ETH to build a base before attempting to challenge higher resistance levels near $3,400 and $3,800.

Featured image from ChatGPT, chart from TradingView.com

Editorial process as Bitcoinist focuses on providing thoroughly researched, accurate and unbiased content. We follow strict sourcing standards and every page undergoes careful review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance and value of our content to our readers.