CryptoQuant CEO Ki Young Ju says on-chain data signals that the Bitcoin (BTC) bull market is back.

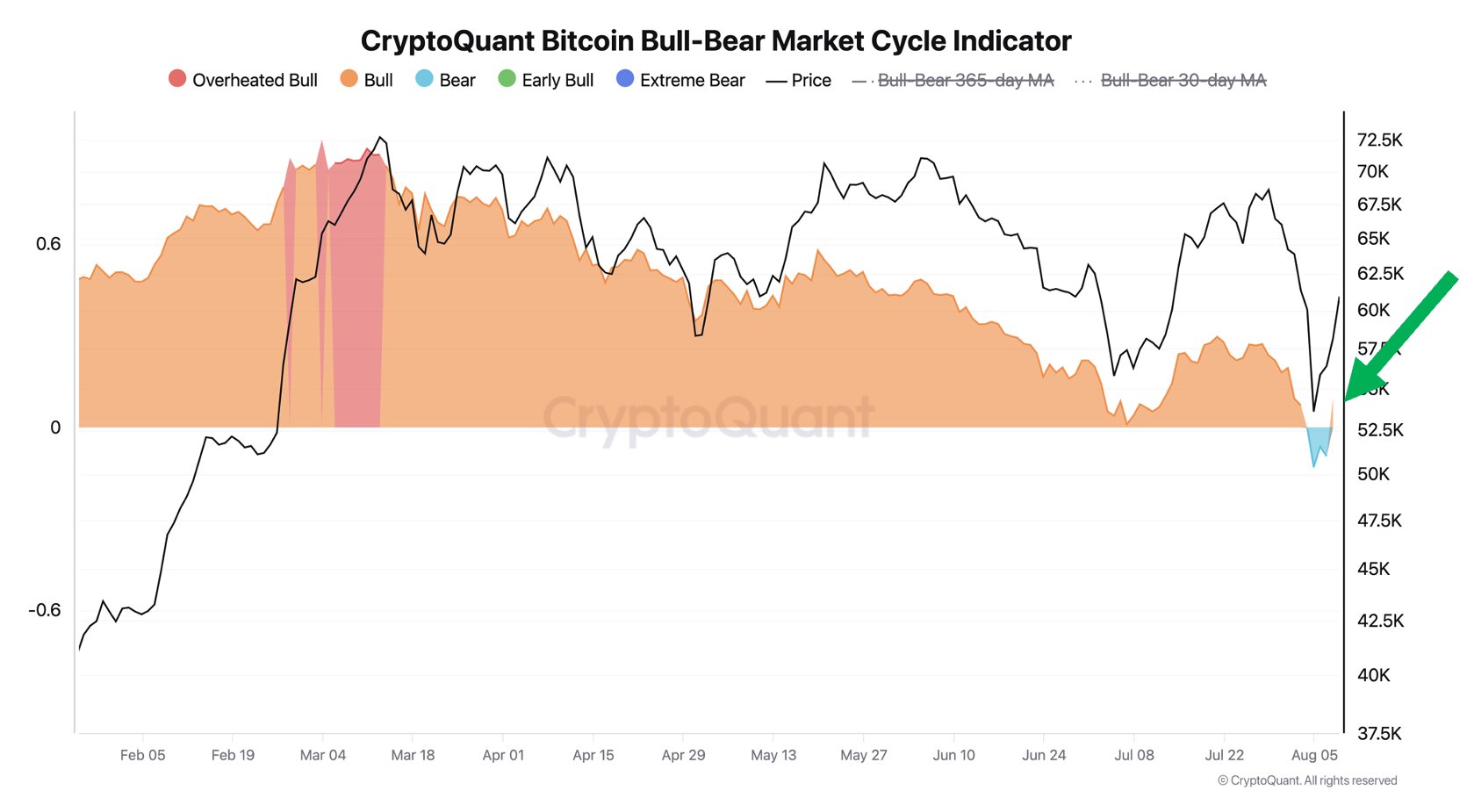

The CEO of the analytics firm tells his 361,000 followers on social media platform X that CryptoQuant’s Bitcoin Bull-Bear Market Cycle indicator, which tracks phases of investor sentiment, is bullish again after briefly dipping into bearish territory.

“Most of the Bitcoin chain cyclical indicators that were hovering around the boundary have now returned to a bull market. BTC has only been depreciated for three days.”

Based on the data, Ju believes the bull market is still intact. However, if the market does not recover in the next two weeks, he says he may reconsider his conclusion.

“I’m the smart money, so if I’m wrong, it means the new whales are either misinformed or have underestimated the macro environment.”

Ju recently reported that 404,448 Bitcoins were transferred to permanent holder addresses over a 30-day period, a clear sign of accumulation.

“Within a year, some entity – whether traditional financial institutions (TradFi), corporations, governments or others – will announce that they have acquired Bitcoin in Q3 2024.

And retail investors will regret not buying it because they were afraid the German government would sell Mt. Gox or some other macroeconomic bullshit.

At the time of writing, Bitcoin is trading at $61,093.

Don’t miss a thing – Subscribe to receive email alerts directly to your inbox

Check price

Follow us on XFacebook and Telegram

Surf the Daily Hodl Mix

Disclaimer: Opinions expressed on The Daily Hodl are not investment advice. Investors should do their own due diligence before making any high-risk investments in Bitcoin, cryptocurrencies or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated image: DALLE3