If you have been around Bitcoin for long enough, you know it moves in cycles and the cycle in half is a big problem. It happens approximately every four years, stops the reward of the blockand historically launched major price movements. But here is the thing: it is not only the event in half that counts; This is what holders do before and after.

Currently, long -term holders who have been holding their BTC for 3 to 5 years are accumulating quietly. Glassnode data show that after having unloaded more than 2 million BTCs in two large waves earlier in this cycle, these carriers are now deep in reactuction mode.

During cycle 2023-2025, long-term holders distributed more than 2 m $ BTC in two distinct waves. However, everyone was followed by a strong reactive, helping to absorb the pressure of the sale. This cyclic balance can be stabilizing prices. pic.twitter.com/haozhg4q8o

– Glassnode (@glassnode) March 31, 2025

Since mid-February, they have added around 363,000 BTC to their wallets. This is a strong signal: they are not traders looking for a quick flip. They play long game and seem to position themselves for what comes next.

Whales intensify accumulation efforts and move on the USD undervalued BTC

Meanwhile, the whales, wallets with more than 1,000 BTC, were occupied Also. At the beginning of April, the “accumulation score” of Glassnode for the big whales struck a perfect 1.0, which means that they were going hard to buy about two weeks in a row.

Whales holding> 10k $ BTC In briefly reached a perfect accumulation score (~ 1.0) at the turn of the month, reflecting intense purchases of 15 days. The score has since been released to ~ 0.65, still signaling a regular accumulation.

Meanwhile, the cohorts of <1 $ BTC Up to 100 $ BTC have intensified their … pic.twitter.com/7uda7g8nsm– Glassnode (@glassnode) April 7, 2025

It has been slightly cooled since then (currently about 0.65), but this still reflects an aggressive accumulation compared to the average.

This The behavior often signals a silent transfer of short -term coins or retail investors to longer -term and pocket actors. Whether they are preparing for a bull race or simply the cover against macro uncertainty, It is clear the Large players treat this price area as a purchase opportunity.

Short -term holders show caution after reducing bitcoin half

Now turn over the objective on the other side of the spectrum: short -term carriers, portfolios that have BTC for a few weeks to six months. These people act more sophisticated. Historically, this group sell Every 8 to 12 months in waves. Their expense behavior is currently near the lower end of the range. Translation? They hold… For the moment.

But it is a double -edged sword. If the price drops, these holders can panic and sell, refueling A potential drawback. SO, Sitting even today, they could become the first domino to fall into a correction scenario.

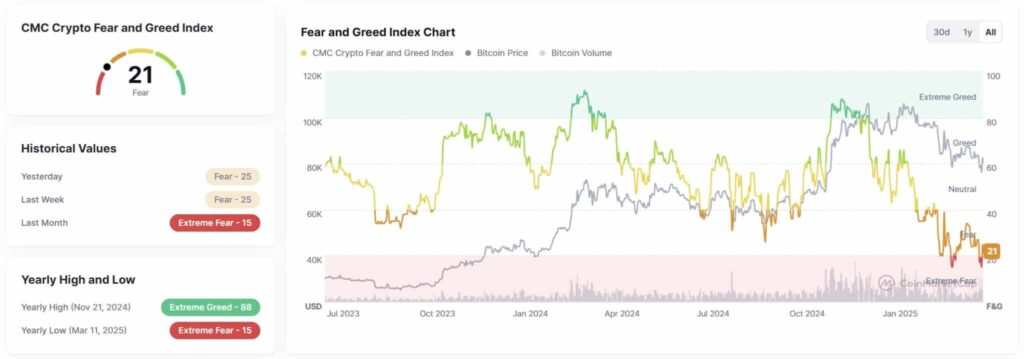

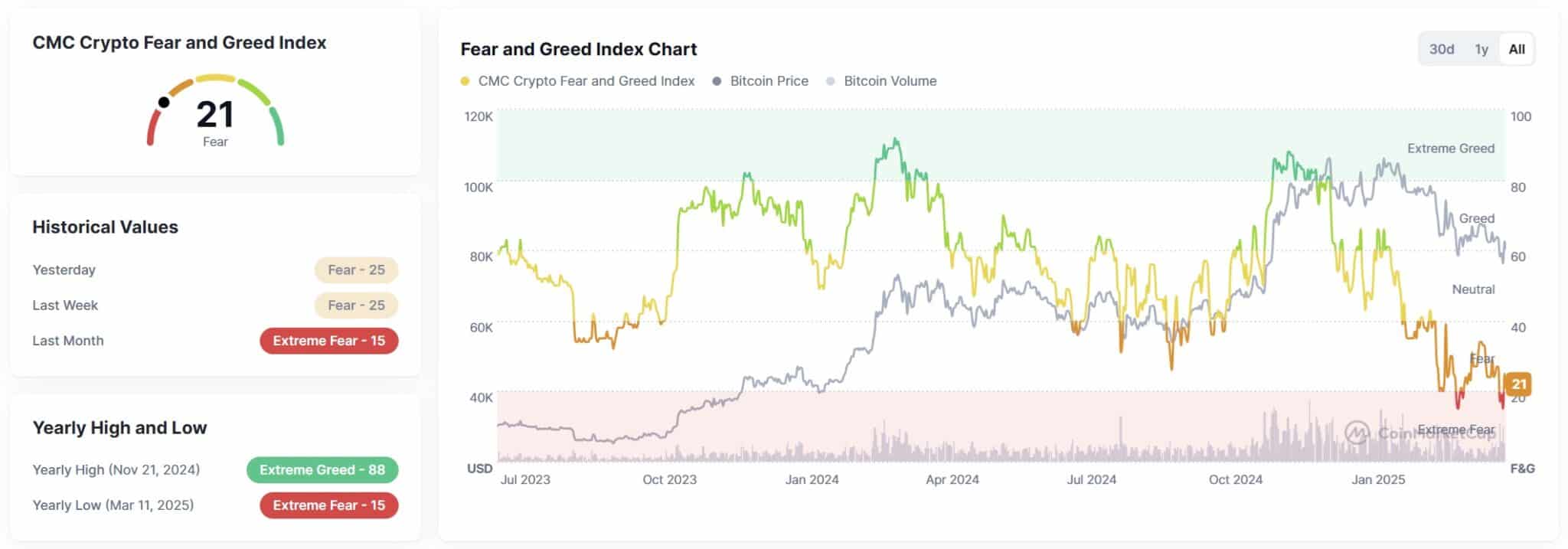

The feeling of the market reflects the underlying uncertainty

And then there is the feeling, always the X factor in crypto. The FEAR & GREED CoinmarketCap index has been sitting in the territory of “fear” and “extreme fear” for weeks. The atmosphere of the general investors has not caught up, even with an accumulation behind the scenes.

Whether it is fears of inflation, macro tension or post-training fatigue, the market is not convinced Or We are heading following. And this kind of mood tends to maintain high and low conviction volatility.

In the front: continuous growth potential

SO, Or Does that leave us? Long -term holders and whales accumulate quietly, often preparing the way for higher price action. But we are still in a transitional area until changes in feeling and short -term holders stop starting with each red candle.

Call that calm before the next phase. Half reduction is done – Now the wait (and the observation) begins.

DISCOVER: 20+ Next Crypto to explode in 2025

Join the 99Bitcoins News Discord here for the latest market updates

Main to remember

-

Long-term Bitcoin holders have resumed accumulation, adding more than 363,000 BTC since mid-February after previous sales.

-

Whales with more than 1,000 BTC showed a cutting -edge accumulation in early April, signaling confidence in the current price area.

-

Short -term holders are cautious, with a low expenditure activity, but could trigger drawbacks if the sale of panic begins.

-

The feeling of the market remains in the territory of “fear”, which suggests that investors are uncertain despite strong chain accumulation tendencies.

-

With the reduction of half full and the increase in the rise, the scene can be defined for the next bull phase – once the feeling and alignment of the momentum.

Post-presenting post-reply bitcoin: long-term holders are again responsible-is the next rally a rally load? appeared first on 99Bitcoins.