Join our Telegram channel to stay up to date with the latest news

The price of Bitcoin fell by a fraction of a percentage over the past 24 hours to trade at $88,300 as of 11 p.m. on a 20% increase in daily trading volume at

That’s when CFTC Chairman Michael Selig named Amir Zaidi as chief of staff, marking a first step in leadership as the agency prepares for new regulatory challenges. Zaidi previously worked at the CFTC from 2010 to 2019, holding senior positions including head of the Market Surveillance Division, where he managed key derivatives policies.

He was instrumental in the introduction of CFTC-regulated Bitcoin futures during Donald Trump’s first term, an important step in bringing cryptocurrency-related products under federal oversight. The appointment comes as Congress considers digital asset legislation that could expand the CFTC’s authority.

🚨BREAKING: CFTC Chairman Selig appoints Amir Zaidi as chief of staff, highlighting his previous role in approving Bitcoin futures. pic.twitter.com/X5MfbfuK4o

– Coinbureau (@coinbureau) December 31, 2025

Selig stressed that Zaidi’s experience was critical in guiding the agency through these potential changes and helping it adapt to new responsibilities.

The Market Surveillance Division, previously headed by Zaidi, oversees the futures, options and swaps markets, monitors compliance and supervises exchanges and clearing agencies. Zaidi holds a Juris Doctor, cum laude, from the University of Maryland School of Law, and a Bachelor of Business Administration, summa cum laude, from Boston University.

As chief of staff, Zaidi will manage internal coordination, policy planning and operational oversight. It aims to bring stability to the commission as the derivatives and crypto markets evolve. Supporting the President’s agenda and ensuring regulatory operations run smoothly will be at the heart of his role.

Zaidi’s return highlights the importance of institutional experience and knowledge at the CFTC, particularly as it prepares for an expanded mandate on digital assets. His appointment allows the agency to maintain close oversight and effectively adapt to changes in traditional and crypto markets.

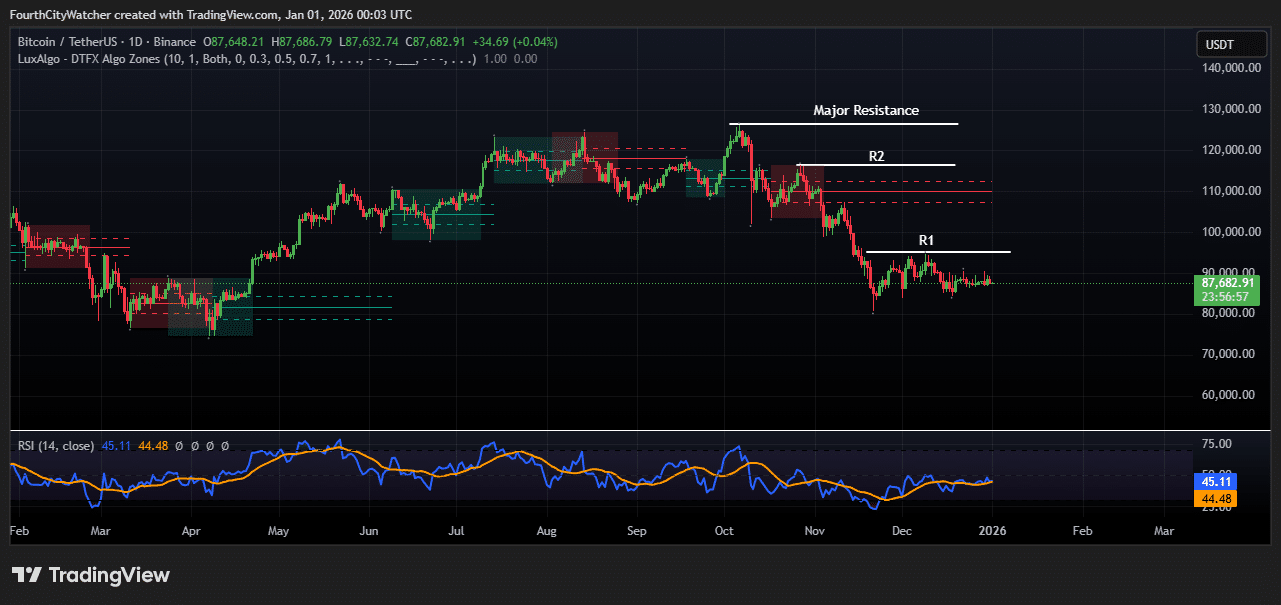

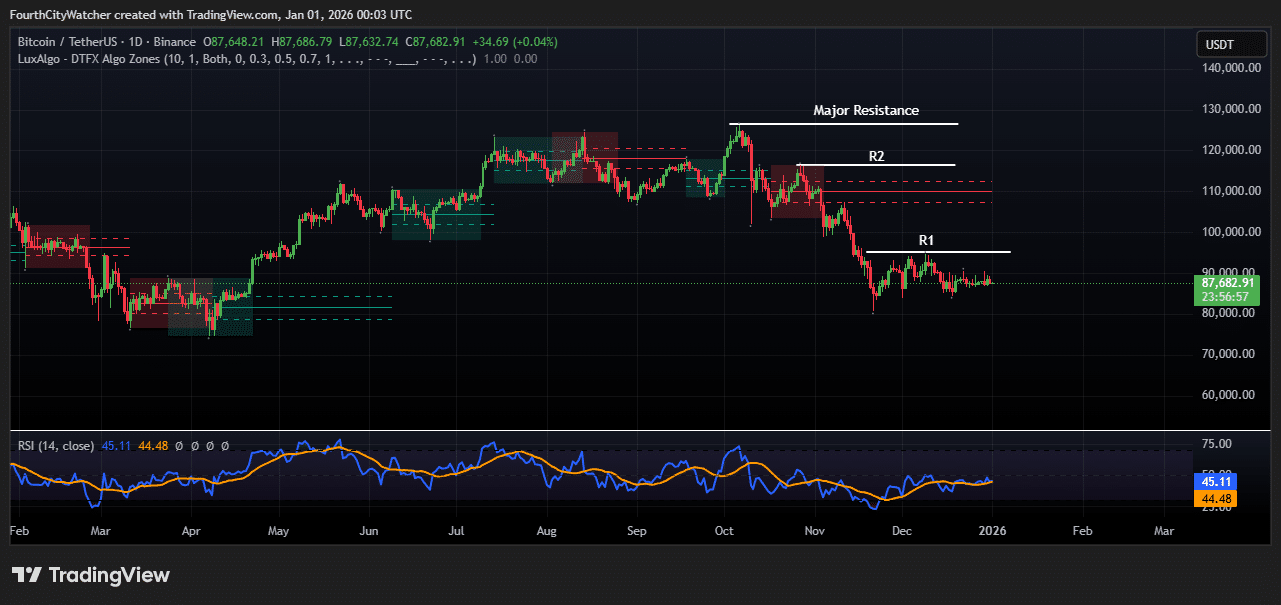

Bitcoin Sideways Action Signals Market Pause After October Drop

Bitcoin is currently trading around $87,632, showing sideways movement after falling from previous highs. On the chart, there are three notable resistance levels: R1 at around $90,000, R2 near $110,000, and a major resistance level between $125,000 and $130,000.

At this point, R1 is the most immediate and critical level to monitor. A successful breakout above this level could open the way to R2; However, the move away from the current price suggests that any upward momentum could be gradual.

The recent narrow trading range indicates a balance between buyers and sellers. This sideways action suggests the market is taking a breather after October’s sharp decline, with neither bulls nor bears holding clear control. Investors seem to be waiting for a decisive signal before committing to significant positions.

The RSI (Relative Strength Index) currently sits at 44.90, just below the neutral 50 mark. This reflects light selling pressure without indicating an oversold condition. A rise above 50 would suggest increasing bullish momentum, while a fall below 40 could indicate stronger selling pressure. Traders should pay attention to how Bitcoin reacts around the R1 level of $90,000, as this can determine the short-term trend.

Technically, this consolidation phase could serve as the basis for a rebound or signal a continuation of the downtrend if key support levels fail. If Bitcoin struggles to exceed $90,000, the next supports are around $85,000 and $80,000. Price action near these levels will be crucial in determining whether the market returns to stability or faces further downward pressure.

Overall, Bitcoin remains in a cautious phase, with immediate resistance at $90,000 and RSI indicating slight bearish sentiment. Traders are closely monitoring the R1 zone to assess potential moves.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news