Join our Telegram channel to stay up to date with the latest news

Bitcoin’s price plunged 6.4% over the past 24 hours to trade at $97,297 as of 2:21 a.m. EST, on trading volume that soared 47% to $110 billion.

The crisis came as BTC led the broader crypto market cap down 6% to $3.37 trillion, with the Crypto Fear & Greed Index showing “extreme fear” in the market.

Spot BTC ETFs (exchange-traded funds) in the United States lost $869.9 million in net outflows on Thursday, their second largest on record, according toin agreement with coin mechanism. The largest leak occurred on February 25, when they lost $1.14 billion.

Bitcoin is feeling the heat!

🔴 Spot ETFs saw outflows of $866.7 million yesterday, the second highest in history.

Stay strong and HODL! 💪 pic.twitter.com/05oG86HPp0

– Carl Moon (@TheMoonCarl) November 14, 2025

Grayscale’s Bitcoin ETF led outflows with $318.2 million, followed by BlackRock’s IBIT ($256.6 million) and Fidelity’s FBTC ($119.9 million).

As the price of BTC fell, Bitcoin mining company CleanSpark spent $460 million to buy back 30.6 million shares.

“Our repurchase of more than 10% of our outstanding shares for approximately $460 million reinforces our confidence in the company we are building and our commitment to long-term value creation.

Which it is not.

Not an ATM.

This is not a stock offering.

No insider is…– S Matthew Schultz (@smatthewschultz) November 13, 2025

It said the buyout supported its strategy of improving shareholder value and optimizing its capital structure.

With Bitcoin down over 13% in the past month, can the downtrend continue or will the bulls regain control?

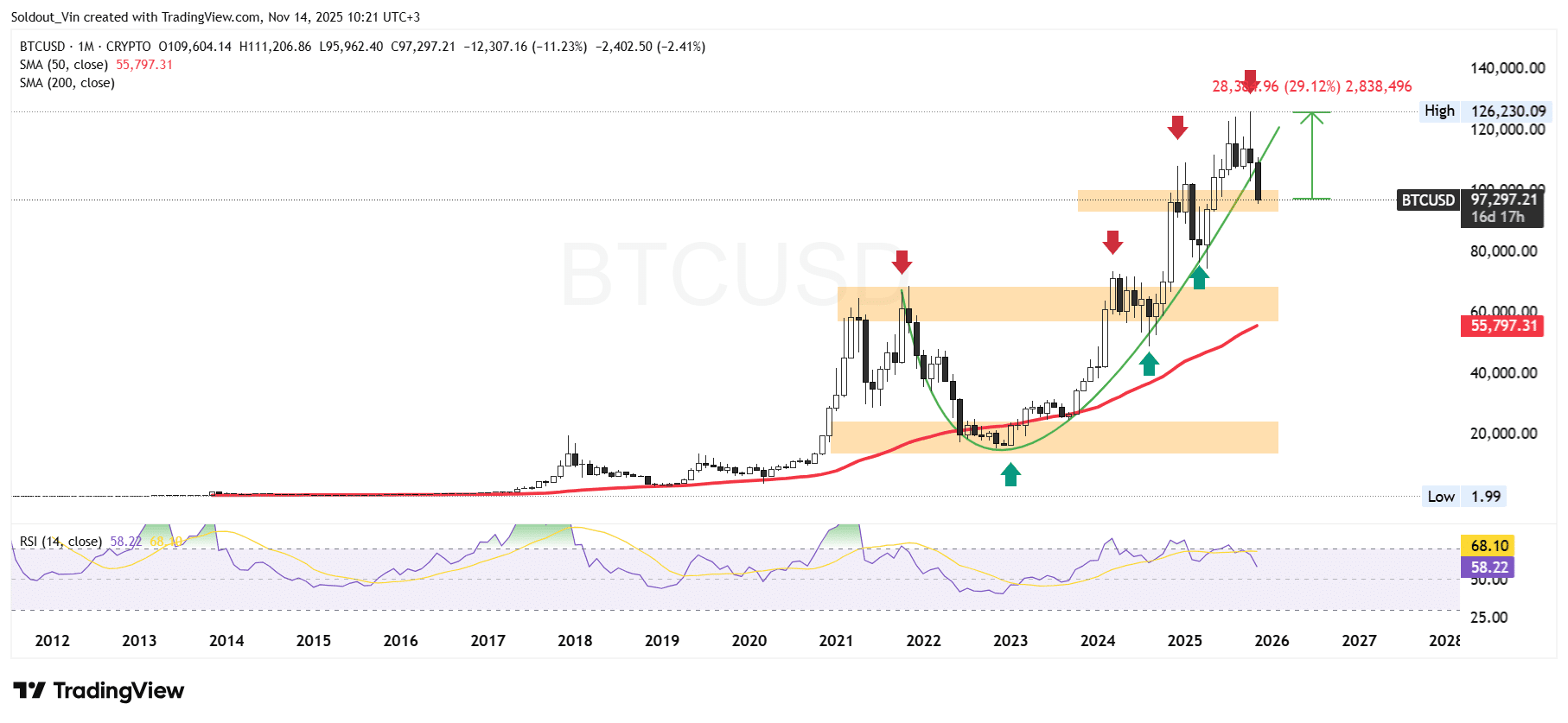

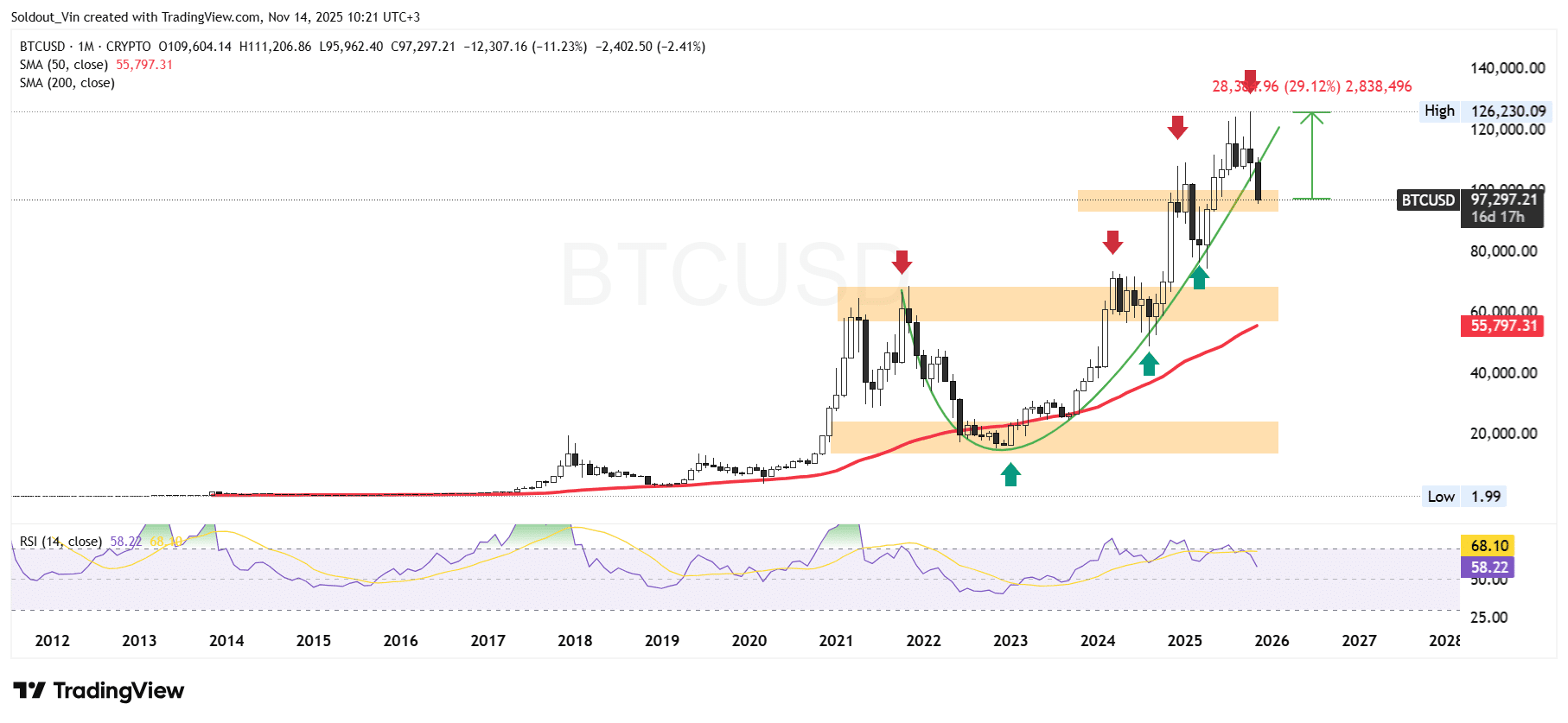

Bitcoin price: a healthy correction

After hitting the $68,500 resistance in 2021, the BTC Price corrected to find support around $15,600 in 2022.

Bitcoin bulls have been in control since overcoming the $25,000 resistance level and the $58,000 and $92,000 demand zones.

Due to this surge, the price of Bitcoin has maintained its position within a well-defined parabolic curve.

The continued rise has kept BTC price above the 50-day simple moving average (SMA) on the monthly chart.

However, after hitting the all-time high (ATH) of $126,230, Bitcoin price appears to be undergoing a healthy correction, with the recent candle falling below the curve limit.

With the market facing bearish pressure, the Relative Strength Index (RSI) is also reacting to this move, moving from the overbought zone of 70 to 58.

As the RSI falls, the price of Bitcoin could continue to fall. The next possible support area lies at $81,479. If the bears break above this level, the next support area lies at the 50-day SMA at $55,797.

According to popular crypto analyst Ali Martinez on X, if BTC falls below $95,930, the next key support levels are $82,045 and $66,900.

Below $95,930 the next key support levels for Bitcoin $BTC are at $82,045 and $66,900. pic.twitter.com/EmxusQlQde

– Ali (@ali_charts) November 14, 2025

Conversely, if the bulls defend the $94,000 support zone, Bitcoin could return to its ATH ($126,230), a 29% rise from the current level.

Michaël van de Poppe, a popular analyst on X with over 814,000 followers, BTC needs to reclaim the $101,000 level for a rally to occur.

In order to reverse the trend, markets must rebound above the previous support level to reclaim that level as support.

Of course, $BTC is showing weakness here, and it is below $100,000, so you would like to see a recovery of $101,000 to think about an upside rally.

Main reason for… pic.twitter.com/WsJA5ZwHBZ

– Michaël van de Poppe (@CryptoMichNL) November 14, 2025

Much will depend on whether the Federal Reserve decides to cut interest rates next month. Right now, the odds of it are down to just 49.6%.according to the CME Group FedWatch Tool.

Related news:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news