Join our Telegram channel to stay up to date with the latest news

Bitcoin’s price fell 0.8% over the past 24 hours to trade at $105,110 as of 4 a.m. on trading volume that rose nearly 3% to $70.22 billion.

The drop comes despite Strive’s purchase of 1,567 Bitcoins worth about $162 million from Vivek Ramaswamy, a purchase that propelled it past Galaxy Digital and into the top 15 global Bitcoin-holding companies. Strive’s latest purchase brings its total BTC reserve to 7,525 coins, while Galaxy Digital lags behind with 6,894, according to BitcoinTreasuries.

JUST IN: 🇺🇸 Vivek Ramaswamy’s ‘Strive’ buys 1,567 Bitcoins worth $162 million. pic.twitter.com/2ER2bBFnru

– Watcher.Guru (@WatcherGuru) November 10, 2025

The BTC purchase follows Strive’s recent IPO on Nasdaq, where its SATA preferred shares sold out quickly. Funding for this IPO fueled the new Bitcoin seizure. The average price paid was $103,315 per piece.

Try the updates:

1. SATA listed on Nasdaq following oversubscribed and upsized IPO.

2. Strive acquired 1,567 BTC for ~$162 million at ~$103,315 per Bitcoin. As of 10/11/25, we held 7,525 Bitcoins.

3. New $ASST & $SATA investor presentation published.

4. $SATA dividends should be ROC…

– Strive (@strive) November 10, 2025

On-Chain Bitcoin Activity Confirms Accumulation Trend

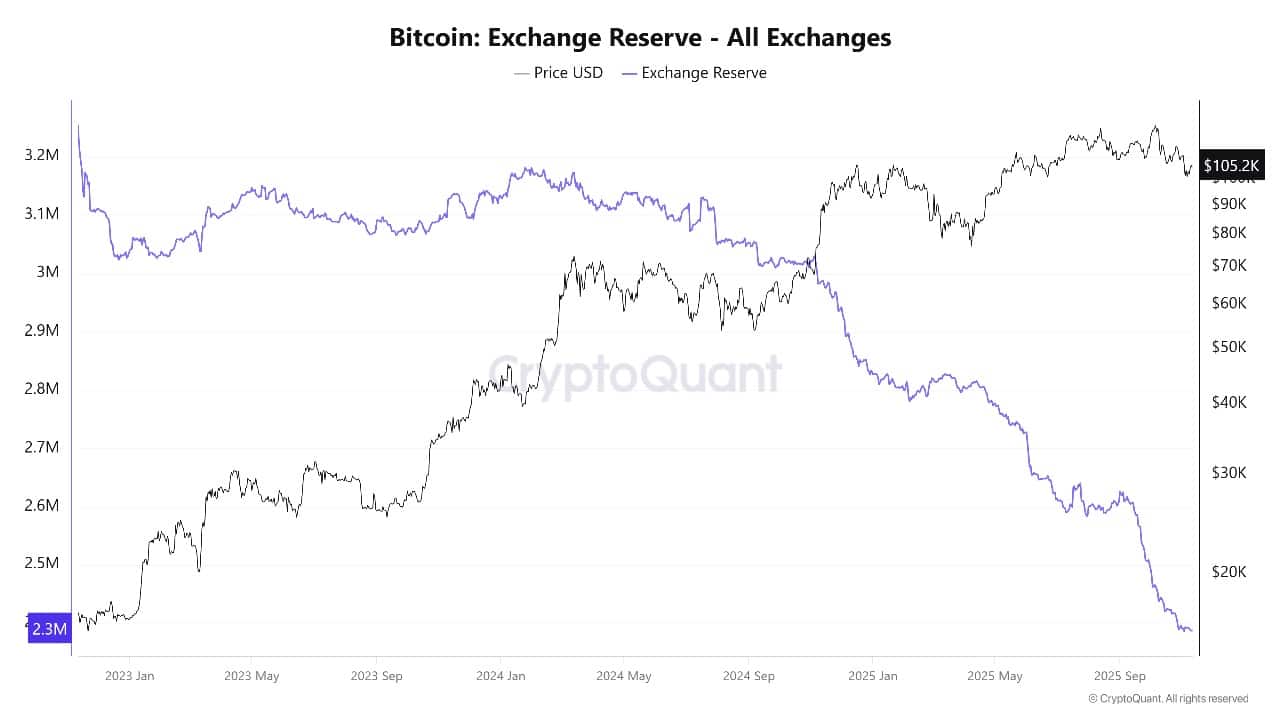

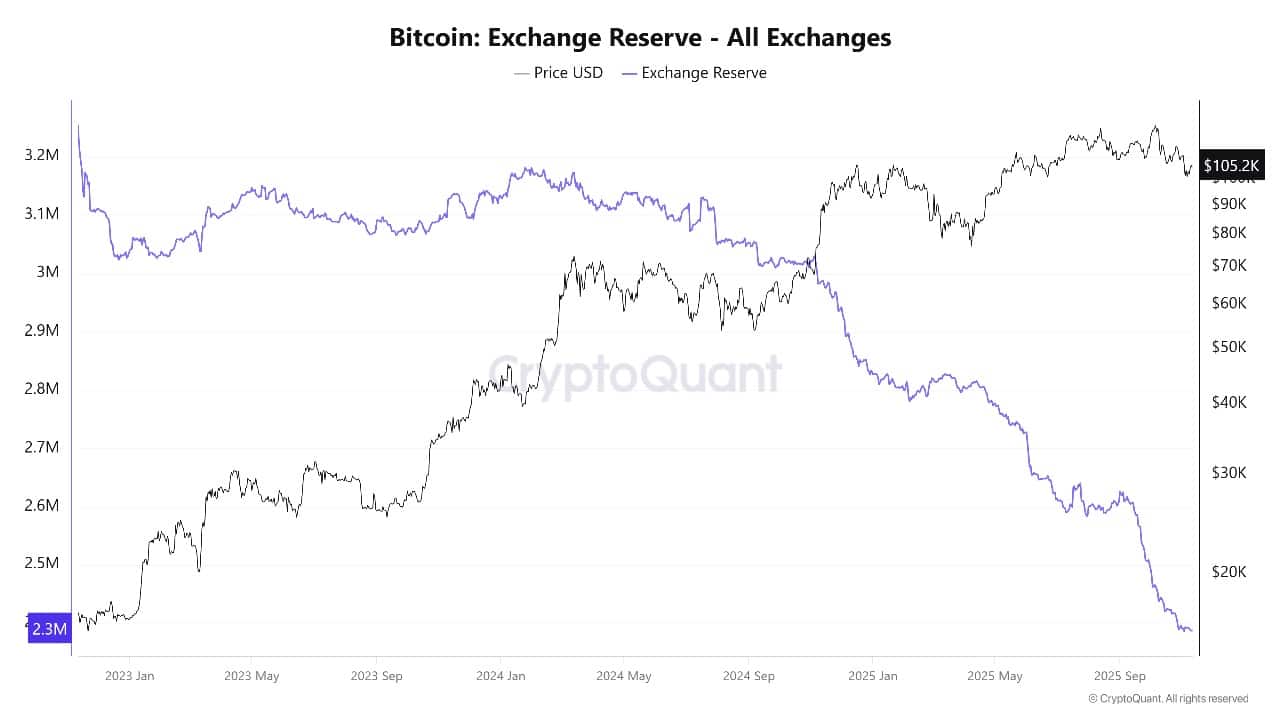

Bitcoin on-chain signals highlight further accumulation. Large companies moving coins to enterprise wallets boost network activity and help keep selling pressure low.

The supply held by treasury companies continues to grow as more companies add BTC to their balance sheets. Increasing wallet balances and decreasing numbers of coins on exchanges demonstrate long-term confidence.

Bitcoin Exchange Reserve: CryptoQuant

As more public companies move Bitcoin into their reserves, investor engagement with on-chain assets increases.

This trend supports rising prices as new buyers continue to enter. Network activity, particularly from large holders and corporate buyers, demonstrates continued demand. The reduction in foreign exchange reserves also indicates a steady accumulation, thereby reducing the risk of a sell-off.

BTC price analysis: towards $125,000 – $145,000?

Looking at the weekly BTCUSDT chart, the price is trading near $104,900, just above the 50-week simple moving average (SMA) at $103,169 and well ahead of the long-term 200-week SMA at $55,361.

BTCUSDT analysis source: Tradingview

Bitcoin price remains in a strong uptrend, moving slowly higher after bouncing off key support around the 50-week SMA.

BTC has formed higher highs and higher lows since mid-2024, showing that buyers remain active and control the direction of the market. Key support lies at $103,169 (50-week SMA), which is the average entry price of Strive’s last purchase.

Major resistance lies at the $126,000 to $145,000 region, based on the Fibonacci extension levels shown on the chart. If buyers surpass the $126,199 high, Bitcoin could quickly climb towards the $145,046 area, especially if larger buyers step in.

Technical indicators give more clues: the relative strength index (RSI) stands at 46.78, showing that momentum is positive but not yet overheated.

The MACD (Moving Average Convergence Divergence) indicator is slightly mixed, with the blue line just above the signal but still pointing upwards. While the Chaikin Money Flow (CMF) remains in positive territory at 0.07, suggesting capital inflows are stable.

As long as Bitcoin holds above the 50-week SMA and continues to make higher lows, the uptrend appears safe. Dips up to the $103,000 region are quickly bought back, showing buyer commitment. If price breaks above current resistance at $126,000, further gains are possible in the coming weeks, with upside targets between $130,000 and $145,000.

However, if Bitcoin falls below the $103,000 level, a short-term sell-off could push it towards the next support near the 200-week SMA at $55.36.

Holding above keeps the uptrend alive. In the event of a dip, buyers are expected to return quickly, locking in BTC for the long term as price demand for the coin increases.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news