Join our Telegram channel to stay up to date with the latest news

The price of Bitcoin fell 2% in the past 24 hours after Cathie Wood’s ARK Invest increased its exposure to crypto-related stocks, adding shares of Coinbase, Circle and Bullish amid an industry-wide price decline.

According to Friday’s ARK trading disclosures, the ARK Innovation ETF (ARKK) purchased 38,854 shares of Coinbase, while the ARK Fintech Innovation ETF (ARKF) added 3,325 more, for a total of $9.4 million. Circle Internet Group purchased a total of 129,446 shares of ARKK and ARKF, worth approximately $9.2 million, and ARK also invested $3.2 million in 88,533 bull stocks.

Coinbase shares closed down 2.77% at $216.95, Circle edged down 0.03% and Bullish fell 2% to $35.75. Along with these cryptocurrency purchases, ARK reduced its positions elsewhere, including selling 12,400 Meta Platforms shares valued at $8.03 million. ARK’s increased exposure comes despite the underperformance of cryptocurrency-related stocks in recent quarters.

Breaking 🚨: ARK Invest plans two crypto index ETFs, one with Bitcoin and major altcoins, and one without Bitcoin.

The ETFs will be listed on NYSE Arca, as Cathie Wood’s company also invests in companies like Netflix, Tempus AI and WeRide.

The company remains optimistic about… pic.twitter.com/Cf4UeeJqYP– CFN (@cryptoflairnews) January 24, 2026

The slowdown in digital assets in late 2025 weighed heavily on the ARK ETFs, with Coinbase becoming the main drag on the ARK Next Generation Internet ETFs (ARKW), ARKF, and ARKK. Coinbase shares fell more sharply than Bitcoin and Ether, as spot trading volumes on centralized exchanges fell 9% quarter-over-quarter following the October sell-off.

ARK Invest remains bullish on crypto

Roblox was the second biggest drag, despite strong bookings in the third quarter, as the company warned of lower operating margins in 2026 and faces additional pressure from Russia’s ban on the platforms. Despite these setbacks, ARK remains optimistic about crypto’s long-term potential. In its Big Ideas 2026 report, the company predicts that the digital asset market could reach $28 trillion by 2030, largely driven by Bitcoin adoption and price growth.

Bitcoin is expected to account for approximately 70% of the total market value, with approximately 20.5 million coins mined by 2030. If this prediction holds true, ARK estimates that Bitcoin could reach between $950,000 and $1 million, fueled by increasing institutional participation, corporate holdings, and the growth of Bitcoin ETFs.

ARK’s recent purchases underscore its long-term confidence in crypto, showing the firm is willing to increase its exposure even amid short-term market volatility and industry-wide declines.

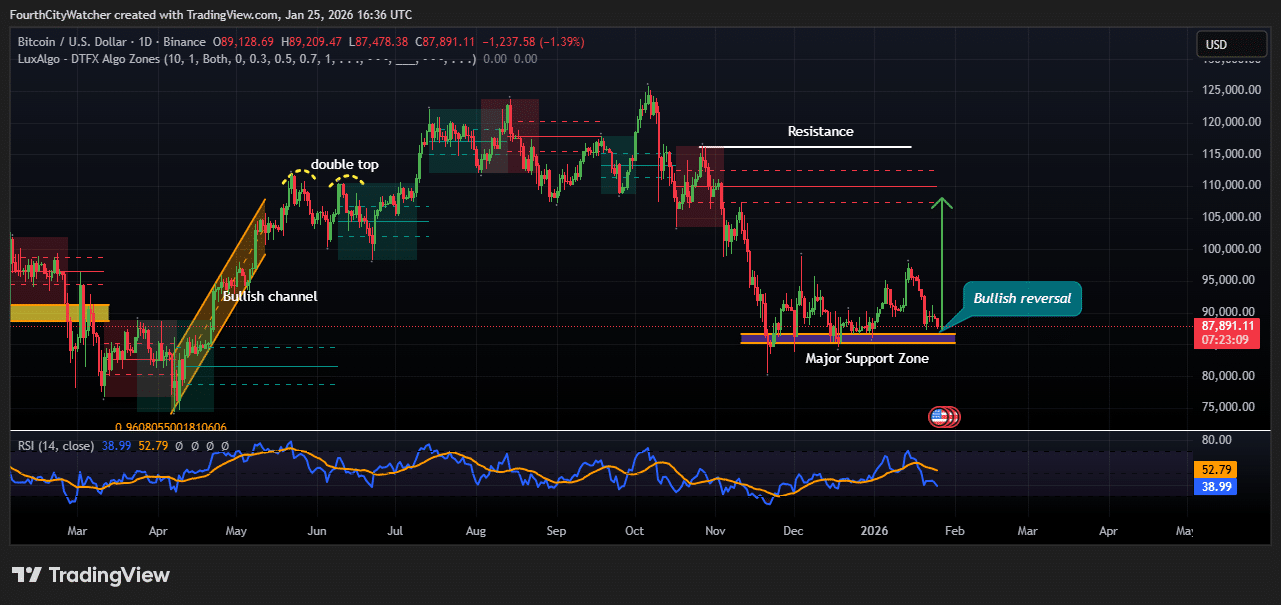

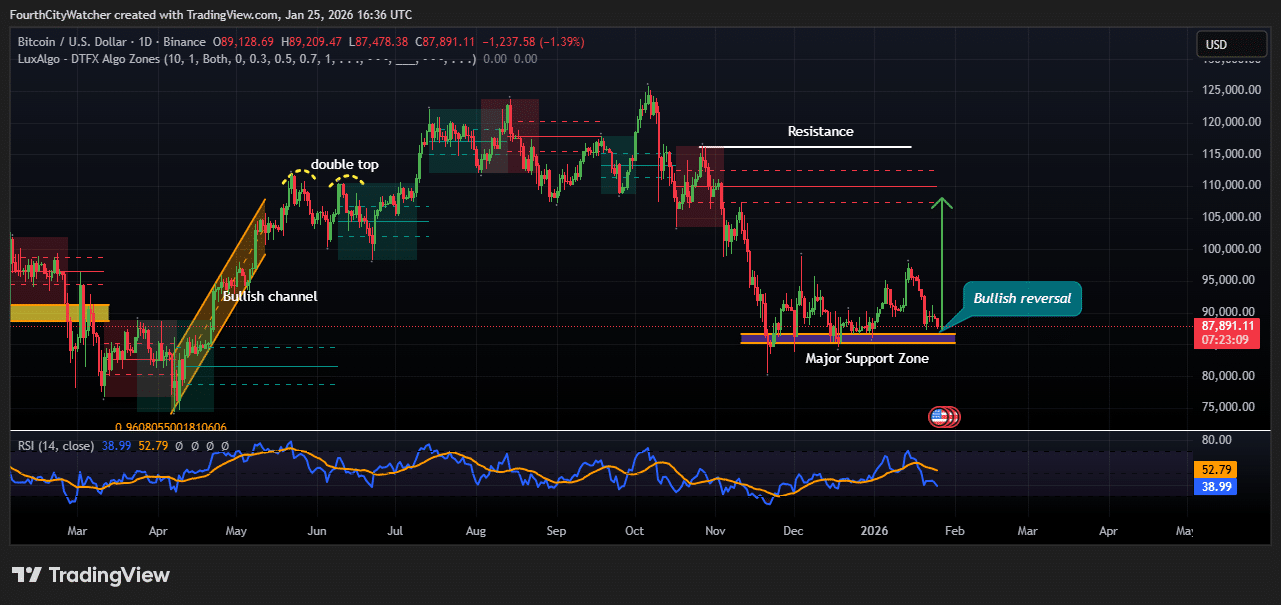

Bitcoin holds critical support at $87,000, signs of reversal emerge

The Bitcoin trading pair shows the market testing a critical moment at the major support zone near $87,000. After a prolonged downtrend from mid-2025, BTC appears to be forming a potential bullish reversal, as highlighted in the chart.

Earlier in the year, Bitcoin experienced a strong upward channel in April, culminating with a double top around the $120,000 to $122,000 level. The double top marked significant resistance, triggering a sharp correction that took BTC into a consolidation phase with multiple lower highs through mid-to-late 2025.

Currently, price action is consolidating above the key support zone, which has historically acted as a strong floor. This area matches previous rejection points, suggesting buyers are defending it.

The relative strength index (RSI) reading of around 39 indicates that BTC is in or nearing oversold territory, further strengthening the likelihood of a bullish reversal. If support holds, the chart indicates a potential upside target towards the $105,000-$110,000 region, close to previous resistance levels, marking a possible recovery of over 20% from current levels.

The broader trend signals caution as BTC remains below long-term resistance between $115,000 and $120,000. A sustained break above this resistance would be necessary to confirm a return to previous bullish momentum. For now, traders should watch for confirmation of the reversal through a strong daily close above the current consolidation zone, combined with improving RSI and volume signals. Bitcoin finds itself at a critical turning point, with a potential bounce from $87,000 signaling the start of a new uptrend, although it must overcome key resistance zones to maintain a long-term uptrend.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news