Join our Telegram channel to stay up to date with the latest news

The price of Bitcoin fell a fraction of a percent over the past 24 hours to trade at $121,310 as of 3:45 a.m. EST.

This comes as Twitter co-founder Jack Dorsey’s Square announced the launch of a Bitcoin wallet for retailers, in a bid to bring Bitcoin payments mainstream and challenge credit cards.

JUST IN: Jack Dorsey’s Square presented a #Bitcoin wallet solution to enable local businesses to accept BTC payments without fees.

Bullish 🚀 pic.twitter.com/giHUcQTLLr

– Bitcoin Magazine (@BitcoinMagazine) October 8, 2025

The wallet, part of Dorsey’s broader vision for Bitcoin, allows merchants to automatically convert up to 50% of their daily sales into Bitcoin, starting November 10. For the first time, small businesses can accept Bitcoin payments and avoid traditional card network fees, with zero transaction fees until 2027.

Connect the ecosystem with @Square This has been the dream since we launched Bitcoin in @CashApp in 2018

Starting today, all traders can now seamlessly stack bitcoins behind the scenes of their daily sales.

Acceptance of Bitcoin payments will be available to everyone on November 10 pic.twitter.com/mTqbu8wfGG

– Miles 🌞 (@milesuter) October 8, 2025

After that, a 1% fee will apply, which is still much lower than typical card fees. Dorsey believes the service will help retailers protect against inflation and economic uncertainty, saying, “Its value will probably increase. It’s certainly a hedge against whatever we’re seeing in the economy.”

At the same time, Dorsey is campaigning for U.S. lawmakers to exempt small Bitcoin payments from taxes, a move that could boost everyday crypto adoption and add momentum to the use of Bitcoin as currency.

JUSTIN: 🇺🇸 Senator Cynthia Lummis tells Jack Dorsey we have a bill ready for de minimis tax exemptions on Bitcoin

Tax-free Bitcoin payments coming soon 😎 pic.twitter.com/VSvULFqAEe

– Bitcoin Archive (@BTC_Archive) October 9, 2025

Bitcoin Price Outlook: On-Chain Trends and Taxes

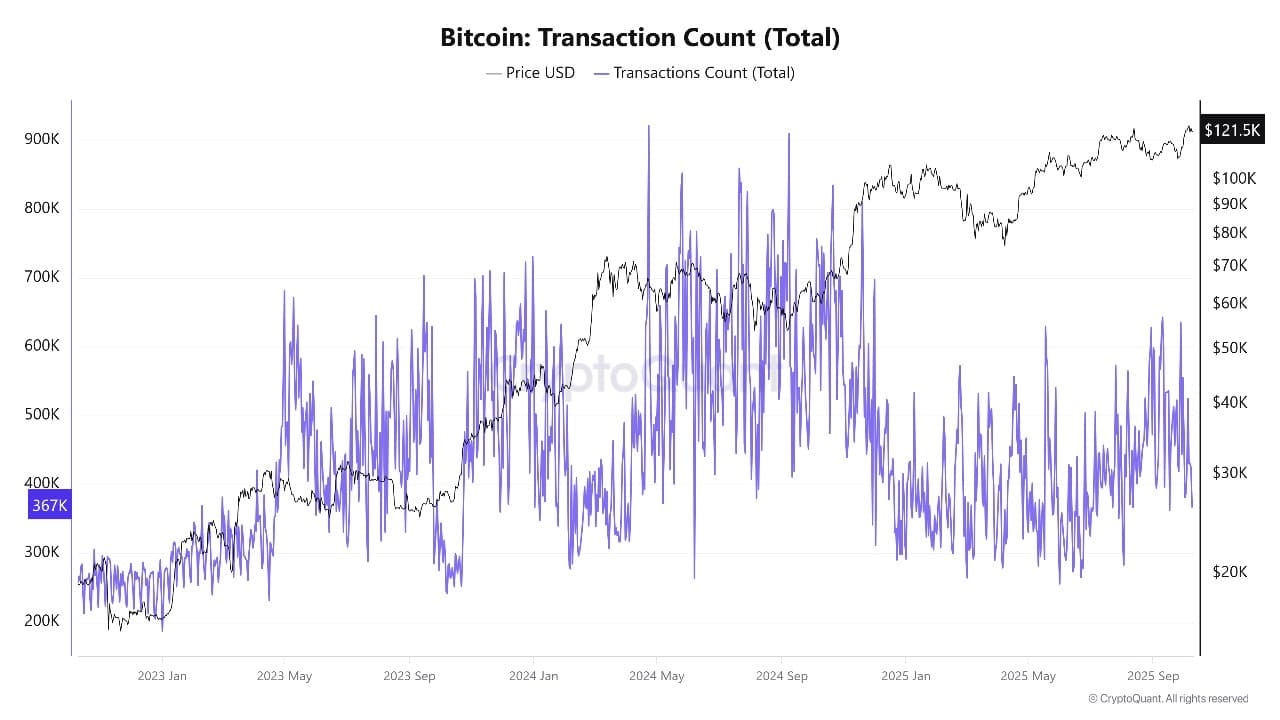

Dorsey’s Bitcoin wallet service could increase demand among retailers, as more businesses begin converting their daily income into Bitcoin. This trend is already being closely monitored on the blockchain. Analysts say Bitcoin address counts and transaction counts show more real activity, with long-term holders increasing their positions.

Source of number of Bitcoin transactions: CryptoQuant

But there is another factor at play: tax rules. The U.S. Treasury recently announced new interim guidance that could exempt certain paper profits on digital assets from the 15% minimum corporate tax.

This is good news for businesses holding large amounts of Bitcoin, but for ordinary users the main challenge is avoiding tax issues related to small, everyday crypto purchases.

Dorsey’s push for a de minimis exemption has gained support from politicians and the crypto community. If passed, the measure could remove a major barrier to spending Bitcoin in stores and could encourage even more users to use crypto for payments.

Increased retail and chain activity is often a sign of healthy demand, but profit-taking could slow momentum in the near term.

Bitcoin Price Analysis: Key Support and Resistance Levels

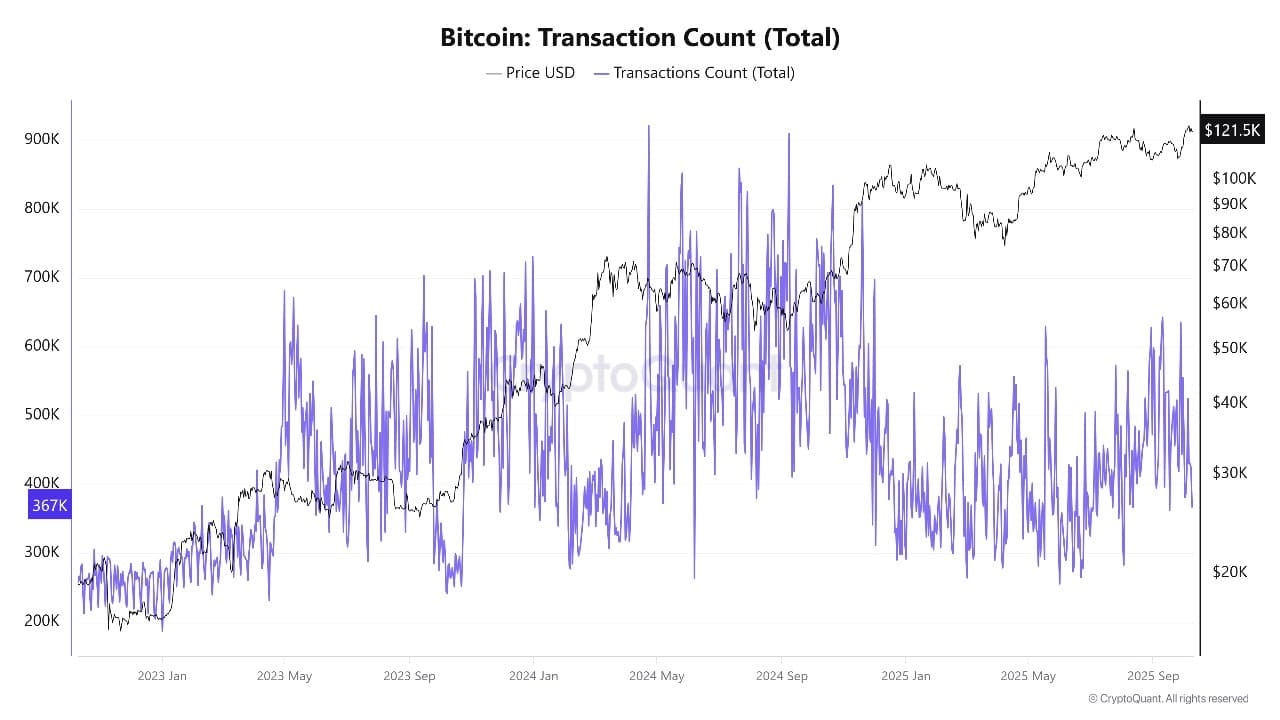

Looking at the BTCUSD 4-hour price chart, Bitcoin is holding above key support at $119,320, just below the current price of $121,273. This support zone lies near recent lows and is closely watched by traders.

BTCUSD analysis source: Tradingview

If Bitcoin falls below this zone, the next major supports will be at $117,040 and $115,251, as shown by the Fibonacci retracement levels and prior consolidation on the chart.

The 50-period simple moving average (SMA) is $122,298, while the 200-period SMA is $115,936. Bitcoin is trading near its short-term moving average, suggesting indecision. The 200-period SMA, located well below the price, acts as a long-term cushion against further declines.

On the upside, initial resistance is seen at $125,903, with a major high at $126,272.

Technical indicators show that Bitcoin is cooling off after its recent rise. The relative strength index (RSI) is at 45.49, meaning the coin is neither overbought nor oversold, which could hint at room for further consolidation before the next big move.

The MACD indicator is slightly negative, indicating slowing momentum and a possible risk of further declines in the near term.

Bitcoin price holds above 119,000 support

If Bitcoin remains above the $119,320 support and buyers step in after the recent news, the price could rebound towards $122,220 and higher resistance near $126,000 in the coming weeks. However, if sellers drop below $119,000, Bitcoin could retest deeper supports around $117,000 and $115,000 before the bulls return.

If Block’s new wallet gains traction with retailers and lawmakers support easier tax rules for crypto, the coin’s price could stabilize and recover soon.

Traders will monitor key price levels, the pace of adoption by traders, and new signals coming out of Washington. All of this could influence whether the next move will be up or down for Bitcoin in October.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news