Join our Telegram channel to stay up to date with the latest news

The price of Bitcoin rose more than 1% in the past 24 hours to trade at $91,278 as of 2:50 a.m. EST on trading volume that plunged 27% to $82.7 billion.

This BTC price rise comes as first-term House member Brandon Gill, a Bitcoin permabull, purchased up to $150,000 worth of shares of BlackRock’s Bitcoin spot ETF (exchange-traded fund).

Gill has been an active buyer of the largest cryptocurrency by market capitalization, accumulating as much as $2.6 million in assets since his start as a House representative.

BREAKING: Rep. Brandon Gill, one of Trump’s closest allies in the House, now brings home about $300,000 in Bitcoin.

He has accumulated up to $2.6 million in BTC since taking office.

The crypto wave has officially hit Capitol Hill. pic.twitter.com/voZM63MxAv– Digital Money Guru (@Moneygurudigi) November 19, 2025

Cboe Futures Exchange will provide ongoing trading of Bitcoin futures

In another development, Cboe Global Markets Inc. announced that it will introduce its new Cboe Bitcoin Continu Futures (PBT) and Cboe Ether Continu Futures (PET).

The products are expected to begin trading on the Cboe Futures Exchange on December 15, pending regulatory review.

JUST IN: Cboe Futures Exchange to Launch Continuous Trading #Bitcoin futures contracts from December 15 🚀 pic.twitter.com/BzKmZImxQE

– Bitcoin Archive (@BitcoinArchive) November 17, 2025

Cboe’s rolling futures contracts are designed to provide traders with long-term exposure to BTC and ETH.

The contracts will have a 10-year expiration at quote and daily cash adjustment, creating a perpetual type of exposure while eliminating the need to periodically roll over positions.

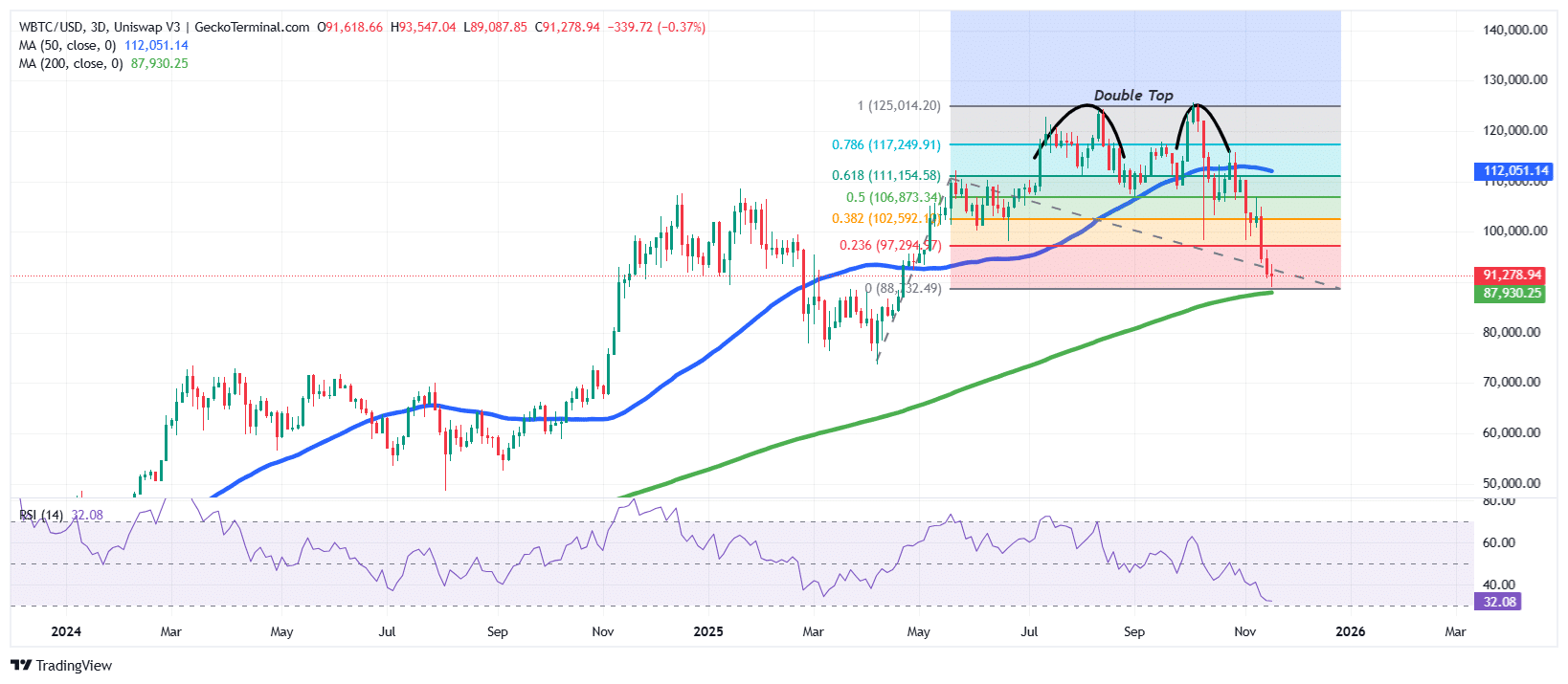

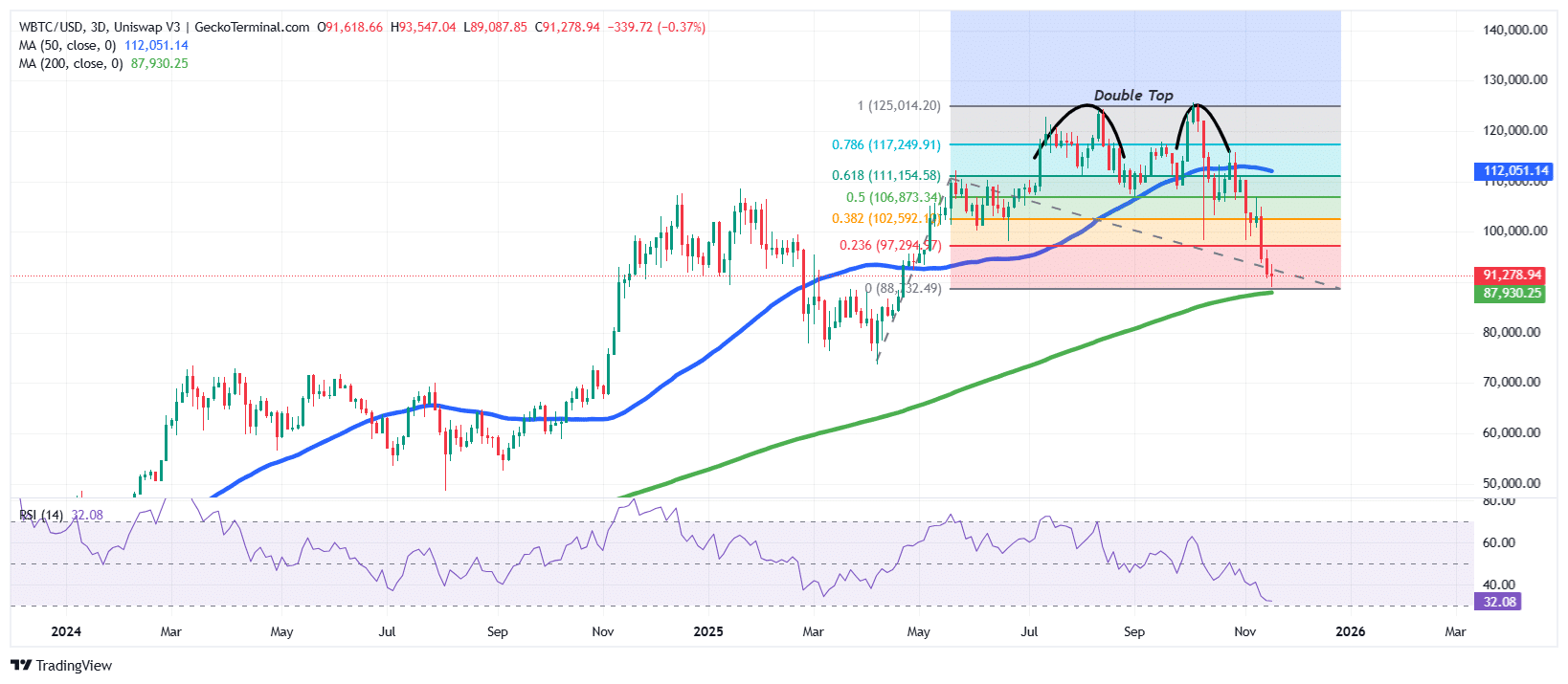

Bitcoin price slides towards 200 SMA as double top breakdown intensifies

After rebounding strongly from the $88,000 region earlier in the year, the BTC Price encountered strong resistance near the $126,000 area. This area triggered repeated rejections, leading to the formation of a clear double top pattern, signaling the exhaustion of the uptrend.

From July to early September, the Bitcoin price consolidated below this ceiling and struggled to gain upward momentum.

Eventually, sellers took control, pushing the BTC price below the neckline of the double top structure. This break marked the start of a sustained bearish phase.

Additionally, the bearish stance is supported by several failed recovery attempts around the 50 simple moving average (SMA) on the 3-day chart.

As the downtrend continued, BTC moved decisively below the mid-Fibonacci levels, losing the 0.382 and 0.5 retracements, which added to the bearish narrative.

Bearish pressure has recently intensified as BTC price dropped to the critical 0.236 Fibonacci support near $97,000 and continued to decline towards the long-term 200 SMA around $87,900.

Trading below the 50 SMA and heading towards the 200 SMA cements the weak trend, as bulls struggle to defend historically strong areas.

Additionally, the Relative Strength Index (RSI) on a 3-day time frame slipped to 32, approaching oversold conditions. Although not yet below the classic level of 30, the momentum is clearly bearish, supporting the strong overall sales dominance.

BTC Price Prediction

Based on current BTC/USD chart analysis, bearish sentiment remains dominant as BTC price trades well below the 50 SMA and approaches the 200 SMA in the long term. The confirmed double top breakdown supports the broader bearish momentum, while the RSI near oversold territory suggests that selling pressure is intense but could be about to peter out.

If the downtrend continues uninterrupted, the next support and cushion against downside pressure aligns with the $87,930 region, on the 200 SMA. A break below this zone could expose a deeper correction in Bitcoin price towards $84,000.

However, oversold conditions could fuel a relief rally in the near term. In such a scenario, initial resistance lies around the $97,000 to $100,000 range, corresponding to the 0.236 Fibonacci level and local horizontal resistance.

Ali Martinez supports this bullish outlook, as his analysis shows that BTC price could rebound up to $99,000.

Bitcoin $BTC could bounce up to $99,000! pic.twitter.com/CgBNG5DDUa

– Ali (@ali_charts) November 19, 2025

A stronger trend reversal would require reclaiming the 50 SMA ($112,051), which would signal weakening bearish momentum and open the door for a broader recovery.

Related news:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news