Join our Telegram channel to stay up to date with the latest news

Bitcoin price jumped 2% in the past 24 hours to trade at $92,341 as of 1:30 a.m. EST, as veteran crypto trader James Wynn shows early signs of a potential bull run for Bitcoin.

Wynn recently reopened a long position after BTC broke the key $93,000 level. Wynn currently holds 124.18 BTC with 40x leverage, valued at approximately $11.5 million. Its average entry price is $91,332, giving it a floating profit of $211,000.

Besides Bitcoin, Wynn also holds a leveraged position in PEPE, consisting of over 364 million tokens with 10x leverage, worth approximately $2.6 million. So far, this position has generated a profit of $590,000. His trades come as Bitcoin continues to rally into early 2026 amid growing tensions between the United States and Venezuela, including the capture of Venezuelan President Maduro.

I just increased my $BTC long.

I know a rash when I see one.

– Wynn pic.twitter.com/7LNmy1assC

– James (Pauly) Wynn (@JamesWynnReal) January 4, 2026

The broader crypto market is also showing signs of strength. According to CoinMarketCap, the total market capitalization is $3.16 trillion, with a daily trading volume of $90 billion. The Crypto & Fear Index turned neutral for the first time since October and the Coinbase Premium Gap rebounded, suggesting professional traders are returning to buying after a slow end to the year.

Analysts say recent price movements could indicate the end of Bitcoin’s traditional four-year cycle, moving instead toward a log-periodic power law (LPPL) growth pattern. This pattern shows Bitcoin in the early stages of a longer growth phase, meaning the current price is still below its trend. Analyst David predicts a year-end target of $218,000 for Bitcoin in 2026.

Supporting this bullish view, spot Bitcoin ETFs saw inflows of $459 million between late December and early January, with BlackRock’s IBIT fund contributing over $320 million.

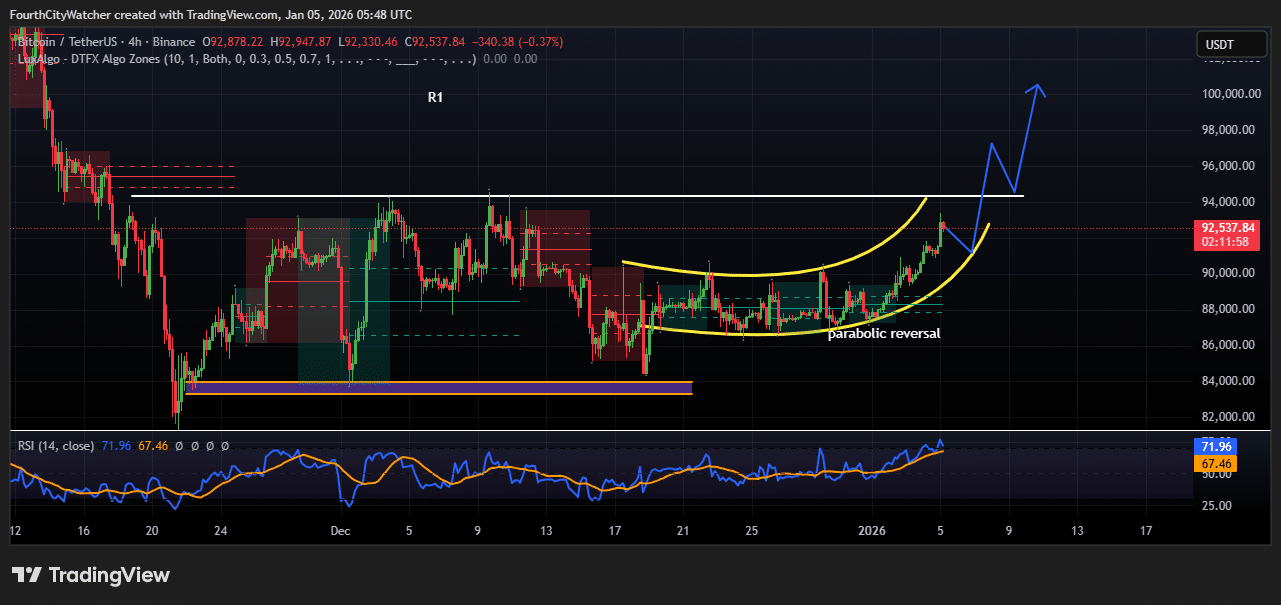

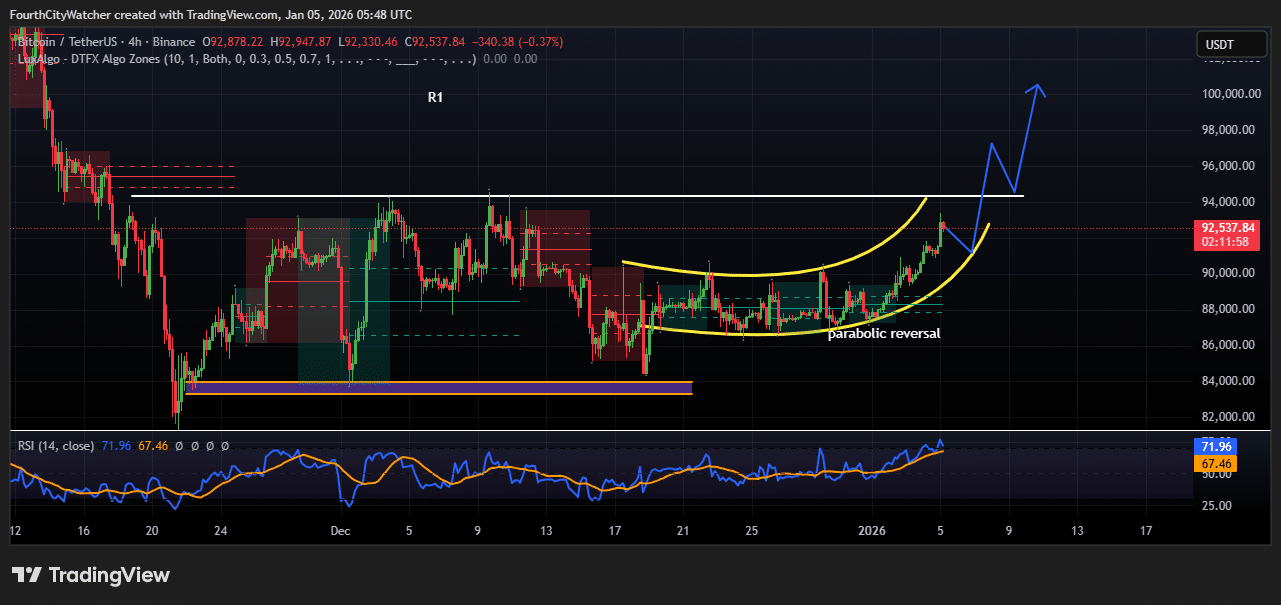

Parabolic Bitcoin Price Reversal Signals Potential Rally to $100,000

Bitcoin is trading at $92,500, showing strong bullish momentum after a period of slower movement. The chart displays a parabolic reversal pattern, which typically signals an acceleration in upward momentum. The curved yellow line on the chart highlights price acceleration, suggesting buyers are intervening more aggressively.

The key support area lies between $84,000 and $85,000, indicated by the orange zone on the chart. This area has served as a solid base in the past, preventing further declines when price tested it. Traders often view this level as a safety net, as a bounce into this area could signal renewed buying interest.

On the other hand, the next key resistance (R1) lies between $94,000 and $95,000, indicated by the white horizontal line. A decisive break above this resistance could trigger a strong upward move towards $100,000, which corresponds to the potential completion of the parabolic pattern.

RSI overbought but bulls in control

Looking at technical indicators, the RSI (Relative Strength Index) currently sits around 72. This indicates that Bitcoin is slightly overbought in the short term. While this may lead to minor pullbacks or consolidation, it does not necessarily mean the trend is ending. In fact, during strong uptrends, the RSI can remain in overbought territory for a period of time, indicating sustained buying pressure.

Price action and projections indicate that Bitcoin could experience a slight retracement near resistance before continuing higher. This is normal behavior in trending markets, where temporary pullbacks help refresh momentum before the next move higher.

However, the current trend suggests that buyers are in control and higher levels could be reached if the momentum continues. If Bitcoin manages to surpass $94,000, the next targets will likely be between $96,000 and $100,000, following the parabolic curve.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news