Join our Telegram channel to stay up to date with the latest news

The price of Bitcoin jumped by a fraction of a percentage in the past 24 hours to trade at $88,150 as of 11 p.m., a 10% increase in daily trading volume at $19 billion.

The BTC price increase comes as Bitcoin critic Peter Schiff warns that MSTR could do even worse in 2026. He criticized the company’s preferred stock, STRC, which now pays an 11% monthly dividend, calling it “desperate” because the company struggled to pay the initial 10% dividend.

Schiff said this shows that STRC is “junk” and that MSTR shares could fall more than last year.

How desperate can you be? You can’t even afford to pay 10%, since Strategy is losing money. So you will now pay 11%. This just proves that your favorite is unwanted. I wonder how much more you will be forced to pay by the end of the year. $MSTR returns will likely be even worse in 2026.

-Peter Schiff (@PeterSchiff) January 1, 2026

MSTR lost about 50% of its value in 2025, falling from a high above $400, with sharp declines in the second half when Bitcoin fell below $100,000 in November. Schiff believes that if Bitcoin falls again, MSTR will face even more pressure. He also said that if Strategy were in the S&P 500, it would have been the sixth worst-performing stock, showing how buying Bitcoin hurt shareholders.

The concerns come as MSCI will decide on Jan. 15 whether companies like Strategy qualify as investment funds. Otherwise, MSTR could be removed from global indexes, which could lead to capital outflows of $2.8 billion, according to JPMorgan, which would hurt the stock.

Market traders are watching closely. Polymarket shows that there is a 77% chance that MSTR will be delisted from the MSCI index by March 31. Bitcoin price and MSCI decision will be key to MSTR’s performance this year. Schiff’s warnings highlight concerns about the company’s dividend plan, Bitcoin exposure and index risks.

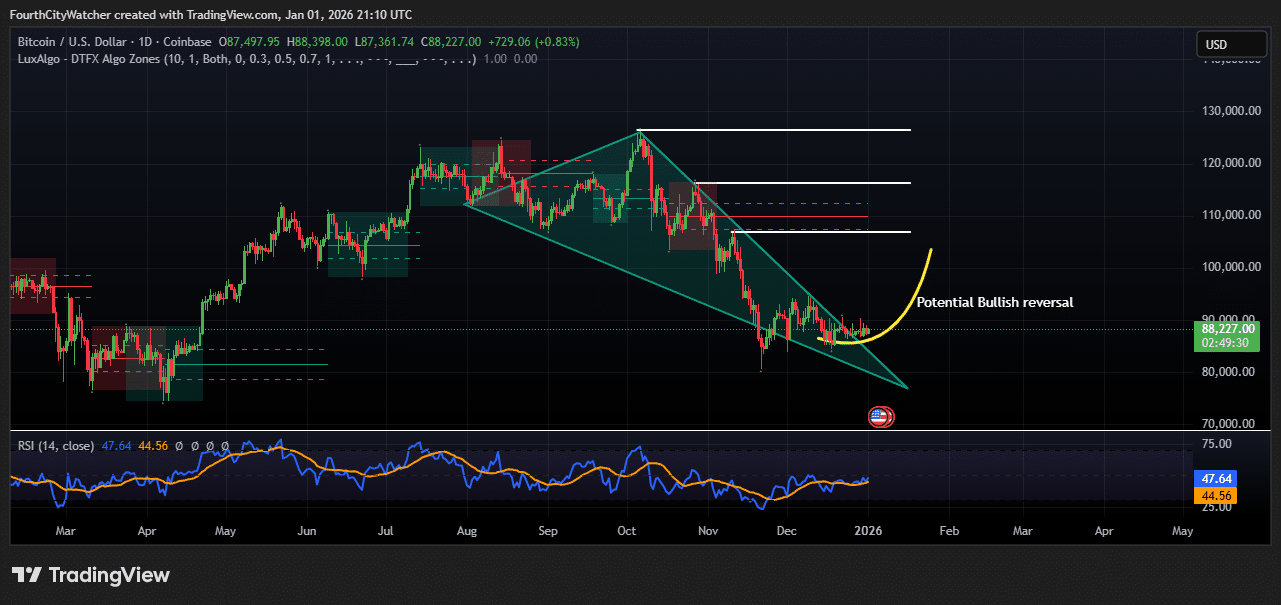

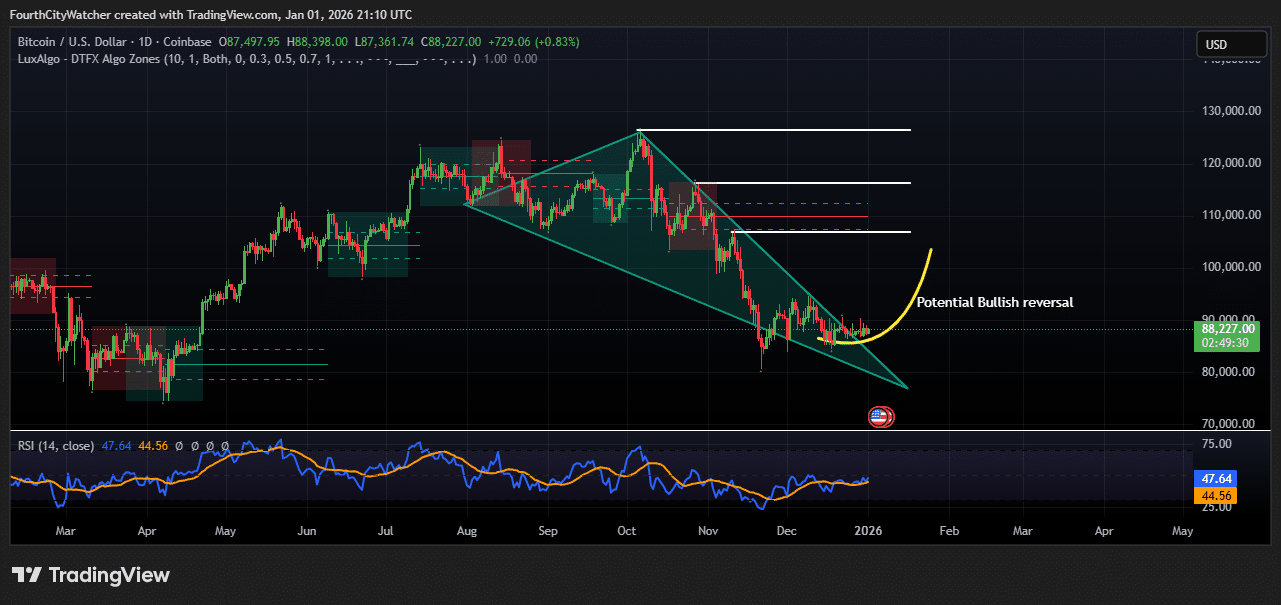

Bitcoin Price Analysis: Falling Wedge Signals Possible Rise

Bitcoin (BTC/USD) is currently trading at $88,227 on the daily chart. Since hitting highs above $130,000 in late 2025, BTC has been in a downtrend. During this period, the price formed a falling wedge pattern, shown in green on the chart.

A descending wedge generally signals a potential bullish reversal. This means that BTC has made lower highs and lower lows, but the wedge is narrowing, showing that selling pressure is weakening and a reversal could be near.

The RSI indicator currently reads 47.64, slightly below the neutral level 50, with the RSI moving average at 44.56. This shows that BTC is neither overbought nor oversold. Recently, the RSI has been rising, suggesting that bullish momentum may be slowly returning.

If the RSI continues to rise and rises above 50, this would provide stronger evidence that the downtrend may be ending, supporting the idea of a trend reversal.

BTCUSDT chart analysis. Source: Tradingview

The chart also shows support between $85,000 and $88,000, where BTC found temporary stability. This level could serve as the basis for a possible upward movement. A clear break above the upper boundary of the wedge would signal that buyers are returning, potentially triggering a stronger rally.

On the upside, the chart highlights three key resistance levels at $110,000, $120,000 and near $130,000, which were previous highs during the last uptrend. These levels are likely targets for any rally and areas where traders could take profits.

A confirmed breakout above the wedge and a rising RSI for stronger evidence of an emerging uptrend. If BTC fails to break out above the wedge, it could continue to consolidate in the $85,000-$88,000 range or even test lower support levels before attempting another upward move.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news