Join our Telegram channel to stay up to date with the latest news

The price of Bitcoin jumped by a fraction of a percentage in the past 24 hours to trade at $95,324 as spot Bitcoin ETFs performed strongly, recording $1.42 billion in net inflows over the past week.

ETF activity was heavily concentrated in the middle of the week. Data shows that Wednesday generated the largest single-day inflow of around $844 million, followed closely by $754 million on Tuesday. Although momentum slowed toward the end of the week, including a notable outflow of $395 million on Friday, strong midweek buying was enough to push total weekly inflows to their highest level since early October. At that time, spot Bitcoin ETFs had attracted around $2.7 billion, underscoring the scale of the renewed interest.

The latest inflow trend suggests that institutional investors are gradually returning to Bitcoin via regulated investment products after a period of caution. Vincent Liu, chief investment officer at Kronos Research, said ETF inflows indicate long-only allocators are re-entering the market. He added that ETF buying, combined with reduced selling by large Bitcoin holders, or whales, is helping to tighten effective supply.

On-chain data shows that whale selling pressure has eased compared to late December, reducing a key source of distribution and downside risk. Ethereum ETFs also saw positive inflows, but at more modest levels compared to Bitcoin. The largest influx day was Tuesday, with around $290 million, followed by $215 million on Wednesday. However, weekend sales weighed on performance, with Friday seeing outflows of around $180 million, bringing total weekly inflows to around $479 million.

Despite the improvement in flow data, analysts remain cautious. Market observers note that short-lived spikes in ETF inflows have historically led to brief price rebounds rather than sustained rallies. Analysts say Bitcoin will likely need several consecutive weeks of strong, consistent ETF demand to support a sustainable uptrend. Without sustained capital inflows, price increases could continue to face resistance and fade during periods of weak demand.

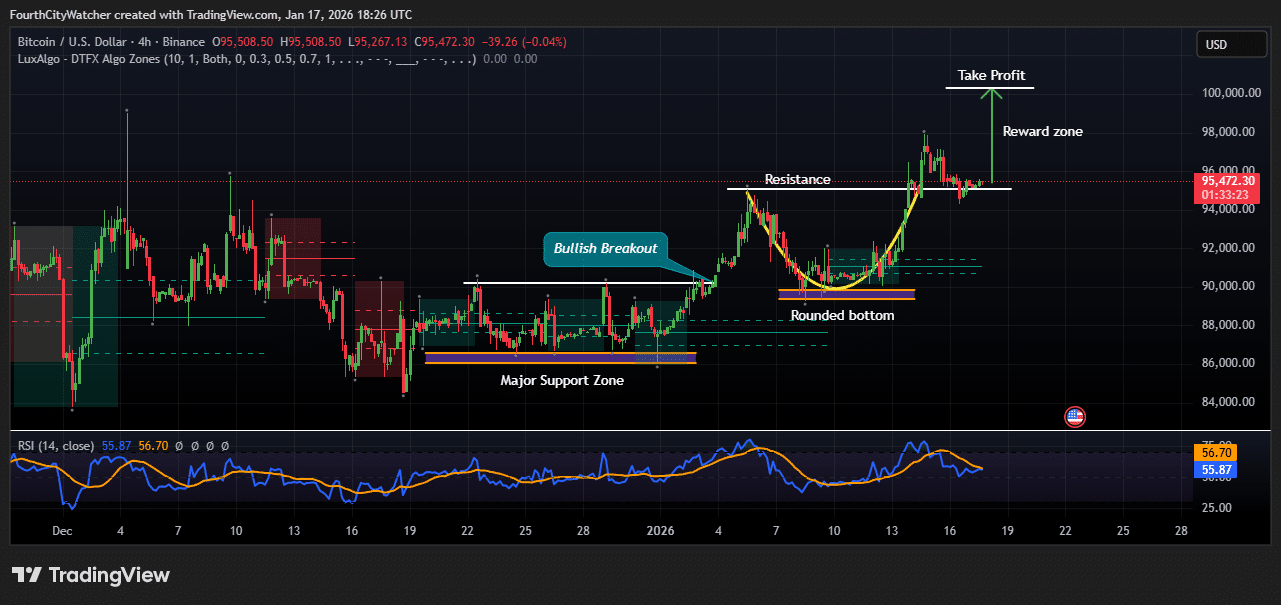

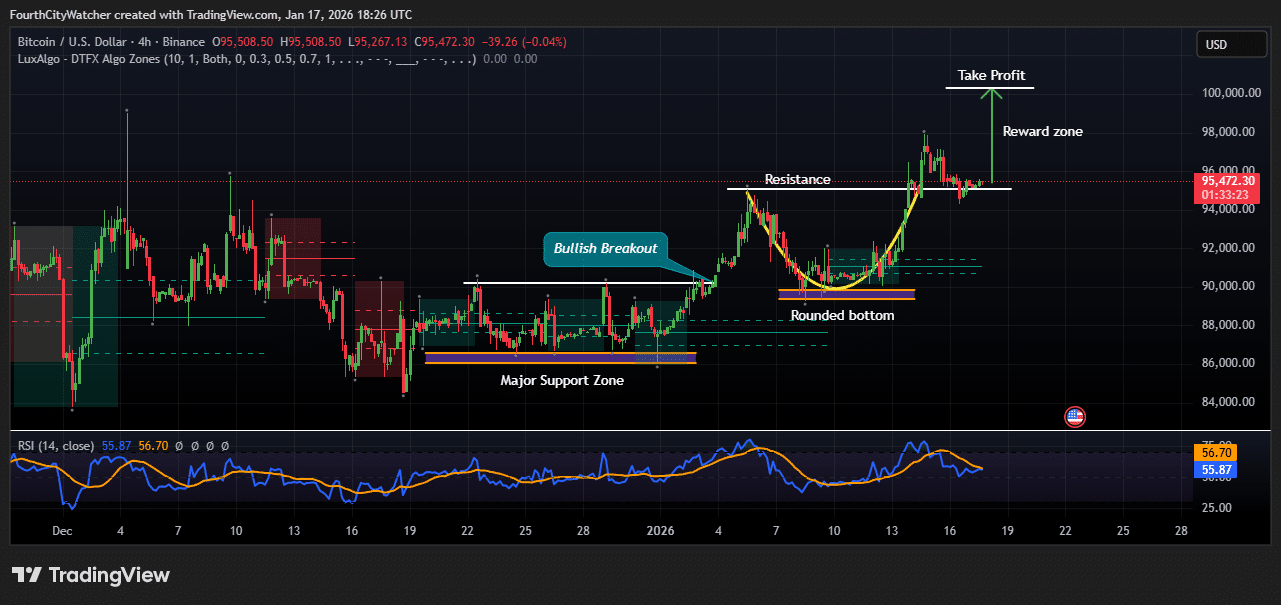

Bitcoin price consolidates above key support after bullish breakout

Bitcoin (BTC) is showing steady consolidation after a strong bullish breakout, according to the latest 4-hour chart, as the price trades at $95,470 at the time of writing. The chart highlights a major support zone near the $86,000-$88,000 range, where Bitcoin previously formed a strong base.

This area acted as a demand zone, absorbing selling pressure and paving the way for a rebound. From this level, BTC began to form a rounded bottom pattern, a classic bullish structure that often signals a gradual shift from bearish to bullish momentum. The bullish bias was confirmed after the price broke a key resistance zone around $91,000 to $92,000, labeled as a bullish breakout on the chart. After the breakout, Bitcoin rebounded strongly towards the $97,000-$98,000 zone, where sellers temporarily intervened. This level now acts as short-term resistance.

Currently, BTC is moving sideways just below resistance, suggesting healthy consolidation rather than weakness. The price is holding above the former resistance zone, which has now become support around $94,500 to $95,000. This behavior often indicates that buyers are defending higher levels while preparing for a possible continuation move.

BTCUSD chart analysis source: Tradingview

The chart also marks a reward zone targeting the psychological level of $100,000, aligning with the projected profit zone. A clean break and close above the $96,000-$97,000 resistance could open the door to a retest of six-figure prices in the near term.

Momentum indicators support this outlook, with the Relative Strength Index (RSI) hovering around the mid-50s, indicating neutral to bullish momentum. Notably, the RSI is neither overbought nor oversold, leaving room for further upside if buying pressure increases.

The technical structure remains constructively bullish, as long as Bitcoin holds above the $94,000 support zone. A decline below this level could lead to short-term pullbacks towards $92,000, but unless BTC loses major support near $88,000, the broader trend continues to favor the bulls.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news