Join our Telegram channel to stay up to date with the latest news

The price of Bitcoin rose more than 1% in the past 24 hours to trade at $87,803 as of 2:45 a.m. EST on trading volume that increased 24% to $61.9 billion.

BTC surpassed the $87,000 level after the Bureau of Labor Statistics reported that the US Consumer Price Index (CPI) for November rose 2.7% from a year earlier, below consensus expectations of 3.1%.

This has reinforced hopes that the Federal Reserve will have more room to act. additional interest rate cuts in 2026.

🚨 BREAKING 🚨

WE #IPC inflation slows to 2.7% in November compared to 3.1% expected pic.twitter.com/s8UfIHhDSy

– FXStreet News (@FXStreetNews) December 18, 2025

Core CPI was also lower than expected, rising 2.6% versus an estimate of 3%.

Bank of Japan raises rates to 30-year high and yen falls

But there was negative news from Asia, where the Bank of Japan (BOJ) announced an interest rate hike of 25 basis points, to 0.75%, its highest level since 1995.

The decision was adopted unanimously by 9 votes to 0, after a two-day political meeting. The increase corresponds to market expectations.

BOJ Governor Kazuo Ueda cited growing confidence in the economic outlook as one of the main reasons for the rise.

🚨 BREAKING: 🇯🇵 BOJ DELIVERS THE HIKE

Rates rose 25 basis points to 0.75%, marking their highest level in 30 years.

The era of ultra-easy money in Japan continues to fade.

This is a major change in LIQUIDITY globally… keep a close eye on the Yen and risk assets. 👀 pic.twitter.com/vfciRH84WJ

– Wise Advice (@wiseadvicesumit) December 19, 2025

This is the second rate hike in Japan this year, following a 25 basis point hike in January, with policymakers announcing further hikes to come.

Despite the rise, the yen slipped to around 156 against the dollar as markets had already fully priced in the rate hike.

Bitcoin price shows signs of bullish reversal

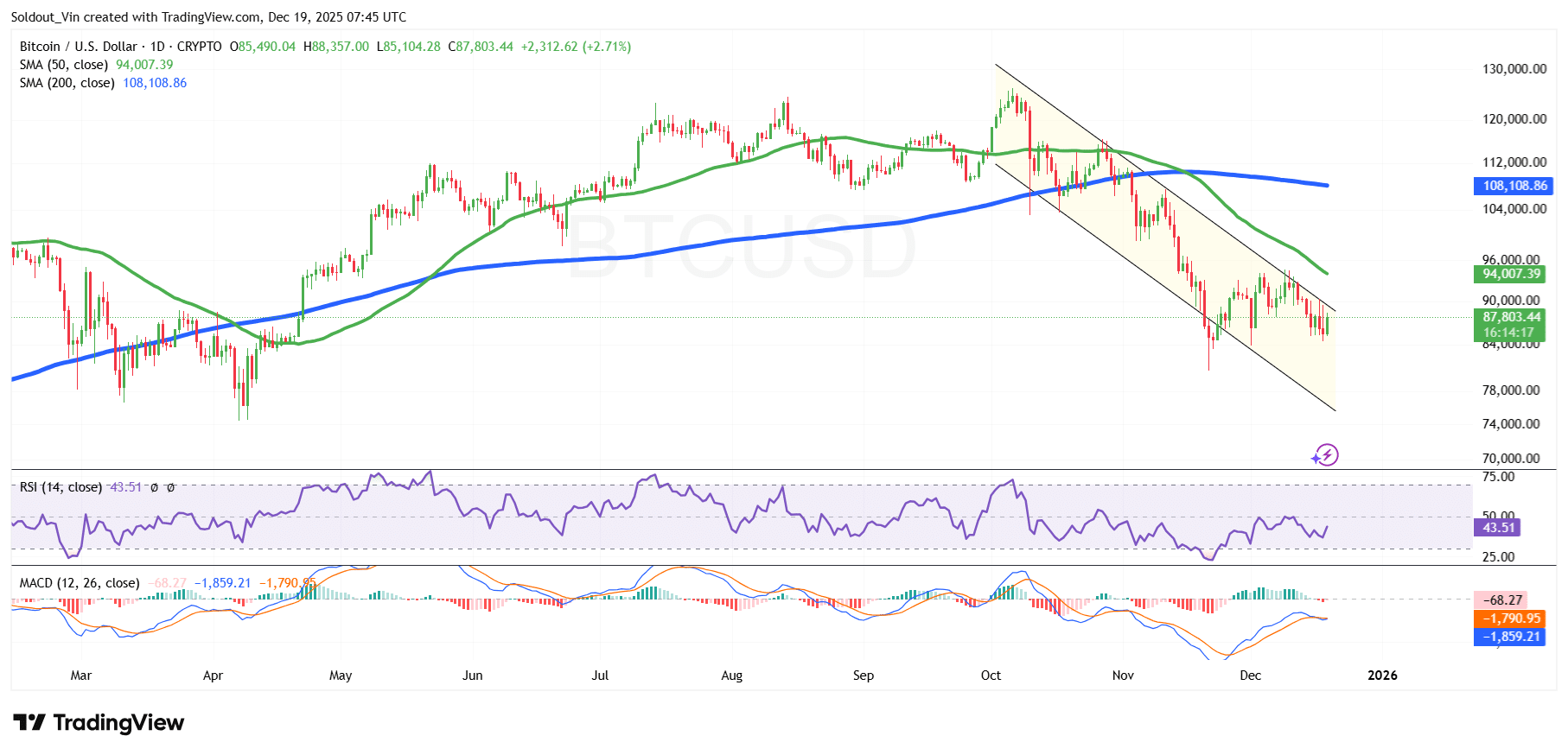

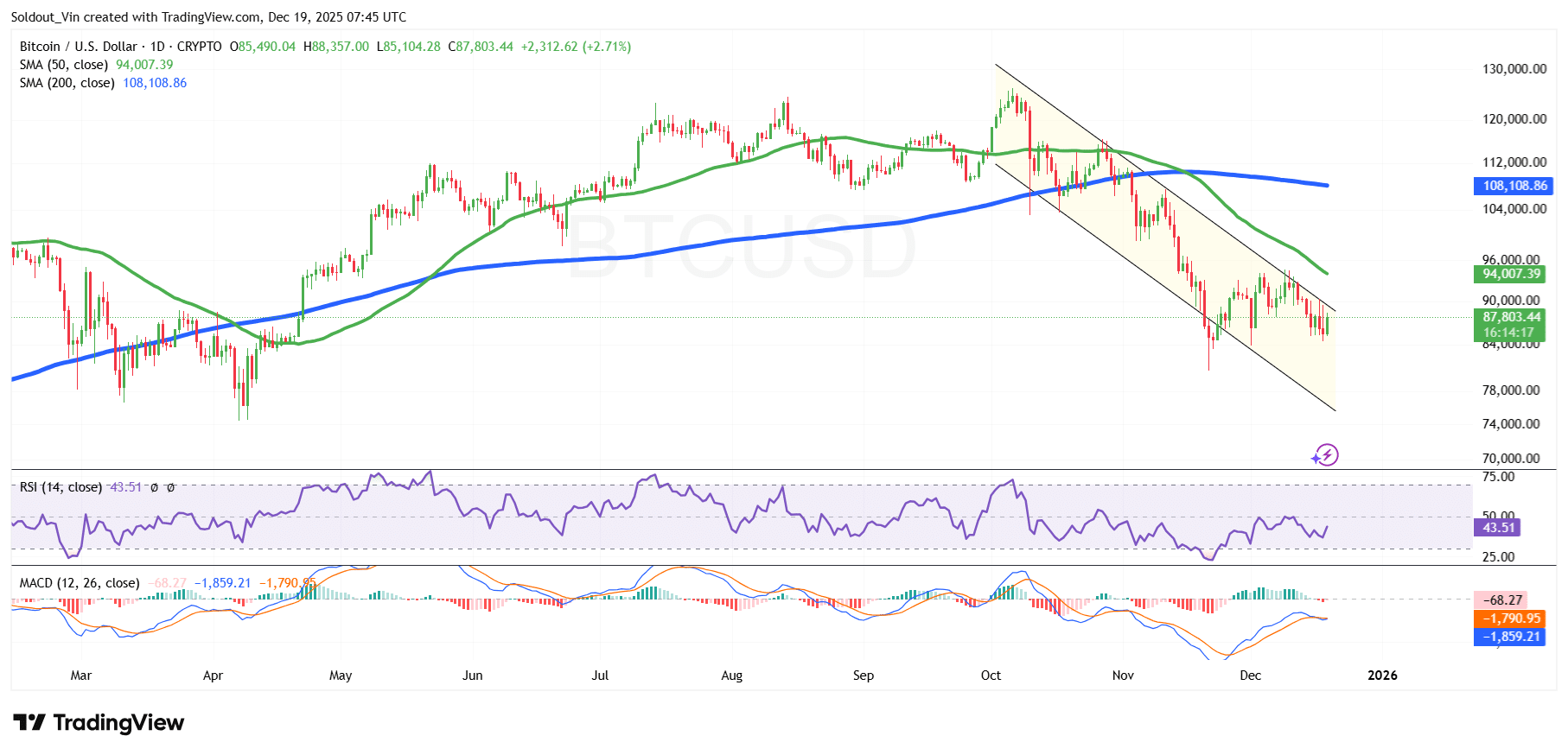

THE BTC Price traded above the $108,000 support level from July to October, a move that saw the asset reach its all-time high (ATH) around $126,230.

However, Bitcoin price then underwent a correction in a descending channel pattern to the lower boundary around the $84,000 support zone. This zone allowed the BTC price to consolidate at the upper boundary, with $94,000 acting as a barrier to the upside.

The bearish stance has pushed BTC to trade below the 50-day and 200-day simple moving averages (SMA). This trend was fueled by the SMAs forming a death cross around $111,035.

Meanwhile, the Relative Strength Index (RSI) is showing signs of a rebound, currently at 43 and rising, indicating that buyers are regaining some control.

BTC Price Prediction

According to the BTC/USD chart analysis on the daily timeframe, BTC price is close to a breakout above the descending channel pattern as it targets a long-term uptrend reversal.

If BTC price breaks above the channel, the next target could be around the SMAs, first at $94,007 (50-day SMA) and $108,108 (200-day SMA).

However, the Moving Average Convergence Divergence (MACD) has turned negative with the orange signal line moving above the blue MACD line. The red bars on the histogram also begin to form below the zero line, a sign of negative momentum.

If bearish BTC prices act on the negative momentum, the price could fall back to the lower boundary of the channel and form support around $78,000.

Related news:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news