Join our Telegram channel to stay up to date with the latest news

Bitcoin price slipped a fraction ahead of key US inflation data tomorrow, with traders increasingly uncertain about the likelihood of a December rate cut by the Federal Reserve.

BTC fell to $102,457.33 in the last 24 hours, but recovered to trade at $104,555.73 as of 5:52 a.m. EST. More than $317 million in leveraged long positions were liquidated in the past 24 hours, according to Coinglass.

BTC Price (Source: CoinMarketCap)

This leaves traders focused on the US CPI (Consumer Price Index) report which will be released tomorrow. This will be a key indicator of what to expect from the Federal Reserve’s next interest rate decision.

Market expectations for a December rate cut have weakened, says CME FedWatch tool showing the odds drop to 67.9%, down from 85% last week, after Fed Chairman Jerome Powell warned that further cuts are “not a done deal.”

Higher-than-expected inflation could dampen hopes for further easing, while lower inflation could reignite risk appetite in crypto markets.

POWELL SAYS A RATE CUT IN DECEMBER IS NOT A CONCLUSION FIRST.

BEARISH STATEMENT… pic.twitter.com/XvrRQQavr6

– Mister Crypto (@misterrcrypto) October 29, 2025

A Wall Street Journal article adds to the uncertainty. report Earlier today it was said that the US central bank was increasingly divided over a December rate cut.

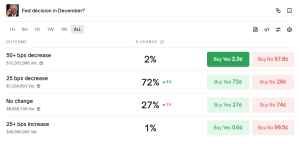

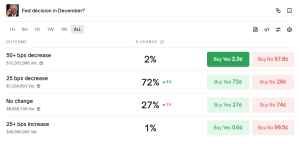

Contract asking what the Fed’s decision will be in December (Source: Polymarket)

Traders on decentralized prediction market Polymarket remain optimistic about a rate cut next month. In a contract asking what the Fed’s decision will be, traders at Polymarket put the chance at 72% that there will be a 25 basis point cut.

Bitcoin Price Tests Major Technical Barrier as Morgan Stanley Says It Takes Gains

From a technical perspective, Bitcoin price is trying to overcome a major hurdle at the $105,795 resistance level.

Daily chart for WBTC/USD (Source: GeckoTerminal)

This price level aligns with the 9 and 20 exponential moving averages (EMA), which are currently acting as dynamic resistance levels for BTC. As such, flipping the resistance level into support could lead to a bullish reversal of the market leader’s current trend. This could then lead to a rise up to $110,830 in the near term.

However, failure to close above the $105,795 resistance level in the next 48 hours could result in a pullback towards the nearest support at $99,680.

Technical indicators on the daily chart, such as the Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI), show that buyers are slowly making a comeback, but they still need to overcome the $105,795 barrier before they can trigger a rally.

As Bitcoin attempts to overcome a major technical hurdle, Morgan Stanley investment strategist Denny Galindo has exhorted investors should take profits in anticipation of a crypto winter.

“We’re in the fall right now,” he said. “Autumn is harvest time. So this is the time when you want to reap your gains. But the debate is how long this autumn will last and when the next winter will begin.”

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news