Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Morbi Pretium Leo and Nisl Aliquam Mollis. Quisque Arcu Lorem, quis pellentesque nec, ultlamcorper eu odio.

Este Artículo También is respondable in Español.

The action of bitcoin prices in recent weeks has been mainly highlighted by a trading fork between $ 80,000 and $ 85,000, with a fight to recover the purchase pressure. Despite the current Lack of a strong bullish impulseMany crypto analysts put on an optimistic continuation and a new Bitcoin prize Before the end of 2025.

According to the trading of crypto analyst, Bitcoin could be approaching the last leg From this bull cycle, predicting a peak greater than $ 125,000. However, this analysis is delivered with a warning that a prolonged bear market could take place by October 2025.

Long -term bitcoin cycles refer to an imminent peak

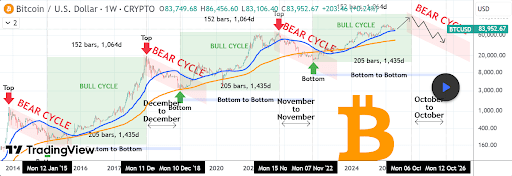

Tradingshot analysis, which was published on The TradingView platform, is based on more than a decade of symmetrical behavior of the Bitcoin market which shows that the bulls and bear cycles take place within coherent deadlines. According to TradingShot, the bull cycles dating from 2015 all lasted around 1,064 days, 152 weeks, each cycle exceeding almost exactly three years after the previous background. On the other hand, Bear Cycles has always lasted about a year, from December to December or from November to November.

Related reading

This historical symmetry is reflected in the graph below, which highlights three bull cycles followed by three periods of bear, all forming a repetitive pattern. The most recent background, recorded on November 7, 2022, marked the start of the current bull cycle. If this scheme is valid, Bitcoin could reach its next summit in the week of October 6, 2025.

The bull cycle led to Bitcoin exceed $ 100,000 And now with a summit of $ 108,786, but like many others, the analyst predicted this peak will still be broken this year. This peak will probably be Reflect explosive rallies This ended the 2017 and 2021 cycles and finally exceeded $ 125,000.

Sell all in October 2025, buy back in October 2026

The main tradingshot advice is frank but strategic: sell everything by October 2025. According to the analyst, this window could be the last opportunity to get out of the summit before the next bear cycle settled. The counting of 1064 days from the most recent bottom of $ 15,600 on November 07, 2022, gives an estimate of time for the next cycle of the cycle on October 6, 2025. If the story is repeated, the following bearish phase will probably last 12 months and less around October 12, 2026, before the next bull phase.

This timing is not speculative; It is based on a coherent coherent phase of one year on three complete market cycles. Therefore, it would be better to sell before October 2025 and start to accumulate by October 2026.

At the time of writing this document, Bitcoin is negotiated at $ 84,500, up 0.9% in the last 24 hours and 48% of the planned peak of $ 125,000.

Adobe Stock star image, tradingView.com graphic