Join our Telegram channel to stay up to date with the latest news

The price of Bitcoin jumped 7% over the past 24 hours to trade at $92,844 as of 5:56 a.m. EST, a 21% increase in daily trading volume to $86.22 billion.

This BTC price surge began shortly after Vanguard lifted its long-standing ban on trading Bitcoin ETFs on its platform, opening the door for millions of long-term conservative investors to gain easy exposure to the leading crypto.

Bloomberg ETF analyst Eric Balchunas called the move the “Vanguard effect,” noting that Bitcoin jumped about 6% immediately after the U.S. market opened, the first day Vanguard clients could trade Bitcoin ETFs.

THE LEADING EFFECT: Bitcoin jumps 6% around US open on first day after Bitcoin ETF ban lifted. Coincidence? I don’t think so. Also $1 billion in IBIT volume in the first 30 minutes of trading. I knew these Vanguardians had a bit of degeneracy in them, even some of the more conservative investors… pic.twitter.com/OKyihvEqqD

– Eric Balchunas (@EricBalchunas) December 2, 2025

Balchunas also pointed out that BlackRock’s IBIT spot Bitcoin ETF saw approximately $1 billion in trading volume in the first 30 minutes of this session.

Bitcoin price boosted by ETF demand

ETF flow data from Farside Investors shows that US spot Bitcoin funds have returned to net inflows. This follows a difficult November, when redemptions topped $4.3 billion. Recent daily releases show money flowing back into key products like IBIT and FBTC.

This pushes the cumulative total of net creations higher again and suggests that the worst selling pressure may be over for now. Analysts note that even modest positive flows can have an outsized impact on the price of Bitcoin. This is because spot ETFs must purchase actual Bitcoin from the market, thereby removing supply at a time when new issuance is already limited after previous halving events.

If the current multi-day inflow streak continues, especially with Vanguard accounts now able to access these funds, this could provide a stable supply to the market and support any attempt by BTC to reclaim the $100,000 region.

On-Chain Bitcoin Signals Show Healing

On-chain data providers show that the latest stock market crash resulted in a loss of a large number of speculative coins in the short term. However, long-term holders have mostly stayed put. This suggests that the sell-off was more due to leverage and weak hands than a long-term change in conviction.

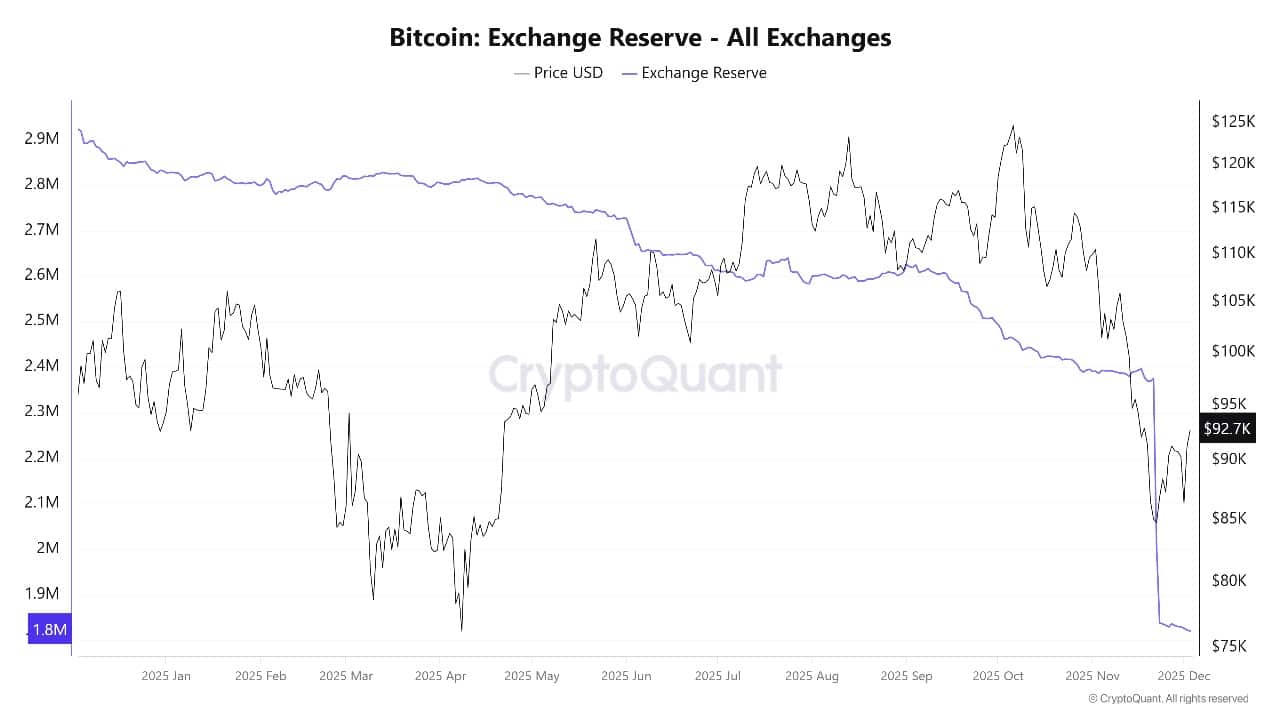

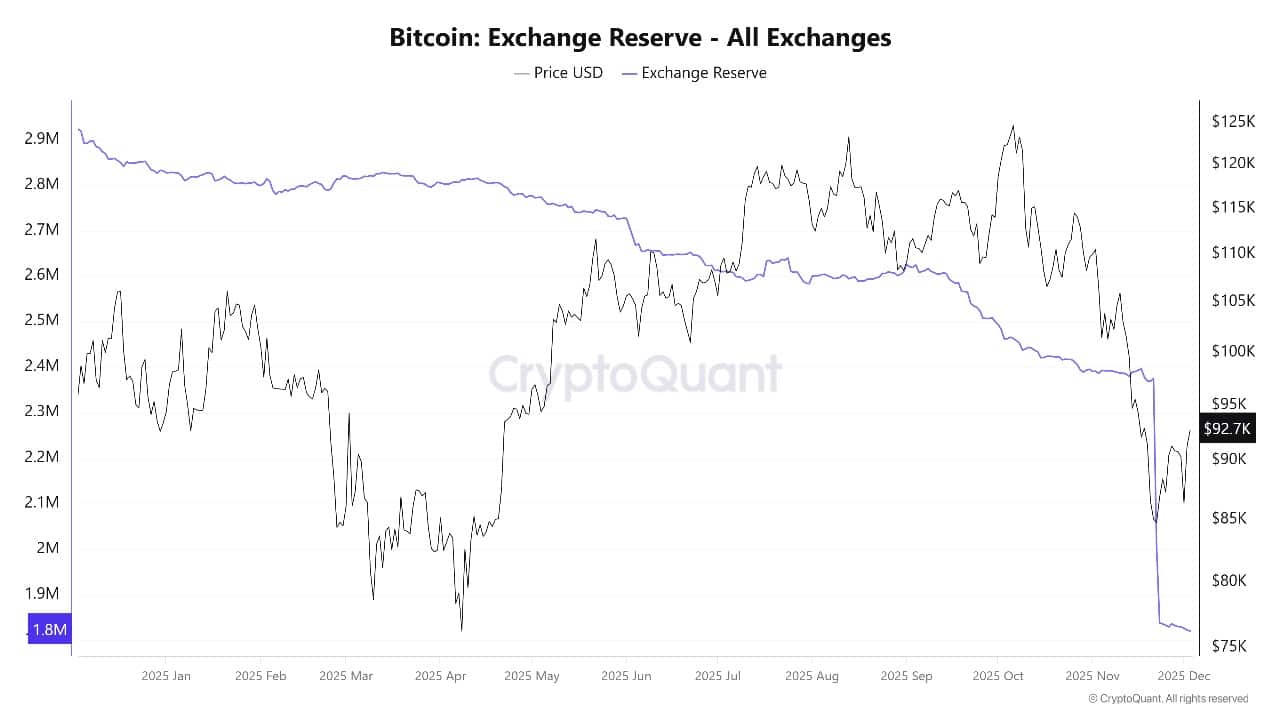

Foreign exchange balances have started to fall again and coins are returning to cold storage, which usually signals further accumulation rather than continued panic selling.

Bitcoin exchange reserve (all exchanges) Source: CryptoQuant

Bitcoin Price Prediction: Key Levels to Watch

The daily chart shows Bitcoin rebounding from a recent low near $80,000, with the price now trading around $92,800 and trying to push back above a descending resistance line that started from the November high.

The 50-day simple moving average (SMA) sits just above $100,000, while the 200-day SMA is higher, near $110,000, creating a technical zone that bulls need to reclaim to confirm that the broader uptrend is back in full control.

The RSI is recovering from oversold territory towards the mid-40s zone to the lower 50s zone. Meanwhile, the MACD attempts to rally from negative values, and the ADX around the 30 highs shows that the recent downtrend was strong but may now be running out of steam.

BTCUSD analysis source: Tradingview

If buyers can push BTC above the downward-sloping green resistance channel shown on the chart, the next upside targets are near $109,500 (around the 200-day SMA), then the previous range highs around $126,000, which corresponds to the upper green trendline.

On the downside, immediate support lies just below $90,000 along the midline, with stronger support closer to $74,000.

A sharp break below the lower green support band on the chart would warn that the recent bounce has failed and open the door for a deeper correction before the bulls try again.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news