Key notes

- Legislators face the midnight deadline on an expenditure invoice of $ 1.7 billion of prediction markets showing a probability of a stop of 87%.

- Bitcoin Short Traders deployed $ 1.4 billion lever at $ 115,000 in market characteristic for a potential American government funding crisis.

- BTC is negotiated up the corner model nearly $ 113,871 with critical resistance at $ 115,000 determining the following directional movement.

US vice-president JD VANCE refers to the first closure of the US government in 7 years in an Oval Office news bread on September 30, arousing new risk signals in the world markets.

According to Reuters, legislators are deadlocked on “discretionary” expenses of 1.7 billion of dollars for the agency’s key operations.

The closure could reduce the funding of the American government to the main federal projects from October 1, if the legislators of the Republican Party and Democrats do not reach a timely agreement on the expense bill, or an extension before midnight. This should have a considerable economic impact, with critical bureaucratic services put on hold of the government closure, while non -essential workers can undergo redundancy.

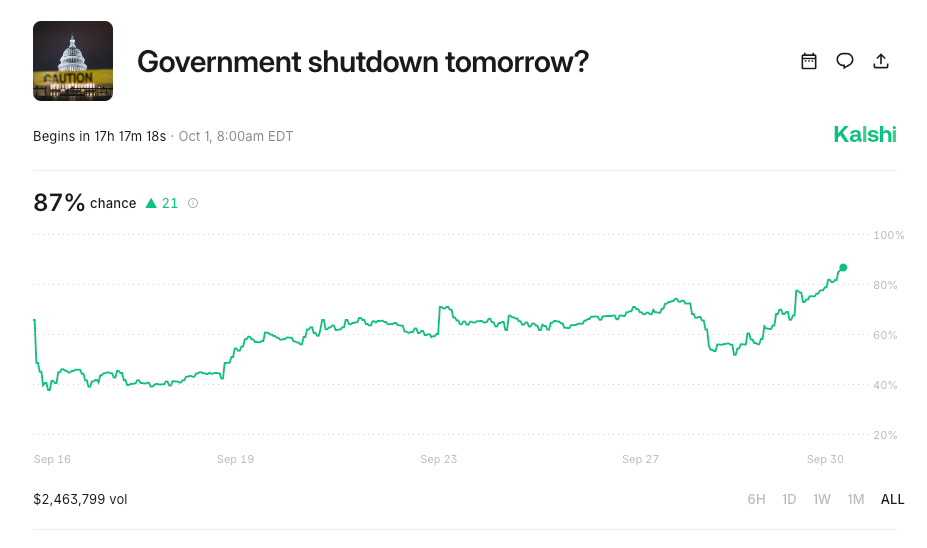

The prediction markets show 87% chance of the US government’s closure | Source: Kalshi, September 30

The real-time data of the KALSHI prediction market platform show 87% of the expectations of a closure, with a total bet approaching $ 2.5 million from this report.

Instant impact was observed in key markets with the price of gold (XAU) increasing by 0.6% to $ 3,843 and the S&P 500 in increased technology increasing by 0.1%. In the meantime, with the industrial average of Dow Jones (DJI), a drop of 0.022% reflecting the rotations of active capital as investors react.

President Donald Trump has threatened with irreversible job cuts for federal workers according to BBC News, amplifying uncertainty on the main markets. While Bitcoin

BTC

$ 114 415

24h volatility:

0.1%

COURTIC CAPESSION:

$ 2.28 T

Flight. 24 hours:

$ 57.43 B

The prices have consolidated near the weekly frame of peaks of around $ 114,000, the exhibition to American financial markets could see traders maintain a prudent position.

How will the price of Bitcoin react to the closed American government?

Before rebounding $ 114,200 on September 30, Bitcoin Price initially traced less than $ 113,500, the Bears quickly deployed $ 1.4 billion while the markets were preparing for the impact of the imminent US closure talks.

The BTC has often rallied on security betting during periods of Testy political crisis. However, the action of volatile Bitcoin prices and the negotiating metrics of the derivatives observed on September 30 points out the lowering expectations of crossing in the American markets.

Since the last closure of the government on December 22, 2018, cryptocurrencies have been increasingly entangled with the American financial markets and the political landscape.

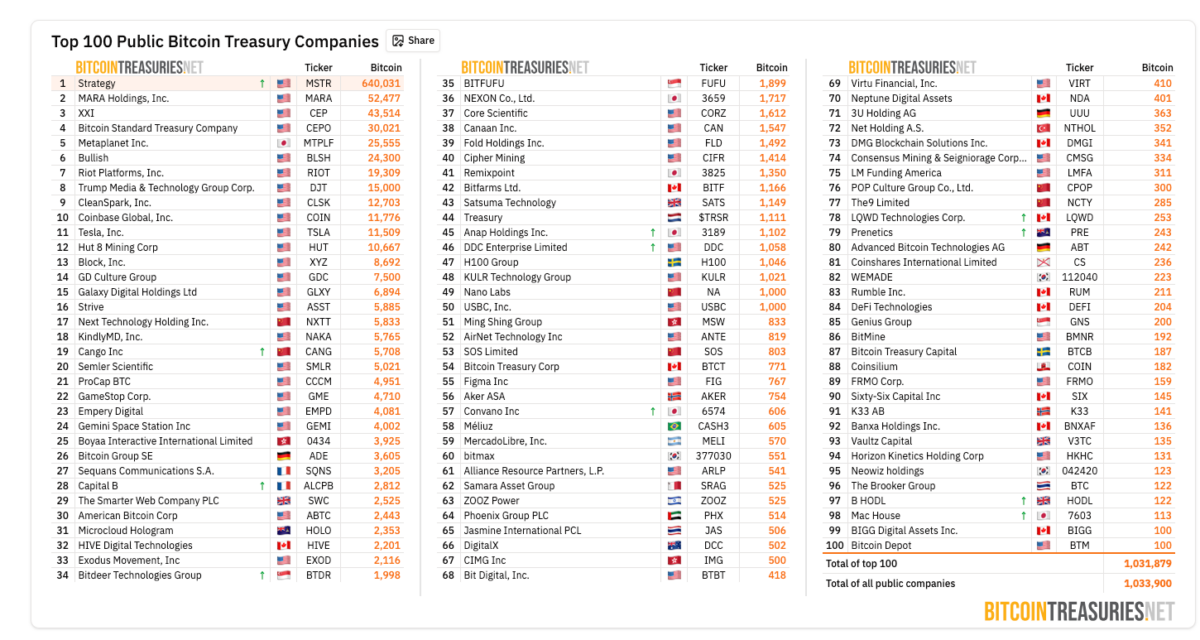

Top 100 public companies published by the United States holding Bitcoin, on September 30, 2025 | Source: Bitcointheries

Crypto-native companies like Coinbase and Robinhood were included in the S&P 500 stimulated by a positive change in American crypto regulations as part of the current Trump regime which took over in January 2025.

Furthermore, BitcoinTheries lists more than 100 public companies in the United States bearing a cumulative 1,031,879 BTC on the balance sheet, including the largest BlackRock active manager who currently holds nearly $ 100 billion in his Offers ETF active for BTC and ETH.

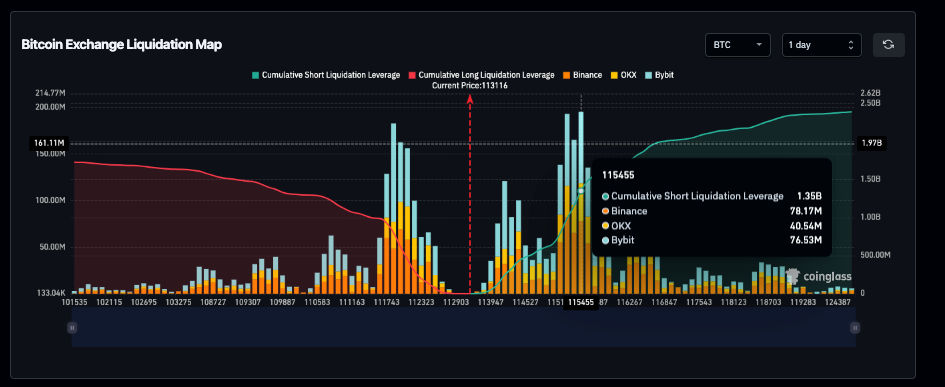

Bitcoin Short Traders deploys $ 1.4 billion on a total leverage of $ 2.4 billion at $ 115.3k | Source: Coringlass

Coinglass’s liquidation card data captures the reaction of the BTC short traders to the US government closure reports. As illustrated below, the short active BTC positions reached $ 2.4 billion with long limited to $ 1.73 billion in the last 24 hours, reflecting dominant lowering expectations.

A more in -depth examination of the graph shows that short BTC traders brought together $ 1.4 billion lever around the price level of $ 115,000, representing 58% of the total active positions.

While the closure of the US government is not confirmed, the lever effects of $ 115,000 could limit the prospects for Bitcoin rebound while the traders weigh their options.

Bitcoin price forecasts: will BTC recover $ 115,000 or will he succumb to upcoming correction signals?

The price of bitcoin is negotiated in an increasing corner training on the weekly graph, a structure often preceding net directional movements. At current levels close to $ 113,871, BTC presses the mid -range, with equal bulls and bear.

Uplining, the rise in the price / volume ratio (PVT) approximately 725,550 BTC supports an optimistic perspective of Bitcoin prices, which suggests that long -term capital inputs remain intact. If the judgment fears the request for fuel in complete safety, as shown by gold by entering territories on ignition, Bitcoin Bulls could capitalize to trigger an escape above the upper limit of the growing corner nearly $ 120,000.

Bitcoin (BTC) Analysis of technical prices | Source: tradingView

Conversely, the MacD line at 4,861 trends below the signal at 5,859 signals fading the momentum, while the weakness of the histogram reflects the downward pressure. Ventilation below the corner support at $ 105,000 would confirm the downward divergence, potentially accelerating losses to $ 95,000.

With the largest lever cluster currently at $ 115,000, this level remains essential to the next Bitcoin movement. A rejection there could confirm the downward domination, while a decisive closure above the coming days, can trigger a short coverage frenzy, which has potentially led the BTC price to $ 120,000.

The best portfolio presale is closer to $ 16.2 million with the BTC price stuck in limbo

Bitcoin merchants weighing on the opposite winds from the imminent closure of the United States government, investors turn to projects at the start of the stage like the best portfolio (BEST), for an increase in the rise.

The best portfolio (the best) is a multi-chain storage solution built with institutional quality security to disrupt the non-guardian portfolio sector of $ 11 billion.

Best portfolio (best) presale

At the time of the press, the best portfolio presale exceeded $ 16.1 million collected. With less than 24 hours up to the next price level, investors can always acquire tokens at $ 0.0257 via the website for the best portfolio, to unlock early advantages before its official launch.

following

Non-liability clause: Coinspeaker undertakes to provide impartial and transparent reports. This article aims to provide precise and timely information, but should not be considered as financial or investment advice. Since market conditions can change quickly, we encourage you to check the information for yourself and consult a professional before making decisions according to this content.

Ibrahim Ajibade is a seasoned research analyst with training by supporting various web3 and financial organizations. He obtained his undergraduate diploma in economics and is currently studying for a master’s degree in blockchain and distributed major book technologies at the University of Malta.

Ibrahim Ajibade on LinkedIn