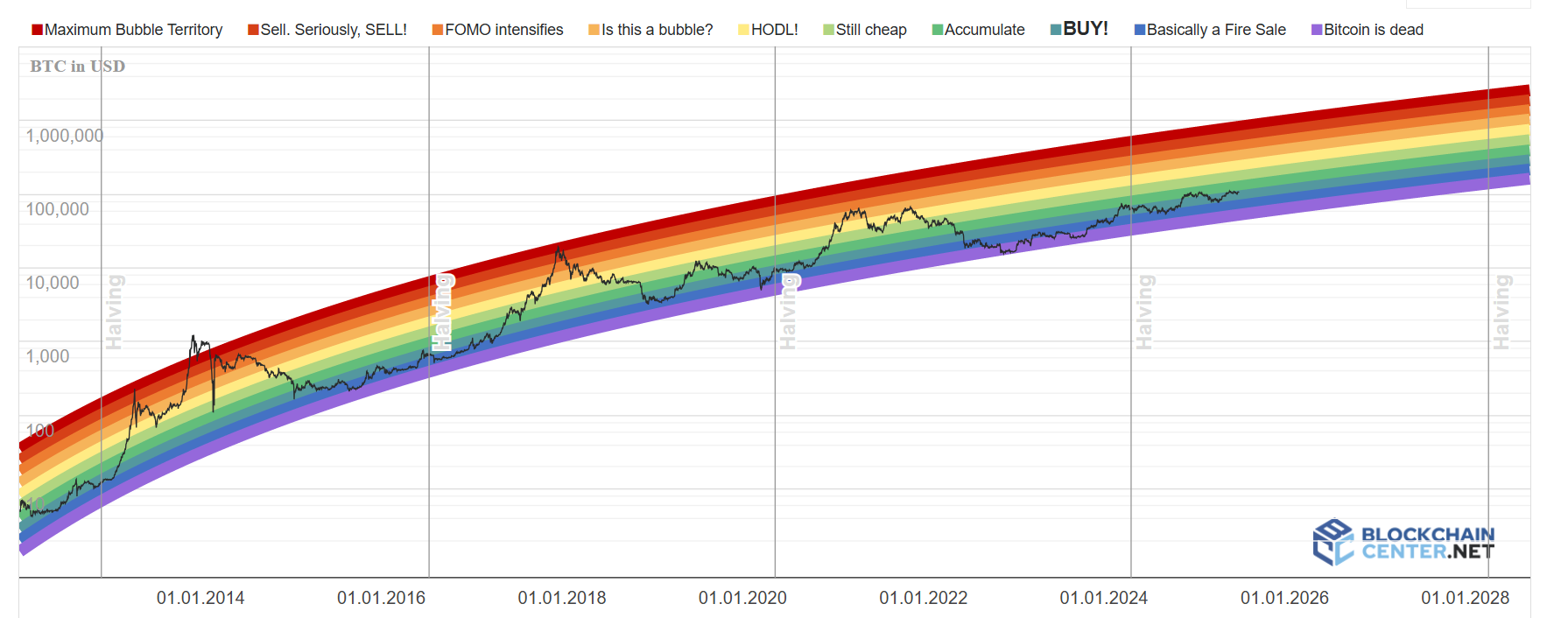

The Bitcoin rainbow board shows BTC ▼ -0.12% Cruise well above $ 100,000 and even cheap.

However, the analysis of 99BITCOIN shows that the supply of the USDT culminates and that the leverage shorts are swollen, which are signs that we could oscillate in both cases.

Meanwhile, criticisms of popular predictive models such as the M2-Bitcoin correlation of economist Raoul Pal make us ask us,, Is this cycle different? Is the Alt season canceled?

Bitcoin Rainbow Chart: the battle between bulls and bears

Bitcoin has bounced back to a lower $ 98,000 of $ 98, destroying the lowering positions at the price of geopolitical fears. Currently exchanging nearly $ 108,952, the BTC is consolidated in the range of $ 106,000 to $ 108,000 while the bulls have a retain of the psychological level of $ 110,000.

One thing to note: The well -known merchant James Wynn has a short 40x position, worth 1.49 million dollars, which depends on $ 108,630 as a level of key liquidation. Wynn and other Bearish traders could cope with a short pressure if the bitcoin breaks above this area.

All this could trigger a new BTC Ath and a subsequent Alt season later in summer.

Loading the season in Alts-season … pic.twitter.com/sygcmhnev7

– Julien Bittel, CFA (@bitteljuen) June 28, 2025

In addition, Tether’s circulation offer reached a record of $ 158 billion at the end of last week. Combine it with BlackRock with $ 1.15 billion Bitcoin, Bitcoin purchases, which clearly signals that institutions are positioned with intention.

Criticize M2-Bitcoin correlation

Bitcoin’s run six two figures woke up an old debate: is all this really predictable? Raoul Pal says yes, pointing to trends in the M2 money supply as a crystal ball for BTC. However, the co-founder of the 21st capital Sina says that it is nonsense.

Epic collection of Raul Pal’s disastrous recommendations

People really pay to listen to it

– Sina

21st capital (@ sina_21st) January 15, 2025

In a withdrawal published on June 24, he argued that the predictive power of the model dissolves in contact with reality. The more you change it, the worse it becomes. “It is not a forecast but to force a story on the graph,” he said.

Anyway, the next four months show if we are in a “traditional cycle” where bitcoin goes from bananas to printing money, rate drops and geopolitical recharge relays, or if Sina is right.

What is the next step for Bitcoin?

The blind faith in the models inherited from Bitcoin fades. Analysts as Sina urge a return to fundamental principles: liquidity flow, portfolio activity and real -time network signals.

Wrap your bags, your boys (and girls), the next few weeks can decide if the BTC breaks the orbit or is brought back to the chop.

Explore: CEO of Tether Paolo Ardoino hopes that the positive net of the American elections, says that Bitcoin, the strategic reserve is an excellent idea: 99Bitcoins exclusive

Join the 99Bitcoins News Discord here for the latest market updates

Main to remember

-

Critics of popular predictive models such as the M2-Bitcoin correlation of economist Raoul Pal spread

-

All eyes are on Powell next month while inflation persists and labor measures are moving.

The Arc-en-Ciel table of post Bitcoin: the next 4 months for BTC could change everything: is history repeated? appeared first on 99Bitcoins.

21st capital (@ sina_21st)

21st capital (@ sina_21st)