The Bitcoin price breaks $ 90,000, but the financing rate on Binance is negative. Will BTC / USD break $ 100,000 while merchants will flutter?

Bitcoin is booming, is negotiated in early March 2025. As impressive as this increase is, traders on binance, the largest crypto exchange in the world by the number of customers, are not yet entirely on board.

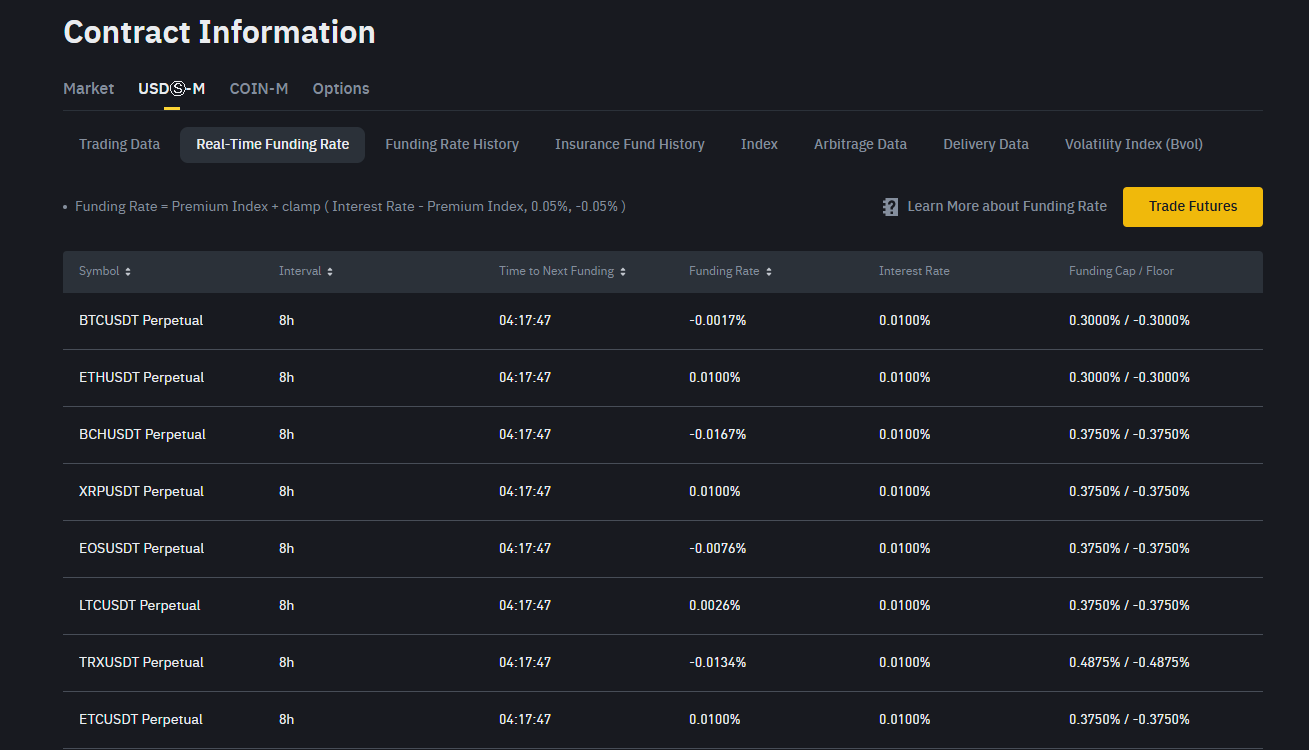

On X, an analyst noted that the funding rate of the Binance remains Negative, a marked divergence showing that, despite the price increase, there were no massive influx or a request for driving of the FOMO.

Binance trader in disbelief!

Do not sleep on this, we do not very often get configurations like this.

While Bitcoin offers a daily performance of almost 5%, investors in Binance do not seem to believe that this rally will last.

Whieas BTC continues to climb, financing rates on … pic.twitter.com/l9pdv8ihty

– Darkfost (@darkfost_coc) April 22, 2025

For experienced merchants who have been following market activity in recent years, this divergence has not only noise. It is a signal that Bitcoin, and by Altcoins extension, can prepare for a massive rally.

EXPLORE: 10 best coins IA Crypto to invest in 2025

The contrary catalyst on binance?

To understand why this is crucial, you have to understand the financing rates in crypto.

Funding rates are periodic payments between short and long traders on crypto perpetual markets. Although they help keep the index close to cash rates, they also evaluate the feeling.

When financing rates become positive, long merchants pay the sellers, which indicates that the purchase of the underlying assets is a bonus. When it is negative, as is currently the case, the sellers pay buyers, pointing to the bearish positioning and general skepticism.

As a rule, financing rates become negative when prices drop. However, they are currently negative despite the rise in bitcoin, exceeding $ 90,000.

(Source)

This evolution on Binance suggests that traders are skeptical about whether bulls can push even higher prices.

Historically, the analyst notes, skepticism with regard to upward strength tends to fuel prices rallies and interest in part of the Best cryptos to buy. In addition, such events are rare, depending on price data.

Capitalize on rare Bitcoin price signals?

In mid-October 2023 and early September 2024, funding rates became negative while prices increased, which preceded rallies that raised bitcoin to fresh summits.

After October 16, 2023, Bitcoin went from $ 28,000 to $ 73,000 and, in September 2024, the signal appeared before BTC / USD went from $ 57,000 to $ 108,000.

(BTCUSDT)

If the history is repeated, the current disconnection of the price of Bitcoin could prepare the ground for another vertical break.

From the price table, the local resistance is at the psychological bar of $ 100,000 and the highest of $ 109,000, serving as immediate targets.

There are clues that merchants are ready to push higher prices.

On X, an analyst noted that during the last 72 hours, more than 57,000 BTCs in new positions worth more than $ 5.3 billion was opened.

In the past three days, posts totaling 57,000 BTCs have been opened on the term market, worth 5.345 billion dollars at the current rate. This is the highest increase in liquidity in the past year. pic.twitter.com/ve08w0zvhq

– Axel

Adler Jr (@Axeladlerjr) April 23, 2025

This is the largest injection of liquidity in the past year, an indicator that the break up of $ 90,000 could be conducted in an institution.

Coinciding with this is the expansion of the Bitcoin growth rate, a metric comparing current and medium entry prices.

First Green Spike – An indication that the market has reached maximum growth speed: the price increases faster than the average entry price of all previous holders, thus creating a speculative premium. pic.twitter.com/0aa1dlm9j6

– Axel

Adler Jr (@Axeladlerjr) April 23, 2025

This growth speed indicates new aggressive capital entries, speculators ready to pay bonuses well above the historical averages for the exhibition.

The tip of this metric suggests that Bitcoin can be in the first stages of a Bull Run which can also help channel capital Present the hottest in 2025.

DISCOVER: Next crypto 1000x – 11 pieces that can 1000x in 2025

The price of bitcoin increased but the financing rate is negative

- Bitcoin goes beyond $ 90,000 for the first time in more than a month

- The funding rate of the binance is negative, signaling skepticism

- In the past, differences like these have preceded net price gains

- BTCUSDT will it rehash $ 109,000?

Post Bitcoin Rallying but the negative financing rate: a classic and rare bull signal not to be missed? appeared first on 99Bitcoins.

Binance trader in disbelief!

Binance trader in disbelief! Do not sleep on this, we do not very often get configurations like this.

Do not sleep on this, we do not very often get configurations like this.

Adler Jr (@Axeladlerjr)

Adler Jr (@Axeladlerjr)