Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Morbi Pretium Leo and Nisl Aliquam Mollis. Quisque arcu Lorem, quis pellentesque nec, ultlamcorper eu odio.

Este Artículo También is respondable in Español.

The price of Bitcoin increased to $ 87,400 on April 21, its highest level since March 29. The intraday rally added more than $ 3,000 to the asset in less than 24 hours, erasing a substantial part of the April withdrawal. Although the appreciation of a day of around 4% is not unprecedented for the notoriously volatile asset, the backdrop which accompanied the advance of Monday has market players who deal with this decision with additional importance.

Why is Bitcoin up today?

The most immediate macro-economic thread was the sale of the US dollar after the director of the national economic council, Kevin Hassett, told journalists on Friday that US President Donald Trump intends to replace the president of the Federal Reserve Jerome Powell. The dollar index (DXY) slipped to 98,182 on Monday, while capital was running in traditional gold simultaneously. The gold at the point went to a new summit at $ 3,385 per ounce, extending its gain from 2025 to 28%. On the other hand, the S&P 500 and NASDAQ term contracts exchanged approximately 0.5% less.

Related reading

Observers have seized the divergence between bitcoin and risk references. The financial author Mel Mattison wrote on X that he “see more evidence this BTC evening this evening which breaks his strong correlation Risk-on / qqq”, recalling his thesis of January that “it is the year when the BTC breaks which is correlation and begins to exchange more sympathy with gold”. The founder of Apollo, Thomas Fahrer, has reached a similar conclusion: “Bitcoin pumps while the actions on actions are negotiated. It is almost as if the market treats it as if it is an alternative financial system or something. ”

Kobeissi’s letter described the alignment between the two hard assembly stories as notable because “Gold reached its 55th higher in all in 12 months and Bitcoin officially joins the race, now greater than $ 87,000.” In a follow -up article, the macro newsletter argued that the two assets “tell us that a lower American dollar and more uncertainty are on the way”, creating part of the Gold force to the publication by President Trump of a list of “non -pricing cheating” on Sunday which targets the manipulation of quarry, to export subsidies and other forms of perceived economic aggression.

Related reading

The renewal of commercial-political anxiety capped a three-day Easter weekend which had failed, in the words of Kobeissi, to deliver “the trade treats the market at prices last week”. Trump’s “reciprocal rate” of Trump’s “reciprocal price” has still sixty-five days, and the feeling of the market seems more and more skeptical about a scanning agreement materialized in this window.

However, Fox Business correspondent Charles Gasparino reported on Sunday that a Wall Street manager “with ties with Trump’s White House” estimates that the Treasury Secretary Scott Bessent is “about to announce an important commercial agreement, likely to be with Japan”, while warning that negotiations remain fluid.

The price of bitcoin bursts

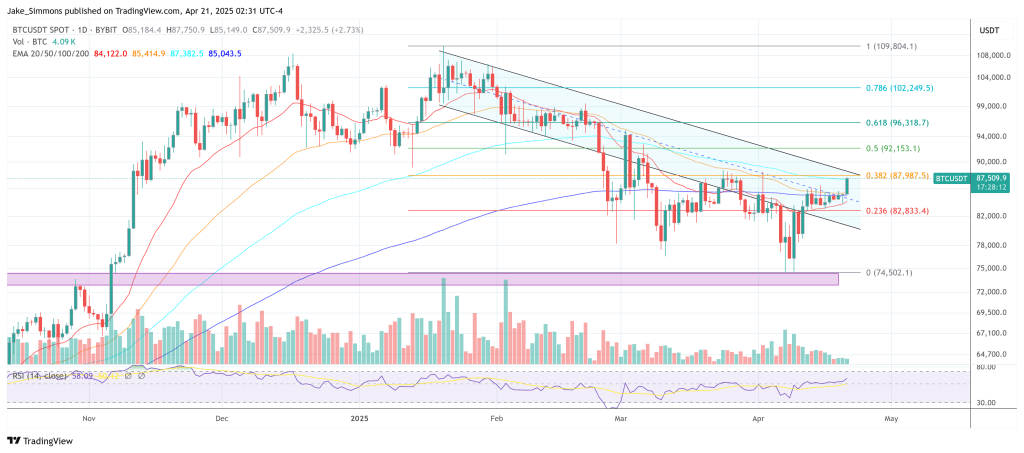

In the macro backdrop, the graphic technicians highlighted an important structural interruption in the daily Bitcoin graphic. The merchant Scott Melker observed that the punctual rate “he pierces through the descending resistance of the summit entirely” and must erase $ 88,804 to invalidate the series of lower ups and lower stockings.

The @ChartingGuy account highlighted $ 94,000 – Fibonacci’s retrace of 0.618 from the entire draw – as “the minimum objective on this rally”, adding that market behavior at this level will determine if the current impulse proves a simple relief rebound or the beginning of a more sustained advance.

Meanwhile, the crypto analyst warned: “It’s good to see the breeze, but the timing is important. Sunday is not one day to celebrate a low -volume pump while the stock markets are closed. If you want to see bullish movements allows you to see the stocks open tomorrow and keep this green candle. Then we can have fun. “

At the time of the press, BTC exchanged $ 87,509.

Star image created with dall.e, tradingView.com graphic