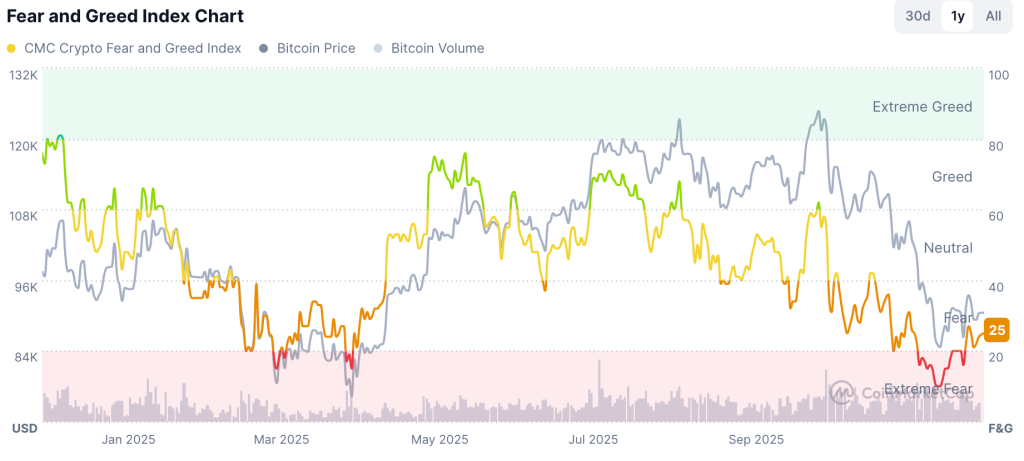

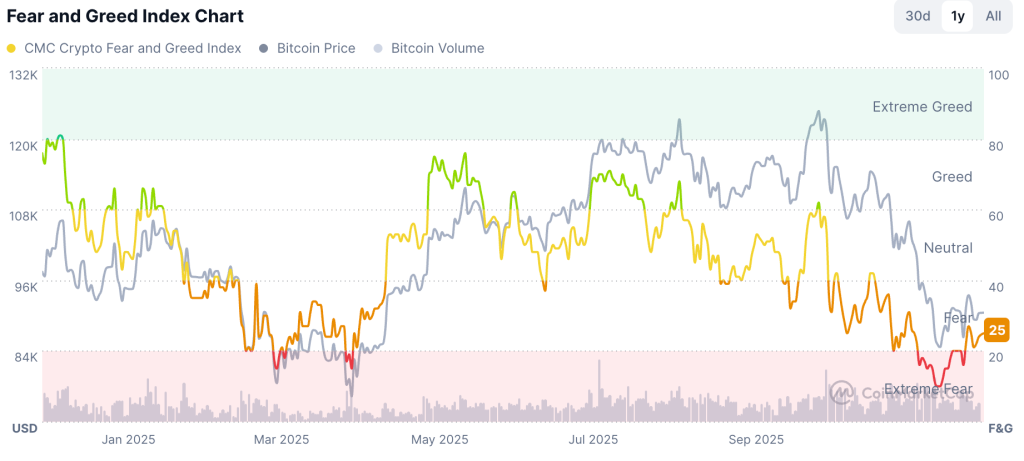

Fear continues to shape the market, even if the strong panic of late November has subsided. The Fear and Greed Index now reads 25, placing sentiment inside the fear band without dipping back into extreme readings.

Bitcoin is trading just above $90,000 with a slight recovery from previous lows, and the market continues to behave as if it is still sorting through recent losses rather than preparing for a broad shift in risk appetite.

In this restricted environment, only a few altcoins are showing clear strength. Zcash, MemeCore and Cardano are advancing while the majority of large caps remain silent. Their performance provides a narrow window into how traders position themselves when the broader market falters but does not fully retreat.

Fear and Greed Index (Source: CoinMarketCap)

Zcash shows its first significant rebound after heavy losses

Zcash (ZEC) is now trading around $426, up about 10% in 24 hours, and its rise stands out as the token fell sharply from a high near $700 in November before losing almost 30% over the course of the month.

Today’s trading data shows firmer depth and a recovery in spot volume across multiple venues, indicating that market participants are revisiting liquid privacy names now that the steepest part of the decline has passed.

The rebound leaves ZEC still far from last month’s peak, but the current structure appears more stable than previous recovery attempts. Activity is spread across multiple markets rather than concentrated in narrow windows, suggesting a more stable base for the token as sentiment stabilizes around mid-20s fear readings.

MemeCore Advances In Continued Community Activity

MemeCore (M) is trading near $1.34, up about 9% in 24 hours. The move follows a period in which community engagement continued even during the extreme fearful conditions of the past week.

MemeCore Price (Source: CoinMarketCap)

Trading screens display stable liquidity on its active pairs, and on-chain usage tied to staking and social features remains visible enough to support small bursts of momentum whenever market pressure slows.

The current rise seems linked to this continued participation rather than to any single driver. MemeCore tends to work best when traders are looking for tokens supported by active user bases rather than one-off events.

Cardano is higher with a large-cap rotation

Cardano (ADA) is trading near $0.45, up about 3% in 24 hours. The growth is modest but consistent with behavior seen in other large caps over the past few sessions, where liquidity remains firm and flows balance out once Bitcoin stabilizes.

Trading volumes today show measured participation rather than heavy accumulation, but ADA continues to benefit from being one of the most established networks during periods of risk aversion.

Cardano’s move does not change its long-term trend, but it illustrates how stable large caps often move first when markets take a break after a decline.

Altcoin season still out of reach despite small pockets of strength

The overall picture still leans toward caution. A fear figure of 25, Bitcoin holding just above $90,000, and limited rotation among major assets all point to a market that has not regained the scale usually associated with altcoin season.

The progress of Zcash, MemeCore, and Cardano shows that selective interest persists, but gains remain narrowly concentrated and rely heavily on liquidity and existing user activity rather than general enthusiasm.

For now, altcoin season sits at bay, with only small pockets of momentum taking shape while sentiment remains anchored in the lower bands of the Fear Index.

The post Bitcoin Stagnates Near $90,000 as Some Altcoins Rally, Leaving ‘Altcoin Season’ on Hold appeared first on Cryptonews.