The cryptocurrency industry expects a friendly Trump administration that will support digital assets, a belief that is already propelling markets to new highs.

Bitcoin supporters and the crypto industry as a whole viewed President Joe Biden’s administration as hostile to digital assets. Securities and Exchange Commission Chairman Gary Gensler, in particular, is seen as hostile, and his eventual departure and replacement should be welcomed.

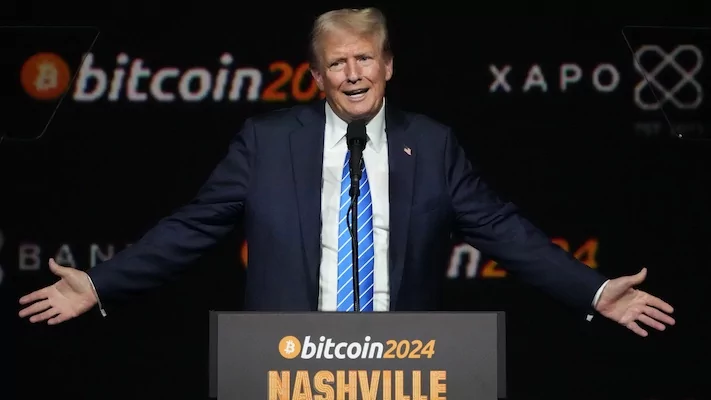

The Trump White House and the SEC should be good for the crypto industry and the markets have reflected this. Bitcoin prices exploded in the days following President-elect Donald Trump’s victory, reaching new record highs, reflecting optimism about change in the new administration and a new Congress.

“I think there’s a lot of optimism within the industry about a more favorable regulatory environment,” said Jennifer Schulp, director of financial regulatory studies at the Cato Institute. Washington Examiner.

CONGRESSIONAL REVIEW ACT: WHAT TO KNOW ABOUT THE TOOL REPUBLICANS HOPE TO USE TO REVERSE BIDEN’S RULES

After Trump embraced the crypto industry earlier this year, leading Bitcoin miners launched a new nonprofit called the Bitcoin Voter Project, which focuses on educating and galvanizing voters around Bitcoin and cryptocurrencies.

Brian Morgenstern, chairman of the group, said in an interview with the Washington Examiner that he believes there will be a “more balanced approach” to crypto in the new administration.

“Where the administration considers the benefits of these assets and the creation of value, and tries to be globally competitive, so that the jobs and all the value are captured by the United States, instead of trying to slander our industry and chase us to other countries. said Morgenstern, who is also head of public policy at Riot Platforms.

On Monday, less than a week after the election, the price of bitcoin was approaching $89,000, a staggering 28% increase from the night of the election itself.

The agency with the greatest influence over crypto is the SEC. Trump should replace Gensler with someone more pro-industry. Changes to SEC policy could begin soon after, according to Schulp.

“I would expect to see attempts to roll back at least some of the enforcement actions against crypto, and an attempt to begin to initiate new regulation development,” Schulp said. “Essentially, the interim president has a lot of authority. »

Trump could appoint one of the SEC’s current Republican commissioners, Hester Peirce or Mark Uyeda, as acting chair. Uyeda has already indicated that he expects a radical change in policy within the SEC.

“The commission’s war on crypto must end, including crypto enforcement actions based solely on failure to register without an allegation of fraud or harm,” Uyeda said on Fox Business. “President Trump and the American electorate have sent a clear message. Starting in 2025, the role of the SEC is to fulfill this mandate.

And the Biden administration has really shaken up the industry, one of the reasons the Bitcoin Voter Project was able to gain support.

Earlier this year, the Biden administration found itself at odds with crypto proponents by opposing bipartisan House-passed legislation 279-136 aimed at clarifying regulation of digital assets while protecting investors and consumers.

Additionally, several Democrats, including Senate Majority Leader Chuck Schumer (D-NY), broke with the administration and voted in May to rescind an SEC accounting policy rule related to cryptocurrency that, according to critics, discourages companies and major custodians from holding crypto assets for their clients.

Schulp expects this accounting policy to be scaled back under the new Trump administration.

Critics of Gensler say he has been too harsh on crypto regulation and has failed to provide clear guidelines on which digital assets are commodities and which are securities, which would require exchanges to register as a securities broker-dealer with the SEC.

Gensler has also been criticized for the SEC’s so-called “regulation by enforcement” approach to crypto. SEC enforcement actions against crypto companies have nearly doubled since Gensler took over in 2021.

Biden regulators have consistently clashed with crypto investors. The SEC has been particularly harsh following the collapse of major exchange FTX.

Bitcoin mining requires a lot of energy and the Biden administration has tried to curb domestic mining, Morgenstern said. He said that agency would likely change course under Trump.

“I would expect Trump’s Department of Energy to take the opposite approach, that it sees the potential in Bitcoin mining to help achieve the president’s energy dominance agenda,” Morgenstern said .

Although much of the crypto crackdown has come from the agency side, Congress also has a role to play – especially now that Republicans appear to want to control both chambers and the White House.

Sen. Tim Scott (R-SC) is the expected new chairman of the Senate Banking Committee, which would likely be involved in crypto legislation. A spokesperson for the ranking member indicated that Scott would help legislate guidelines for digital assets.

“The senator. Scott will work to build a regulatory framework that establishes a trusted pathway for the commerce and custody of digital assets that will promote consumer choice, education and protection and ensure compliance with appropriate Bank Secrecy Act requirements “, said the spokesperson.

Morgenstern said a market structure would be helpful because it would provide clear rules for the industry to thrive in the United States.

Another pro-crypto bill that could be considered is that of Sen. Cynthia Lummis (R-WY), who is one of the industry’s strongest advocates on Capitol Hill.

She proposed legislation, the BITCOIN Act, that would establish a strategic bitcoin reserve and launch a bitcoin purchasing program with the goal of the United States acquiring a total stake of approximately 5% of the total bitcoin supply . The bill would also confirm the self-custody rights of private bitcoin holders.

Lummis told Washington Examiner that Trump will be “the most pro-bitcoin and pro-crypto president in our country’s history” and that under him, the United States will be better positioned to create a strategic bitcoin reserve.

“Congress has already shown that there is strong bipartisan support for crypto industry adoption, and I am thrilled to have the opportunity to partner with President Trump and my colleagues to take this big step towards a new financial frontier and make our economy strong again,” she said. said in a statement.

Morgenstern said he and his group are optimistic about the future of bitcoin and cryptocurrency under Trump, who is expected to take office on January 20. He said “the sky is the limit” in terms of what changes can be made.

CLICK HERE TO READ MORE FROM THE WASHINGTON EXAMINER

“That’s why we’ve funded the Bitcoin Voter Project and other ways to support pro-bitcoin candidates,” he said. “Because we lived for four years under a government that was trying to put us out of business. A candidate ran against this government and said, “I want you to succeed.” I want the United States to be the Bitcoin superpower of the world.

“I think it will be a much friendlier environment for us to thrive in,” Morgenstern added.