- Long-term holders could start accumulating BTC as short-term holders gradually distribute their holdings.

- Miners have seen their profitability increase despite the increasing difficulty of mining BTC.

Bitcoin (BTC) established a new price level above $100,000 for the second time this year, reaching an all-time high of over $109,000.

This step suggests that $100,000 could potentially serve as a new level of psychological support, with bullish market sentiment providing further momentum for higher prices.

AMBCrypto’s analysis showed that the continued trading of BTC between short- and long-term holders further contributed to the cryptocurrency’s bullish outlook.

Will history repeat itself as BTC changes hands?

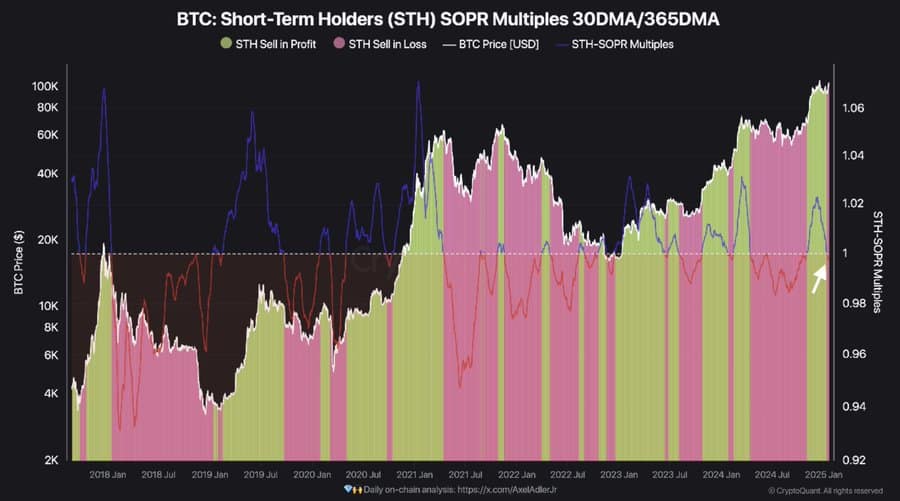

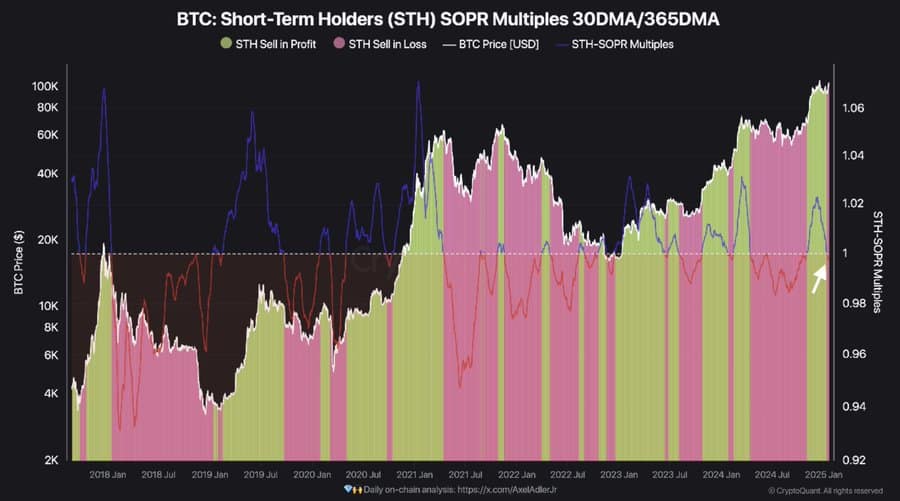

According to information from CryptoQuant, short-term Bitcoin holders have started selling at a loss, as indicated by the Short-Term Holder (STH) SOPR multiple.

This metric compares the short-term holder’s spent profit ratio (SOPR) over 30- and 365-day periods.

Generally, a value greater than 1 indicates that STHs are making profits, while a value less than 1 indicates losses. Current data shows that STH is selling at a loss.

Source: Glassnode

Historically, when STH SOPR becomes negative, it often attracts long-term holders (LTH) to accumulate more BTC.

LTHs are considered a very bullish cohort in the market as they hold BTC for at least 155 days.

This behavior reduces circulating supply, meaning accumulation at this level could positively impact the price of BTC and push it higher.

Can miner profitability drive prices up?

As long- and short-term BTC holders actively trade their positions, miner profitability has reached new heights despite the increasing difficulty of mining.

Mining difficulty is a mechanism designed to maintain the security of the Bitcoin network by ensuring consistent block production over time.

As the difficulty increases, it becomes more difficult for miners to process transactions and earn rewards.

Source: Glassnode

According to Glassnode’s difficulty regression model, miners experience approximately 3x higher profitability. The current cost of mining 1 BTC is $33,900, while the price of BTC at the time of publication stood at $104,900.

This large profit margin could incentivize miners to hold on to their BTC reserves as the value of the asset increases.

This behavior, coupled with accumulation by long-term holders (LTH), reduces the circulating supply of BTC and could pave the way for an eventual price rally.

Could BTC be on track for a 500% surge?

BTC’s current price performance appears to align with historical trends, particularly the bullish market rally seen between 2015 and 2018, according to Glassnode data analyzing BTC’s price movements since the cycle low.

Based on this metric, BTC has the potential to rebound by approximately 562%, or 5.62 times its current price of $104,850.

Source: Glassnode

Read Bitcoin (BTC) Price Forecast 2025-2026

If this projection holds true, BTC could surpass $589,000 by the end of the current cycle, setting a new all-time high for the cryptocurrency.

So far, market sentiment remains optimistic, reinforcing the possibility that BTC will continue its upward trajectory.