Join our Telegram Channel to stay up to date on the coverage of information on the breakup

The Bitcoin price has dropped below $ 110,000 in the last 24 hours while Fear has entered the cryptography market for a second consecutive day.

The price of the BTC DArrived a fraction of one percent to negotiate at $ 109,817 at 12:40 p.m., while the Crypto Fear and Greed index increased from 28 to 33 yesterday, still depriving a “fear” state among investors as prices have dropped.

📈 The potential Bitcoin push linked to the change of nourished leadership

Mike Novogratz suggests $ BTC could reach $ 200,000 if the next president of the federal reserve adopts a highly dominant monetary policy position. The CEO of Galaxy Digital considers this change of potential leadership as the “biggest bitcoin bull… pic.twitter.com/icvjqvaixv

– 👁 Kolyan trend | NFT and METARSSE 👁 (@kolyan_trend) September 27, 2025

However, a Bloomberg report that President Donald Trump reduced his limited list for the next president of the Federal Reserve to three CEO candidates from Galaxy Digital, Mike Novogratz, who said BTC May has increased $ 200,000.

“It is the largest potential bull catalyst for Bitcoin and the rest of the crypto,” said Novogratz in an interview with Kyle Chasse.

A dominant position of a new FED chief would mean a drop in interest rates, and it would probably be a bull catalyst for Bitcoin and other risk assets.

The economic adviser of the White House, Kevin Hassett, the governor of the federal reserve Christopher Waller and the former Fed governor, Kevin Warsh, are the names of the restricted list of Trump to replace Jerome Powell to the Fed, reported Bloomberg.

Can the BTC falling below the work resistance of $ 110,000, can bulls take care of pushing the assets at higher levels?

Bitcoin price on the edge of an escape

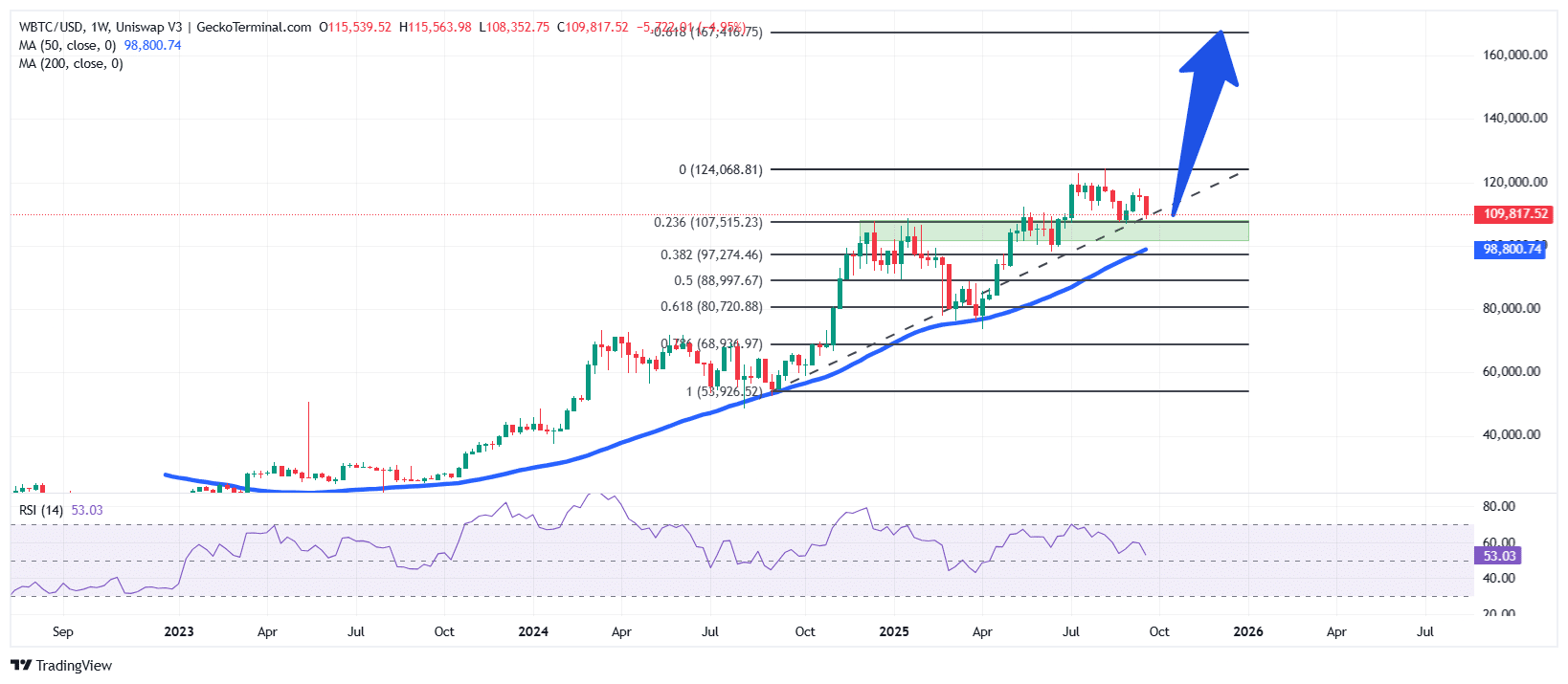

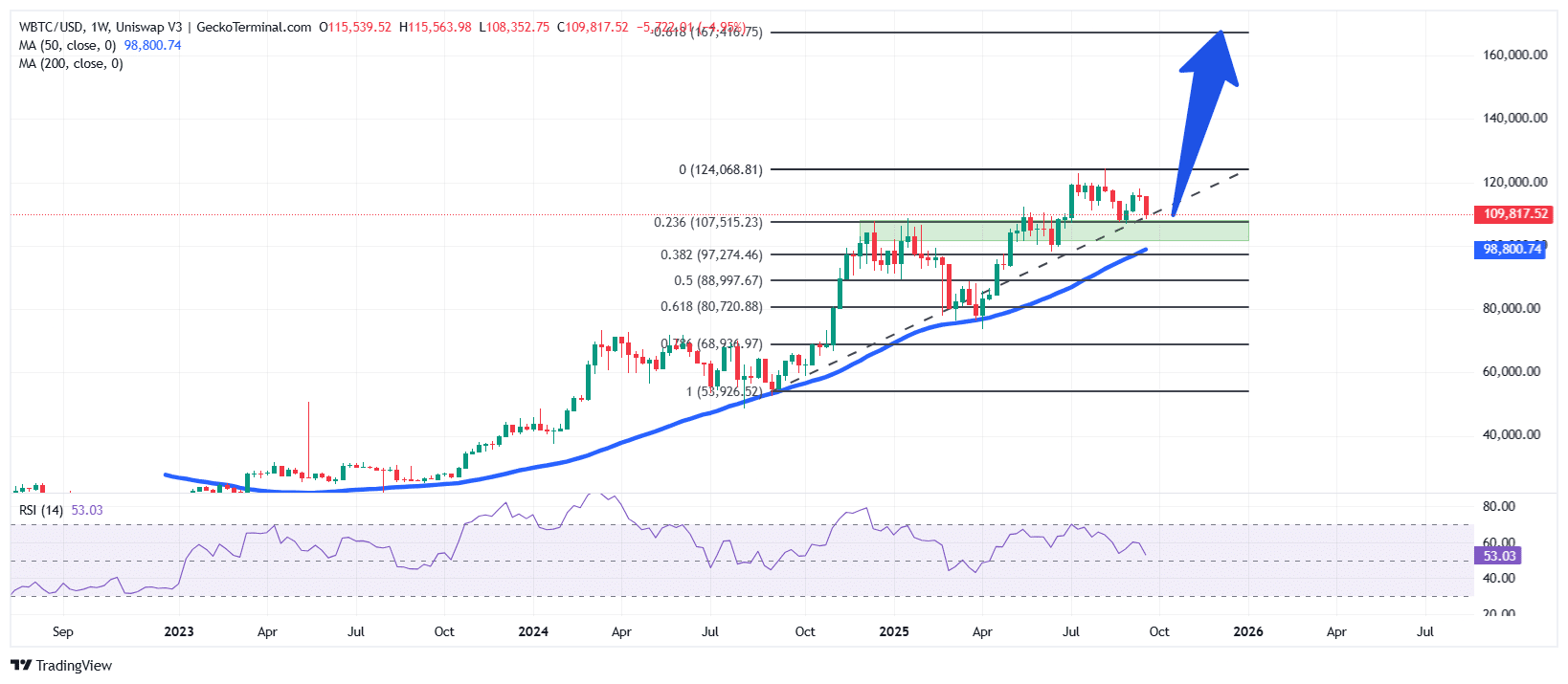

The weekly graphic for the BTC price reveals a strong long -term trend that has been intact since the end of 2023.

The action of the Bitcoin price shows higher ups and downs and higher stockings, the last candles consolidating just above the level of fibonacci retracement of 0.236 around $ 107,500. This area acted as a critical support area, preventing deeper corrections.

By examining the main indicators, the simple 50 -day mobile average (SMA) on the one week’s graph is positioned well below the current price, indicating a healthy structure.

The price of the BTC remaining comfortably above these levels, it signals the strength of the trend. Fibonacci trace levels provide key areas of interest, with the level from 0.382 to $ 97,274 and the $ 0.5 to 88,997 level used as potential supports if the market is decreasing.

Meanwhile, the relative resistance index (RSI) is at 53, a neutral reading that suggests neither overbound nor occurring. This balance often offers room for an increase without immediate risk of exhaustion.

Based on the current configuration, the price of bitcoin seems to be to build a base for another higher leg. If the level of $ 107,500 holds, BTC could go to the FIB goal following $ 160,000, after having released its top of all time (ATH) above the $ 124,000 area.

This occurs when Eric Trump thinks that Bitcoin could exceed the level of $ 1 million in the fourth quarter.

🇺🇸 Eric Trump says: “I think Bitcoin will exceed $ 1,000,000 and the fourth quarter of this year will be incredible” 🚀 pic.twitter.com/fh4czfs0dz

– ash crypto (@ashcryptoral) September 26, 2025

Conversely, if the price of Bitcoin drops below $ 107,500 support, the following cushion against the downward pressure could be around SMA of $ 50 days at $ 98,800 and near the FIB level of 0.382 ($ 97,274).

Related news:

Best wallet – diversify your crypto wallet

- Easy to use cryptographic wallet, easy to use

- Get early access to ICO to toys to come

- Multi-chaînes, multi-walk, non-guardians

- Now on the App Store, Google Play

- Pape to win the native token $ the best

- 250,000+ monthly active users

Join our Telegram Channel to stay up to date on the coverage of information on the breakup