When the markets become trembling, investors rush for a port in the storm. During generations, this port of Safe was almost always gold. Today, two new digital arrivals are competing for this title – the gold that has been converted into exchangeable tokens and the original cryptocurrency – Bitcoin.

Examining what makes a truly safe asset shows how these new options adapt and break the old mold.

A real refuge is supposed to Zig when the rest of the Zags market. While investors panic their actions, they should be able to accumulate in these assets to protect their money or even see it develop. To win this confidence, an asset needs some key qualities. You must be able to sell it quickly without crushing the price.

Its supply cannot be something that can be swollen in the uselessness overnight. There must be a stable and wide base of people who want it, and it should not be something that can rot, rust or become obsolete. Having long experience by being useful and accepted certainly helps to build your case.

All these glitter can be gold …

The Gold Curriculum Vitae for this work is long and corrected.

During the 2008 financial collapse, for example, gold prices climbed as the S&P 500, showing this perfect inverse relationship. We saw a flight similar to safety during the initial chaos of the COVVI-19 pandemic. Its reputation is built on a solid ground – it is liquid, with a price recognized worldwide, a new offer is limited and costly to mine, demand is constant from jewelry to industry at central banks, and it is practically indestructible.

However, a recent analysis suggests that its role could change. Especially since he has sometimes evolved with actions during more recent fear.

Tokenized gold tries to give old metal a modern digital makeover. It works by creating digital claims on a blockchain that corresponds to a real physical gold held in a secure safe. This approach directly addresses some of the drawbacks of physical gold. By scanning it, you can exchange tiny fractions of a bar, 24/7, from anywhere, which could make it even easier to buy and sell.

It can also reduce the costs of storage, insurance and transactions by removing intermediaries. The blockchain can also provide a transparent and unchanging recording from what has what. Compromise, however, is a new class of concerns. The rules of these digital assets are still in writing and can differ madly from one place to another.

You also fully depend on the honesty and competence of the company issuing the token and keeping real gold. And, of course, the digital platforms themselves can be hacked.

Is Bitcoin a legitimate competitor?

Bitcoin does not just want to improve gold. In fact, he presents a completely different security philosophy. Fans see it as the ultimate value store for a digital world.

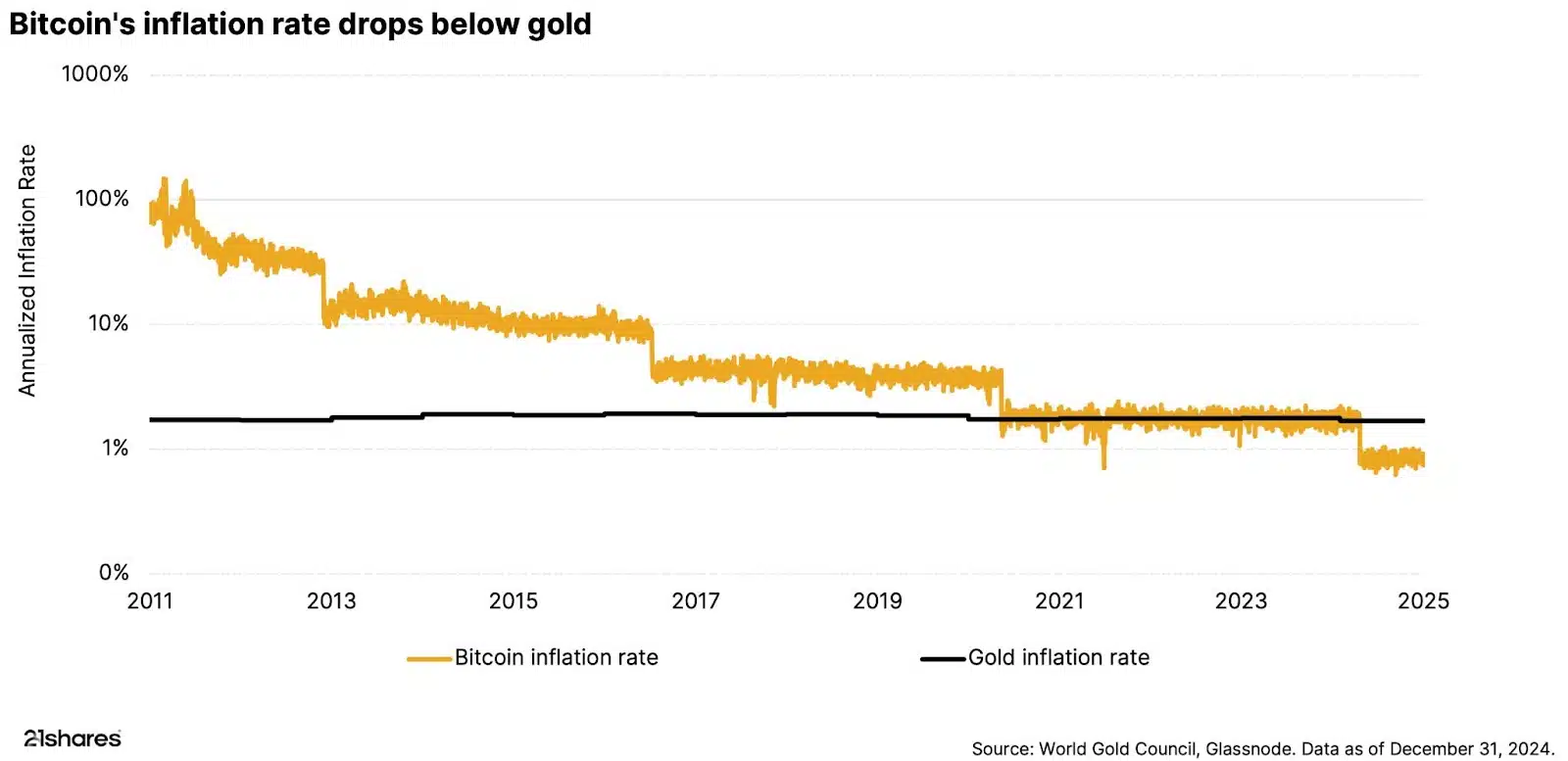

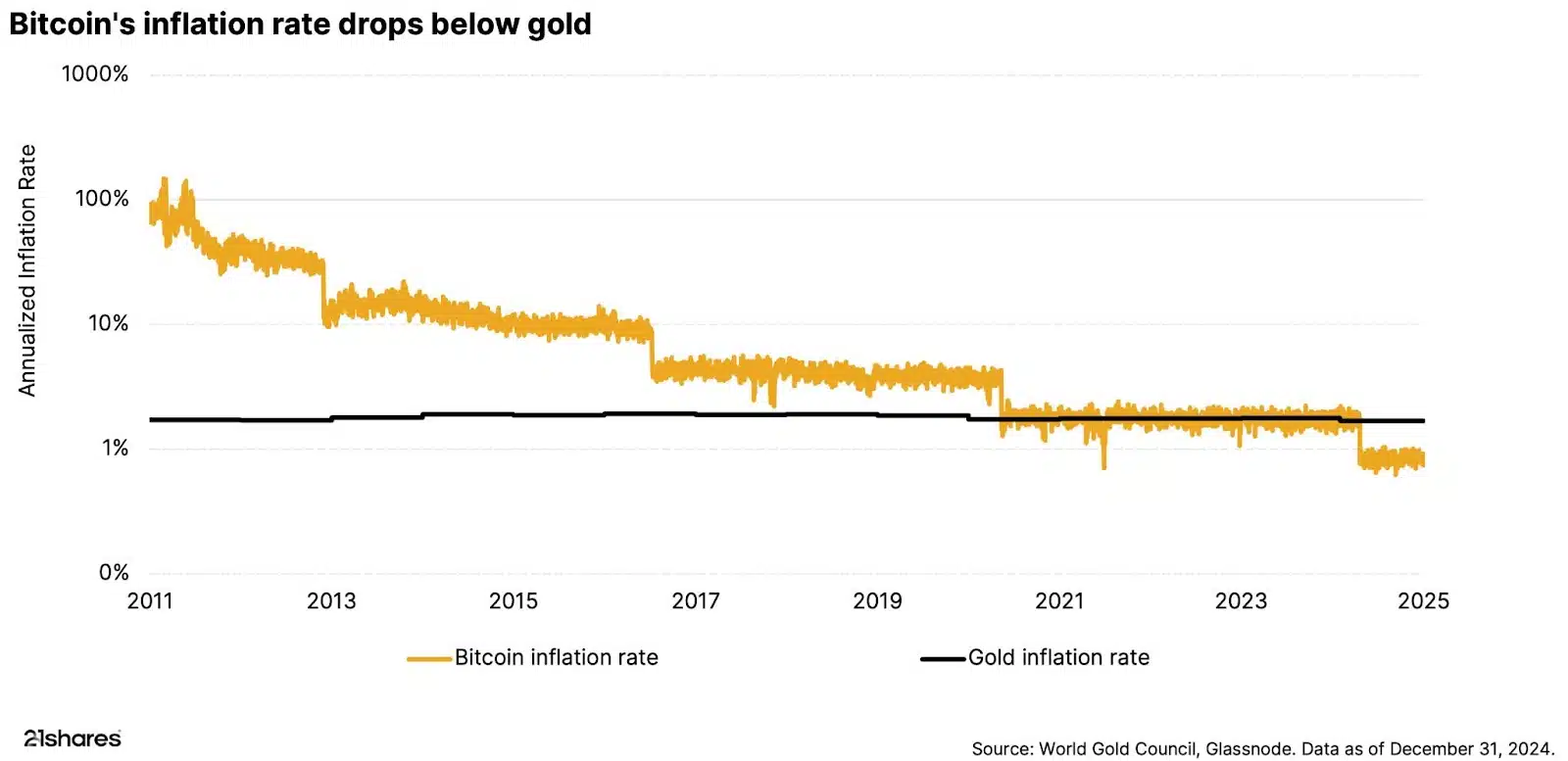

Source: 21Shares

The argument for Bitcoin is based on some powerful ideas. It is decentralized, so no government or business can control or censor it. Its supply is mathematically fixed and predictable, with a hard ceiling of 21 million pieces which can never be modified. It is also without border, transferable to anyone with an internet connection.

Alas, the Bitcoin path to become a safety port is blocked by a massive obstacle – its own wild price oscillations. Its value is famous for the huge and sudden movements that undermine any pretension to be a stable place to browse wealth. In several recent slowdowns, Bitcoin has actually fallen harder than the stock market, acting more as a risky technological stock than a financial rescue canoe. Its story wink at Gold millennia, and its behavior in a deep and prolonged global recession is completely unknown.

Source: Blackrock Investments

The very meaning of financial security is to be won.

Gold is the proven norm, although its perfect record is now questioned. Tokenized gold smoothes the rough edges of the physical goods, but presents a different set of risks based on confidence and technological.

Bitcoin is a revolutionary but not proven alternative, whose extreme price swings make it a questionable shelter of a financial storm. Although it can have a place in a diversified portfolio, its performance during the market panic suggest that it is far from being a real refuge.