Key notes

- Spot Bitcoin ETFs just recorded their worst month since February, with $3.48 billion in outflows.

- The massive accumulation of whales has formed one of the densest cost support zones near $80,000.

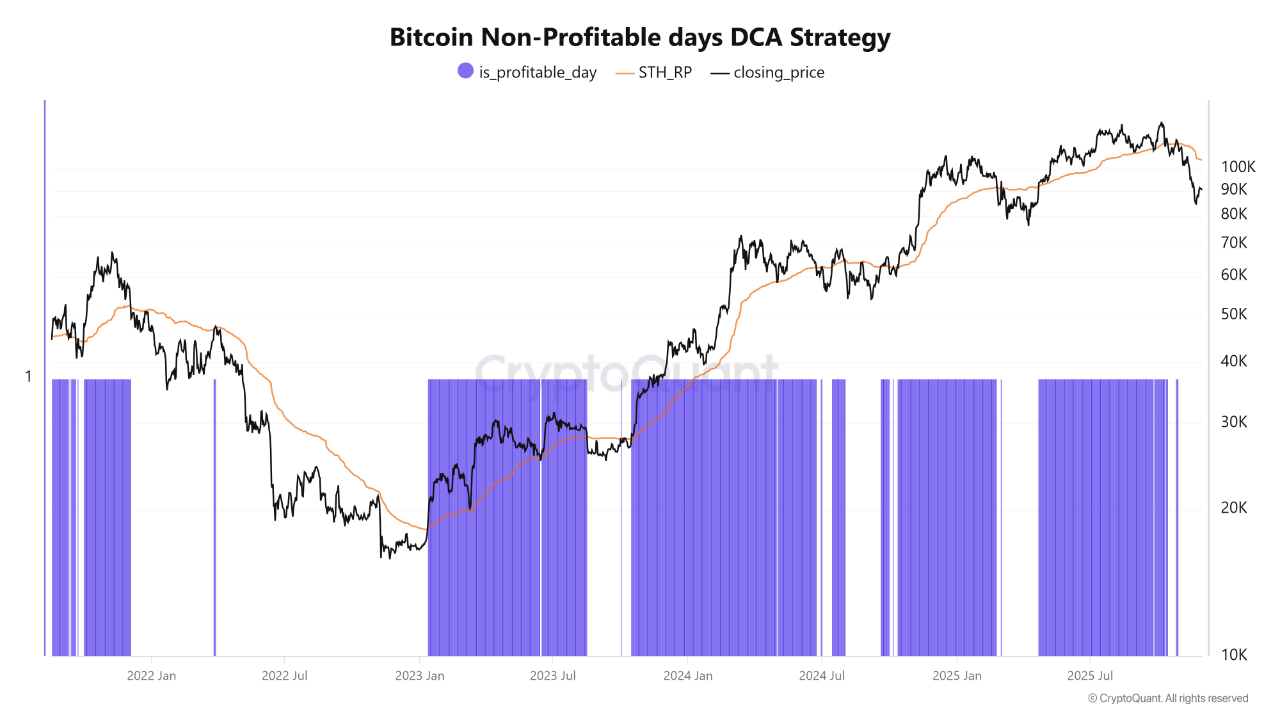

- Analysts say Bitcoin’s decline below the DCA stress line historically signals the best long-term buying zones.

Bitcoin

BTC

$85,803

24h volatility:

6.5%

Market capitalization:

$1.71 million

Flight. 24h:

$71.53 billion

entered December after ending the previous month with the worst performance for spot BTC ETFs since February, as large capital outflows were met with a sudden collapse in market liquidity.

Data from SoSoValue shows that spot ETF products ended November with $3.48 billion in net outflows, as well as a single-day abrupt outflow of $903 million on November 20.

BlackRock’s IBIT saw its own record two days earlier when investors withdrew $523 million and pushed its monthly outflows above $2.4 billion on November 25. However, IBIT remains BlackRock’s most profitable ETF globally and holds over $119 billion in assets, with cumulative inflows still close to $58 billion.

A major defense against bears

Glassnode observed in an article

A new cost basis cluster formed after Bitcoin fell to the $80,000 region, showing further accumulation at these levels. This area is now one of the densest on the heat map and could be a strong support area, likely to be defended by recent buyers.

📉 pic.twitter.com/yQHK8ziwMA– glassnode (@glassnode) December 1, 2025

The company pointed to massive demand at the exact time many short-term traders were selling, which turned the sell-off into an opportunity. This cluster now constitutes a potential defensive wall for the evolution of Bitcoin prices.

Market analyst Michael van de Poppe added that the start of a new month activates algorithms and drains liquidity, especially after the elimination of several market makers in October.

Typical movement in the markets for $BTC.

Just like clockwork, a new month begins, the algorithms are activated and the price is lower.

Liquidity is considerably low. For what? Because a ton of market makers got hammered on 10/10.

Nothing has changed in the price action of #Bitcoin.

It was… pic.twitter.com/mNCcdZMl4r

– Michaël van de Poppe (@CryptoMichNL) December 1, 2025

Poppe added that BTC was rejected during very significant resistance and continues to consolidate. He expects a retest of this resistance in the next week or two, followed by a real chance of a breakout towards $100,000.

Bitcoin was executed?

On the other hand, entrepreneur Shanaka Anslem Perera argued that Bitcoin did not simply fall. In his own words, he was “executed.” He attributed the shock to rising yields on Japanese government bonds, which have reached levels not seen since before the global financial crisis.

This sudden rise dismantled the multi-trillion dollar carry trade that had enabled decades of cheap capital flows into global assets. As yields rose and the yen strengthened, leveraged positions became unprofitable. Forced sales, margin calls and liquidations resulted in massive liquidations on October 10.

Perera also pointed out that whales accumulated around 375,000 BTC while institutions reduced their exposure and miners significantly reduced their own sales.

BITCOIN DIDN’T CRASH.

He was executed.

The weapon: Japanese government bonds.

On December 1, 2025, the Japanese 10-year yield reached 1.877 percent. The highest since June 2008. The 2-year rate reached 1 percent. A level not seen since the fall of Lehman.

This triggered the denouement of… pic.twitter.com/i9aWHoIbm

– Shanaka Anslem Perera ⚡ (@shanaka86) December 1, 2025

DCA all the way

According to CryptoQuant analysts, whenever Bitcoin trades under the DCA strategy on unprofitable days, new buyers suffer losses and the market enters a phase of stress and low volatility. Historically, these phases have produced the best long-term results for patient buyers.

Spot Bitcoin (BTC) ETFs Just Recorded Their Worst Month Since February, With $3.48 Billion in Outflows

The method avoids attempts at prediction and relies on structural discount periods illustrated by basic cost behavior. The logic is simple: fear signals opportunity, not danger.

following

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article is intended to provide accurate and current information, but should not be considered financial or investment advice. Because market conditions can change quickly, we encourage you to verify the information for yourself and consult a professional before making any decisions based on this content.

A crypto journalist with over 5 years of industry experience, Parth has worked with leading media outlets in the crypto and finance world, gaining experience and expertise in the field after surviving both bear and bull markets over the years. Parth is also the author of 4 self-published books.

Parth Dubey on LinkedIn