(Bloomberg) — Bitcoin lagged traditional assets in August as the month drew to a close, hampered by declining liquidity and lingering concerns that governments could sell off their cryptocurrency stockpiles.

Bloomberg’s most read articles

The United States, China, the United Kingdom and Ukraine are potential sources of such sales, as are creditors receiving tokens from the bankrupt digital asset exchange Mt. Gox, research firm Kaiko wrote in a note. That’s part of a possible $33 billion oversupply of Bitcoin, the analysis found.

Kaiko estimates that the U.S. government holds about 203,220 bitcoins, followed by China with 190,000, the U.K. with 61,200, and Ukraine with 46,350. Governments seize tokens in criminal cases, while Ukraine reportedly received donations to fund its defense against Russian invasion. Meanwhile, Mt. Gox has about 46,170 tokens to distribute, Kaiko said.

“Oversupply has been a talking point in crypto markets throughout the summer,” Kaiko analysts Adam Morgan McCarthy and Dessislava Aubert said. There are several “large holders that could be potential sources of selling pressure in the months ahead,” they added.

Bitcoin fell 2.9% to $57,800 on Friday, about $16,000 below its March peak. Tokens such as Polygon and Solana fell more, each down more than 5%.

Decrease in liquidity

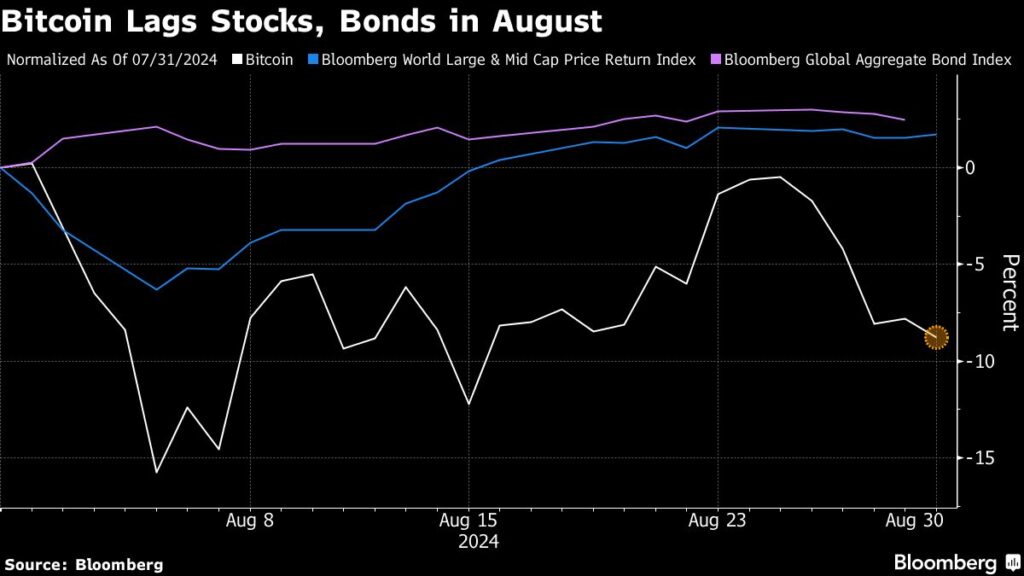

Fears of massive sell orders come amid a decrease in liquidity in the Bitcoin market, which can amplify price swings in response to large transactions. The digital asset has fallen about 10% since the start of the month amid this backdrop, compared with gains of about 2% for global stock and bond indices.

“Spot market volumes for Bitcoin remain low, contributing to recent price volatility,” Sean Farrell, head of digital asset strategy at Fundstrat Global Advisors LLC, wrote in a note. Seasonal patterns suggest activity typically picks up after the U.S. Labor Day holiday on Monday, he added.

One metric Farrell pointed to is Bitcoin’s seven-day average turnover (transaction volume divided by the token’s market value), which has declined toward 2% after peaking near 5% around the digital asset’s record rally in March.

Bitcoin struggled in August despite net inflows into U.S. spot-Bitcoin exchange-traded funds and growing expectations that the Federal Reserve will ease monetary policy in the coming weeks.

ETF Background

The trading environment has also become more challenging in the U.S. Bitcoin ETF space, according to strategists at JPMorgan Chase & Co. That’s based in part on a metric known as the Hui-Heubel ratio, which purports to provide information on liquidity by measuring the number of transactions required to move prices.

“It is striking that this metric has been deteriorating for all spot-Bitcoin ETFs since March, indicating an overall deterioration in spot-Bitcoin ETF liquidity over the past six months,” said the JPMorgan team, including Nikolaos Panigirtzoglou.

Combined daily trading volume for U.S. Bitcoin ETFs has fallen to less than $2 billion from a peak of more than $10 billion in March, according to data compiled by Bloomberg.

Bloomberg Businessweek’s Most Read Articles

©2024 Bloomberg LP