According to remarks made at Yahoo Finance’s Invest event, Eric Trump told attendees that he expects a major shift in how money flows between traditional stores of value and new digital assets.

Related reading

He said Bitcoin’s fixed supply of 21 million coins and growth in institutional buying are key factors. In another interview with Fox Business in late September, he predicted a long-term price target of $1 million per Bitcoin, a forecast that highlights how optimistic his view is.

Bitcoin Seen as a Faster Engine of Value

Eric argued that Bitcoin – which he called the “greatest asset” of all time – moves its value more quickly and cheaply across borders than metal which must be transported and locked.

He called Bitcoin “digital gold” and pushed the idea that its code-based supply gives it an advantage over physical bullion.

Based on reports, he also touted crypto as a hedge against inflation, corruption, and weak monetary policy – reasons he said account for its growing adoption around the world.

JUSTIN: 🇺🇸 Eric Trump says a gold-Bitcoin rotation is imminent

“The ratio will shift disproportionately toward Bitcoin.”

“It’s the greatest asset we’ve ever seen.” pic.twitter.com/4TYY1qALlm

– Bitcoin Archive (@BitcoinArchive) November 14, 2025

The rapid rise of American Bitcoin

Eric and his brother Donald Trump Jr. co-founded American Bitcoin (ABTC), which went public in September and now has a market valuation approaching $4 billion.

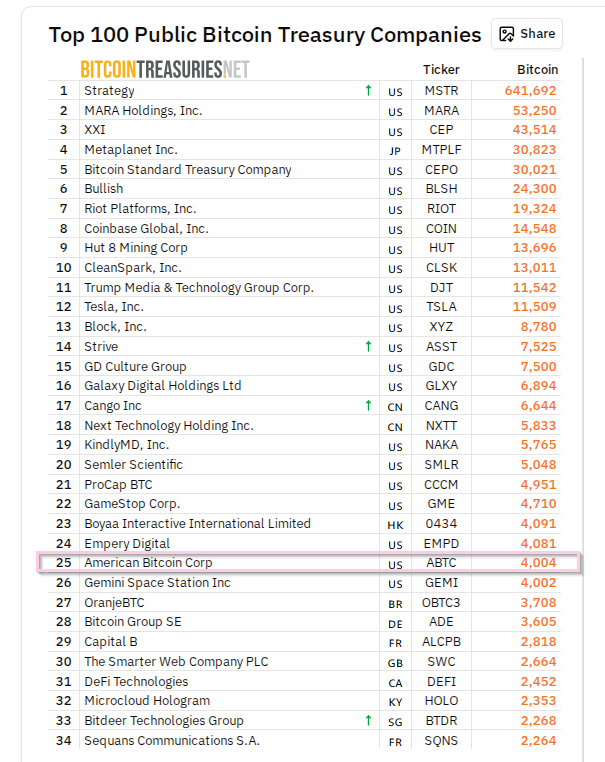

The company grew rapidly after merging with Gryphon Digital Mining. According to Bitcoin Treasuries, ABTC is the 25th largest public Bitcoin holding company in the United States.

Company officials say their West Texas mines benefit from low energy costs, allowing them to produce Bitcoin at about half the current spot price.

Source: Bitcoin Treasuries

Business growth and risks

Growth has been rapid, but analysts and critics warn of obvious risks. Mining companies gain when prices rise and can suffer when prices fall. Some fear that a combined ABTC-Gryphon company could face greater fluctuations in profits and asset values as crypto markets remain volatile.

There are also concerns about the mixing of political and financial ties; World Liberty Financial, a project affiliated with the Trump family, runs a WLFI governance token and a $1 stablecoin, and some observers have flagged transparency issues.

A long record against a young network

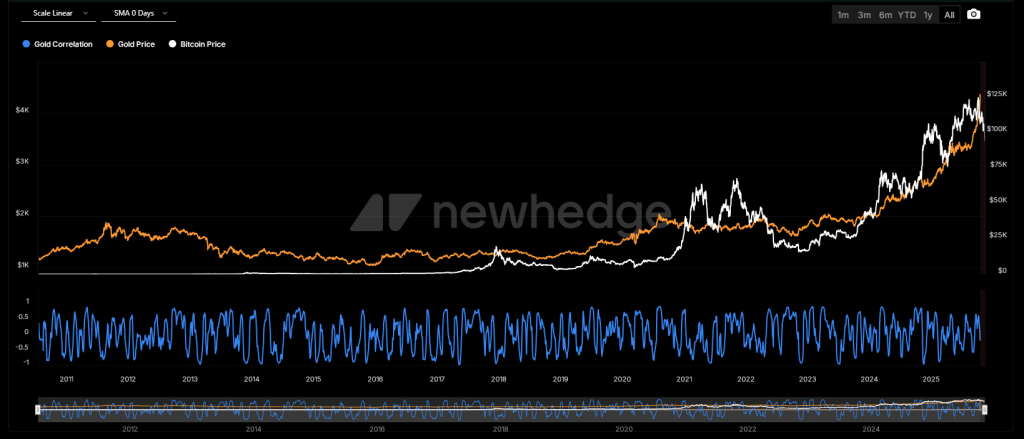

Gold has been used for centuries as a store of value and widely accepted globally. Bitcoin has been around since 2009 and exhibits rapid price movements that can create big winners and big losers.

Historical data indicates abrupt changes: during the 2017 rally, the Bitcoin/gold ratio reached record highs before falling again as prices corrected. This history is often used to remind investors that gains can be followed by sharp declines.

The correlation between the two has evolved over time, with each asset responding to different market pressures.

Bitcoin and gold correlation. Source: Newhedge.

What analysts and critics warn about

Conflicts of interest are a common criticism: executives who publicly praise Bitcoin may also benefit directly when their company owns or mines more of the coin.

Predictions that value a single Bitcoin at $1 million are considered by many to be speculative rather than certain. Regulatory changes, tax rules and policy actions in the United States or abroad could rapidly alter market conditions, and these possibilities are highlighted by cautious commentators.

Related reading

Eric Trump’s position is clear: he believes capital will shift from gold to Bitcoin over time. Markets will decide whether this prediction turns out to be true. For now, both assets are still part of the conversation, with each presenting different risks, costs and histories that investors need to consider.

Featured image from Alamy, chart from TradingView