- The retail merchants stood up in Bitcoin, but the whales withdrew, signaling the potential of a correction.

- The rise in detail optimism and the reprieve could lead to a lively bitcoin correction, because the whales reduce the exhibition.

Bitcoin (BTC) is at the crossroads, with the feeling of the market divided between retail traders and whales. Detail investors are increasingly accumulating in long positions, fueling optimism concerning a recovery in prices.

Meanwhile, WHales currently presents caution by closing long positions or even by launching short positions. Historically, a long aggressive accumulation of retail merchants often precedes a market correction and a wave of potential liquidation.

With the growing tension between retail optimism and the prudence of whales, the critical question is whether retail merchants will increase the market or if the whales will irreed towards a slowdown.

Detail merchants double while whales retreat

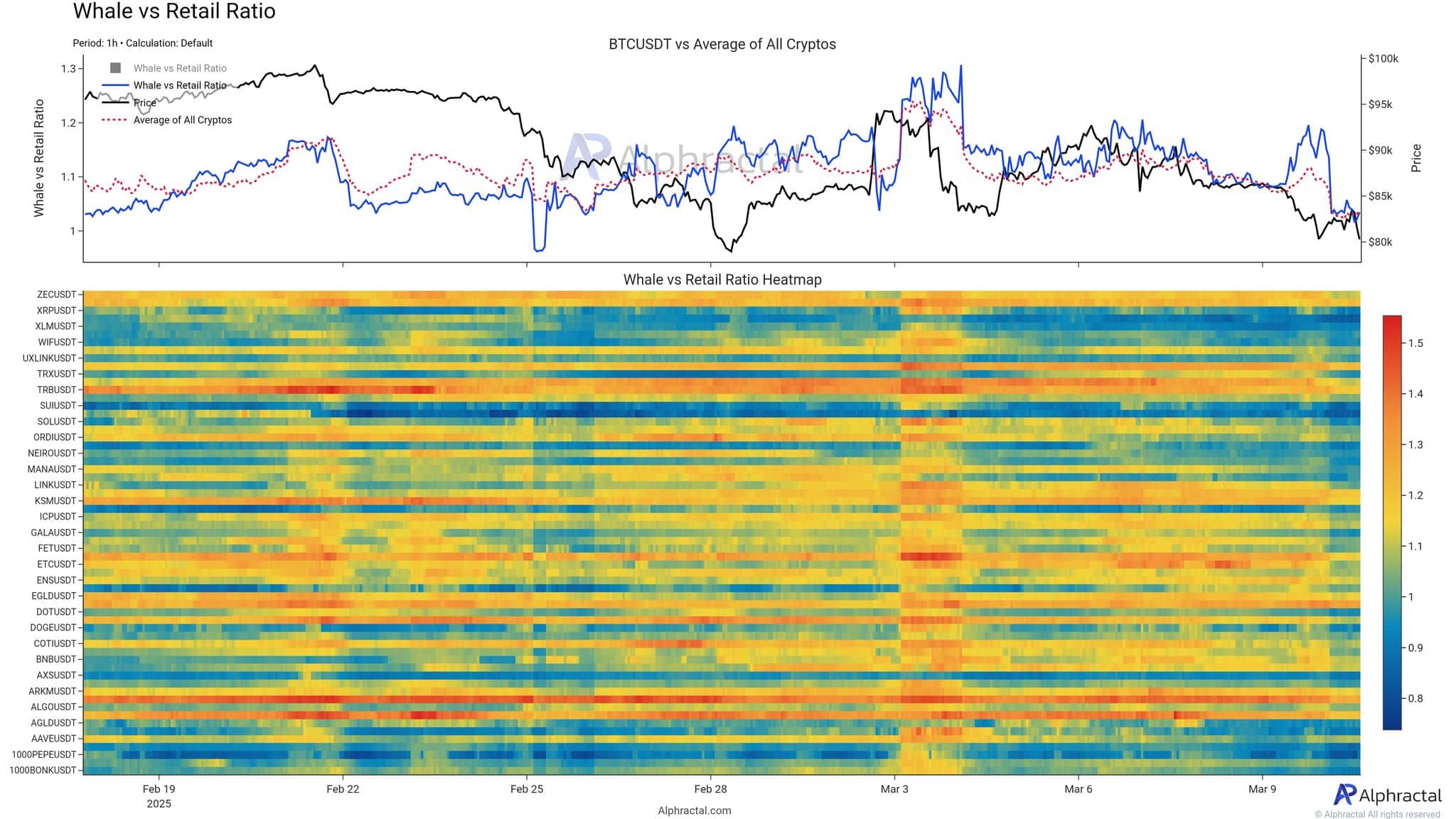

Source: Alphractal

From March 3 to 9, retail activity increased, as the blue to wider yellow spectrum reflects – especially while the price of Bitcoin has remained under pressure.

On the other hand, the whales seem to adopt a more cautious position, as indicated by fewer red bands. Historically, significant increases in the domination of retail without confirmation of whales have often been followed by market corrections.

This divergence resembles previous bull traps, where retail euphoria has encountered inversions based on whales. The current disparity suggests that whales can prepare for a slowdown, even if retail traders remain optimistic about new gains.

Bitcoin: retail traders are all in it, but at what price?

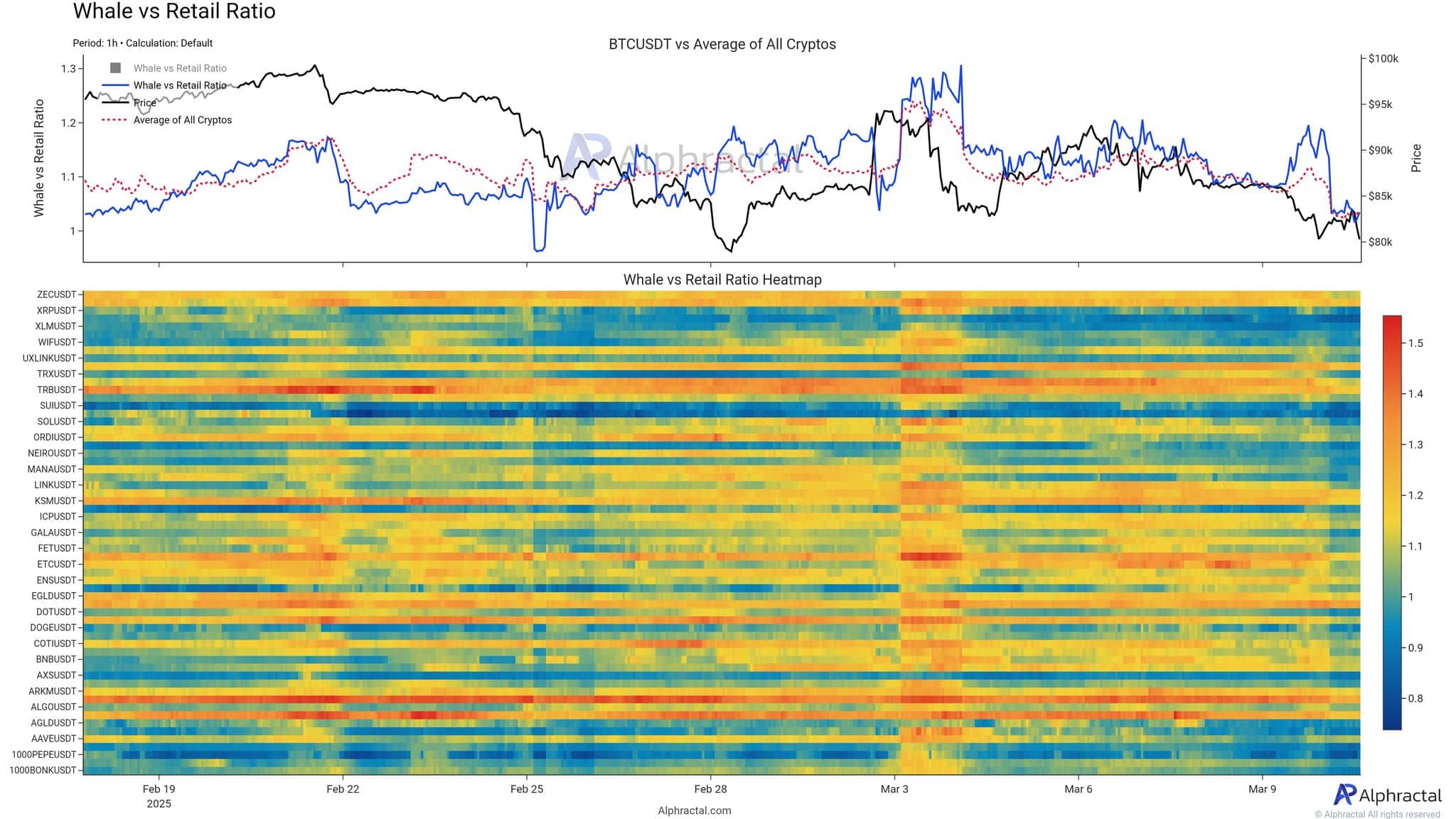

The thermal card of the long / short-circuit ratio shows a strong increase in long positioning among retail merchants in various altcoins from March 3.

However, the action of Bitcoin prices, shown in the upper panel, diverges from this optimism – highlighting an increasing disconnection between the feeling and the management of the market.

Historically, these long -term bias peaks preceded net corrections, as retail positions are vulnerable to rapid slowdowns.

Source: Alphractal

The intensity of the thermal card reveals a high retail conviction – optimistic on the surface, but potentially laying the basics of a drop based on liquidation. If history is a guide, this imbalance could approach a reset, marking the current phase as a precarious moment of excessive trust.

The divergence between the retail trade in bitcoin and the feeling of whales

The data highlight a clear fracture: retail merchants aggressively add long positions, while the whales discreetly reduce their exposure. Historically, such gaps have often led to rapid corrections, with suspended retail traders faced with liquidation, while whales anticipate and capitalize on the decline.

Current trends suggest that if retail merchants hunts momentum, whales are preparing for potential volatility. Without the support of whales, a retail -focused gathering may have trouble maintaining itself, leaving the bitcoin exposed to a net reversal.

Historical context and imminent risks

Bitcoin’s historical cycles often show a recurring scheme: retail traders enter long positions during periods of advanced optimism, just as whales are starting to reduce their exposure. These phases frequently cause steep inversions and liquidation cascades.

This dynamic took place several times, marked by overvoltages of retail confidence followed by net price reductions. The current configuration presents a striking resemblance, the feeling of retail becoming more and more unilateral and draws a user effect. This increases the risk of a sudden drop.