- Bitcoin’s expanding triangle pattern signals high volatility, paving the way for a breakout or decline.

- The MVRV ratio suggests that holders are taking profits, but there is room before critical profit-taking levels are reached.

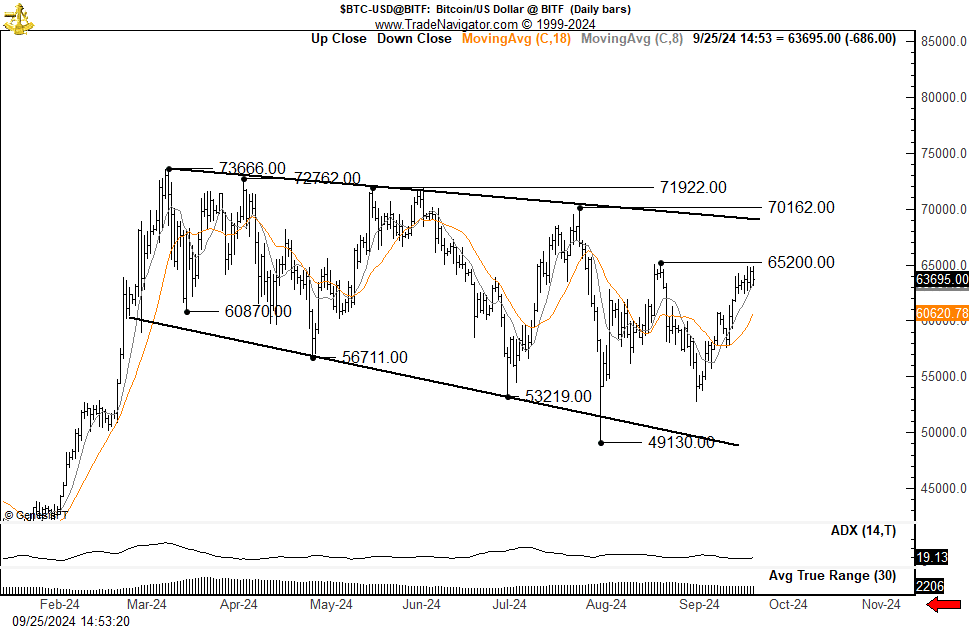

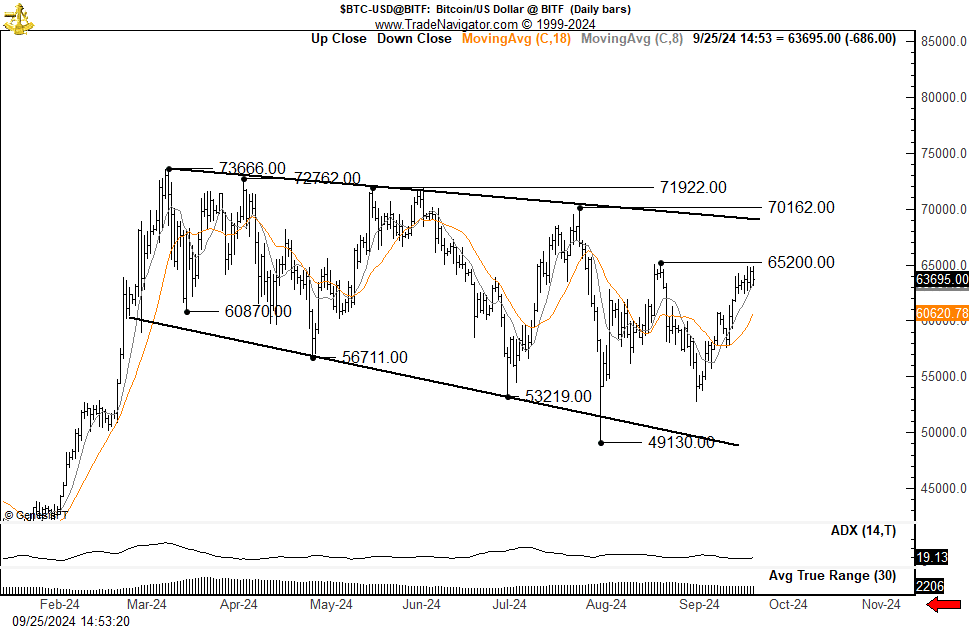

Bitcoin (BTC) The price continued to form an expanding triangle at press time, attracting the attention of analysts.

This formation, characterized by broadened price action, suggests market indecision with increasing volatility.

Crypto analyst Peter Brandt notes that Bitcoin is in a sequence of lower highs and lower lows, which may persist unless the price closes significantly above July highs.

The current technical setup could pave the way for a major breakout or further downside risks.

Expanding Triangle and Support Levels

Bitcoin’s expanding triangle formation reflects market uncertainty, with increasing price swings signaling increasing volatility. Historically, such trends have often preceded sharp movements, upwards or downwards.

Bitcoin’s lower boundary around $49,130 and previous lows at $53,219 are crucial support levels to watch. A break below these points could indicate further downside risks, potentially leading to greater losses.

Source:

At press time, Bitcoin was trading around $63,838.14showing a slight gain of 0.01% over the past 24 hours and an increase of 2.85% over the past week.

The market remains nervous, awaiting a decisive move as price approaches critical resistance levels.

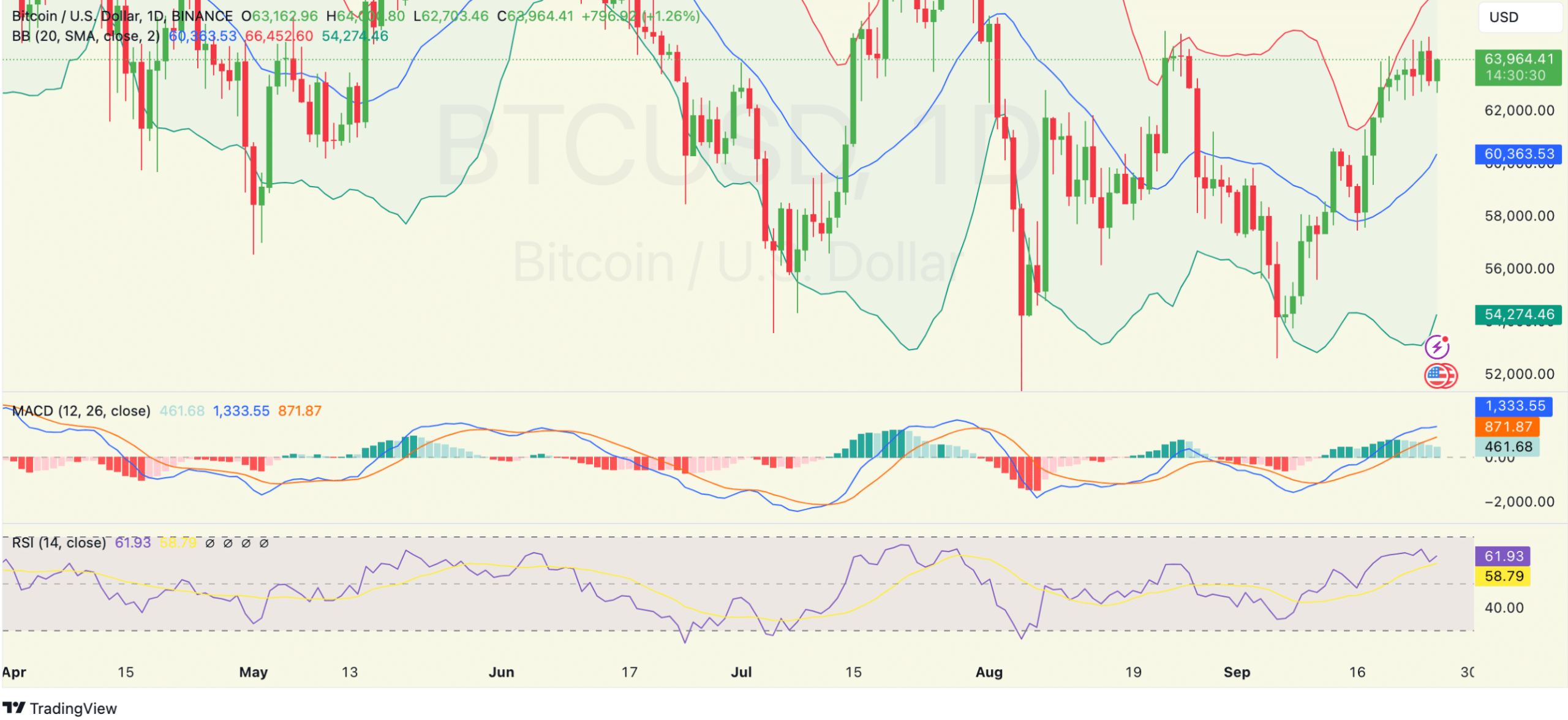

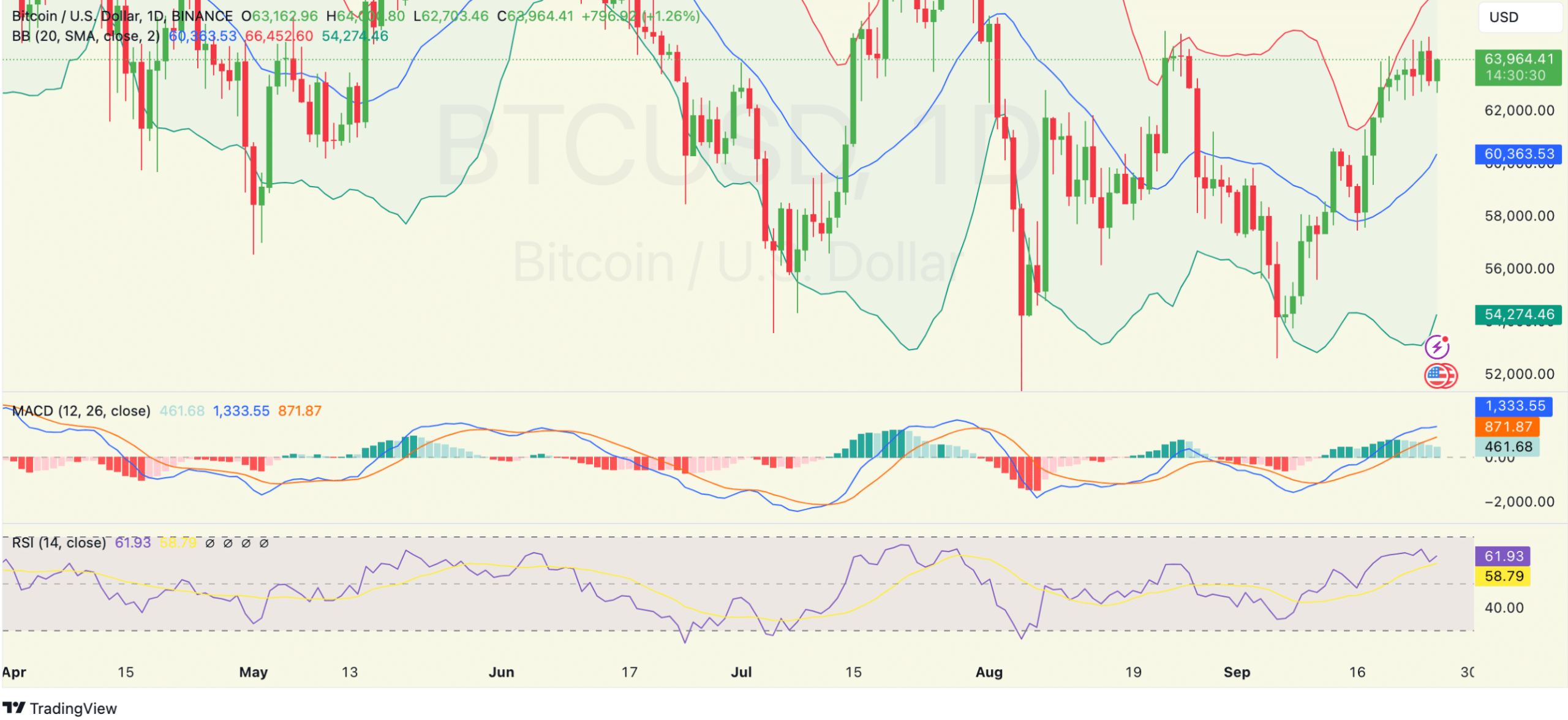

Bollinger Bands and Momentum Indicators

Price action is consolidating near the upper Bollinger band, suggesting Bitcoin is testing resistance at around $63,800.

Widening bands indicate a potential increase in volatility, often seen before a major market move. If Bitcoin manages to maintain its momentum above this resistance, it could signal further upward movement.

Conversely, failure to maintain this level could result in a pullback towards the middle band, near $60,355.

Source: TradingView

Momentum indicators, such as the MACD, show a bullish stance with the MACD line above the signal line and in positive territory.

However, falling histogram bars suggest slowing bullish momentum, prompting traders to exercise caution.

A potential bearish crossover could serve as an early warning of a reversal, prompting careful monitoring of these technical signals.

The relative strength index (RSI) currently sits around 61, indicating that Bitcoin is in bullish territory but not yet overbought.

This suggests that there is room for further price appreciation before reaching overbought conditions, which typically trigger profit-taking.

If the RSI rises above 70, traders could begin to see increased selling pressure, potentially leading to a price pullback.

Bitcoin Profits Near Peak?

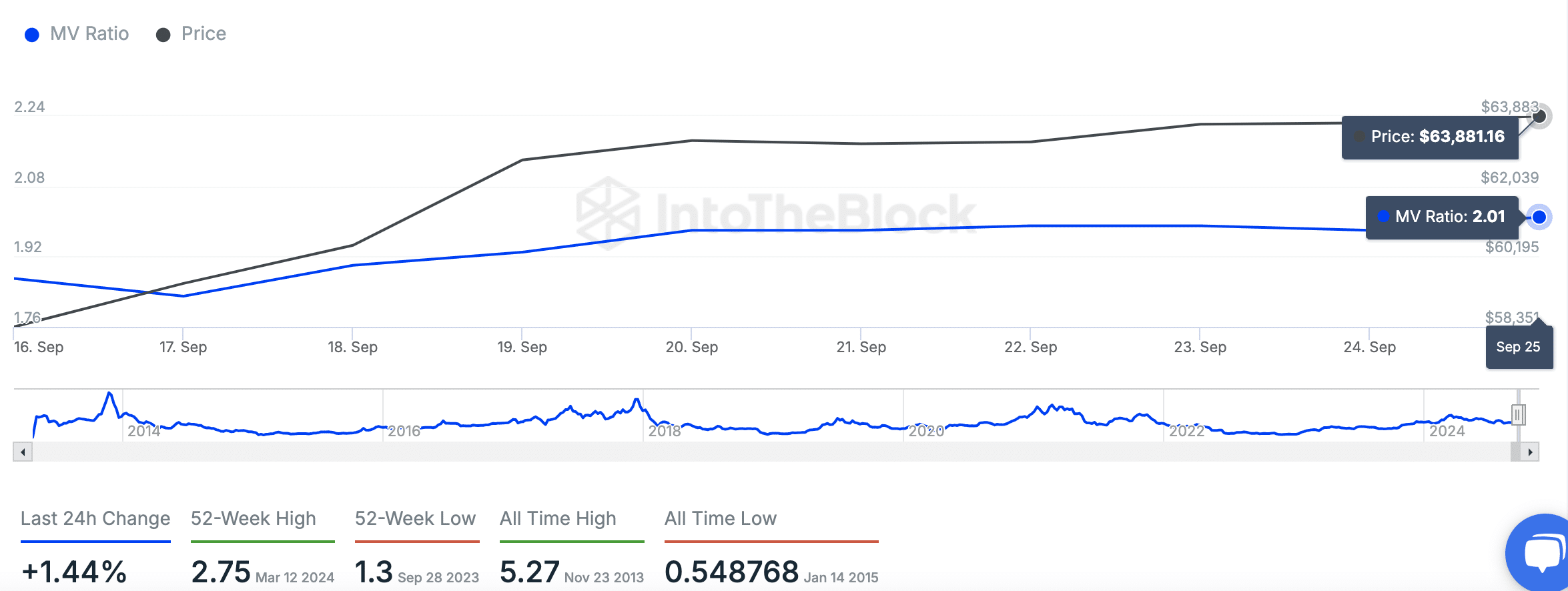

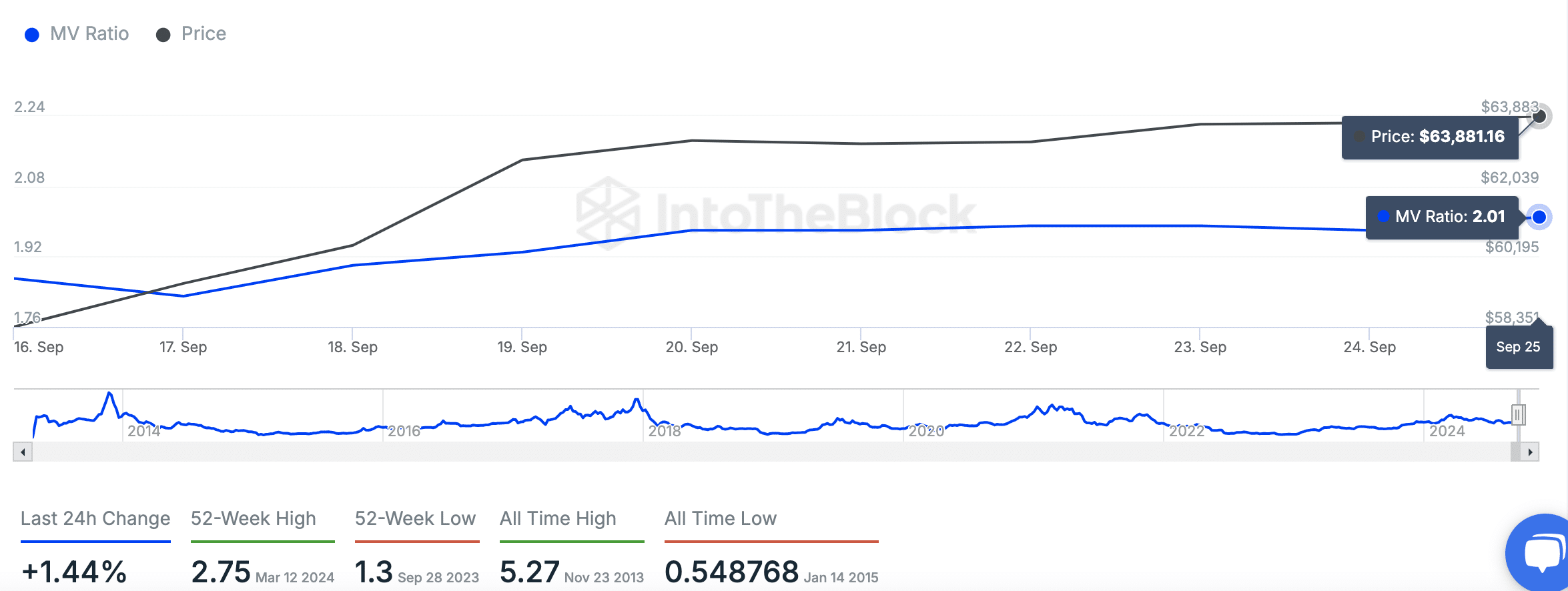

On-chain data shows that Bitcoin’s MVRV ratio is 2.01, reflecting that the market value is double the realized value.

Read Bitcoin (BTC) Price Forecast 2024-2025

This ratio is rising, suggesting that holders are making more and more profits, which could lead to selling if the ratio continues to climb.

Source: In the block

However, with MVRV still below the 52-week high of 2.75, there is room to reach historically significant profit-taking levels.