- BTC’s year-end rebound was capped at $96,000.

- What’s next for BTC in January, before Trump’s inauguration.

Bitcoin (BTC) The rebound to $96,000 was quickly halted on New Year’s Eve, amid slight market caution and a potential recovery from mid-January.

In his recent Telegram updatetrading firm QCP Capital said recent BTC rallies have been capped due to low liquidity.

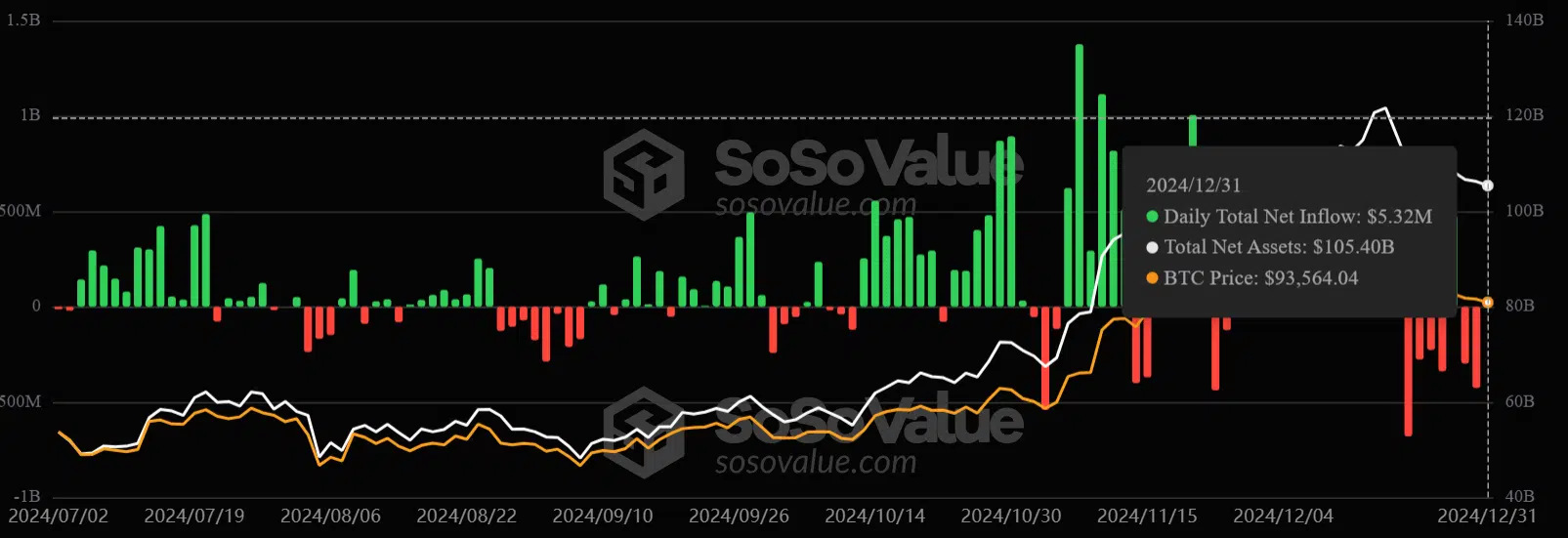

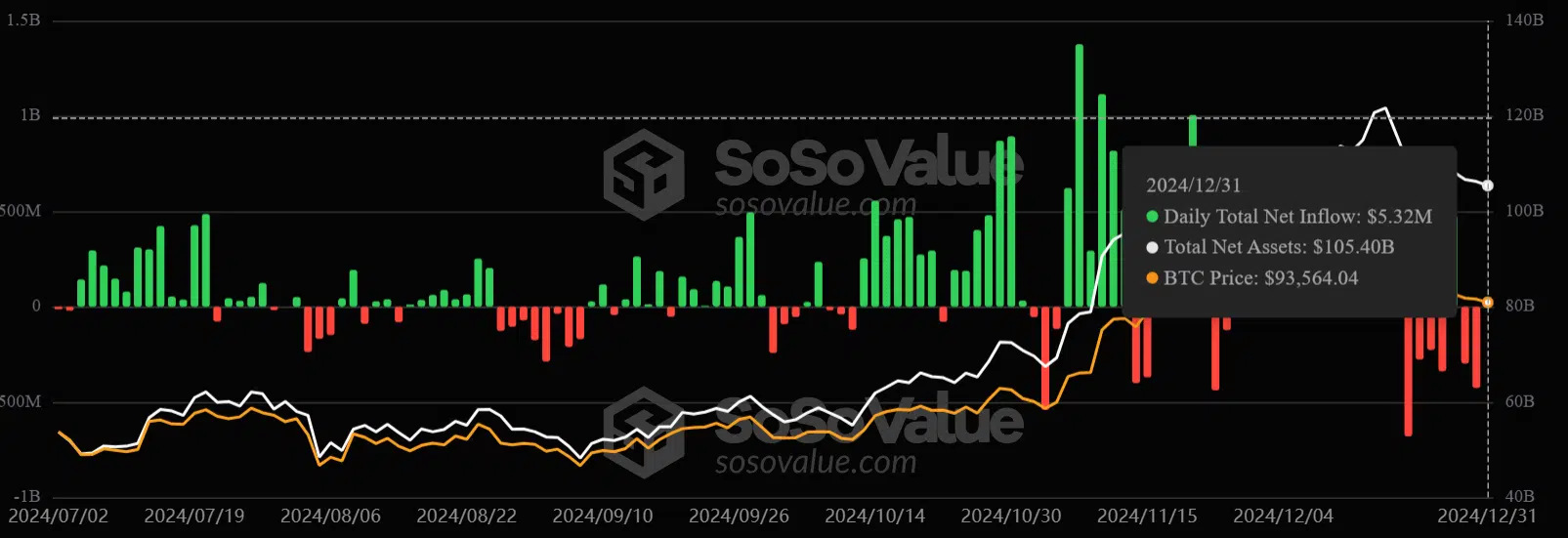

The company added that BTC ETFs have seen outflows of $19 billion since December 19, further tanking the cryptocurrency through the end of the year.

ETF products saw just $5 million in inflows as of December 31, highlighting subdued demand. However, the trading floor expects a potential rebound in January as institutions readjust their capital allocation.

Source: Soso Value

A difficult start for BTC

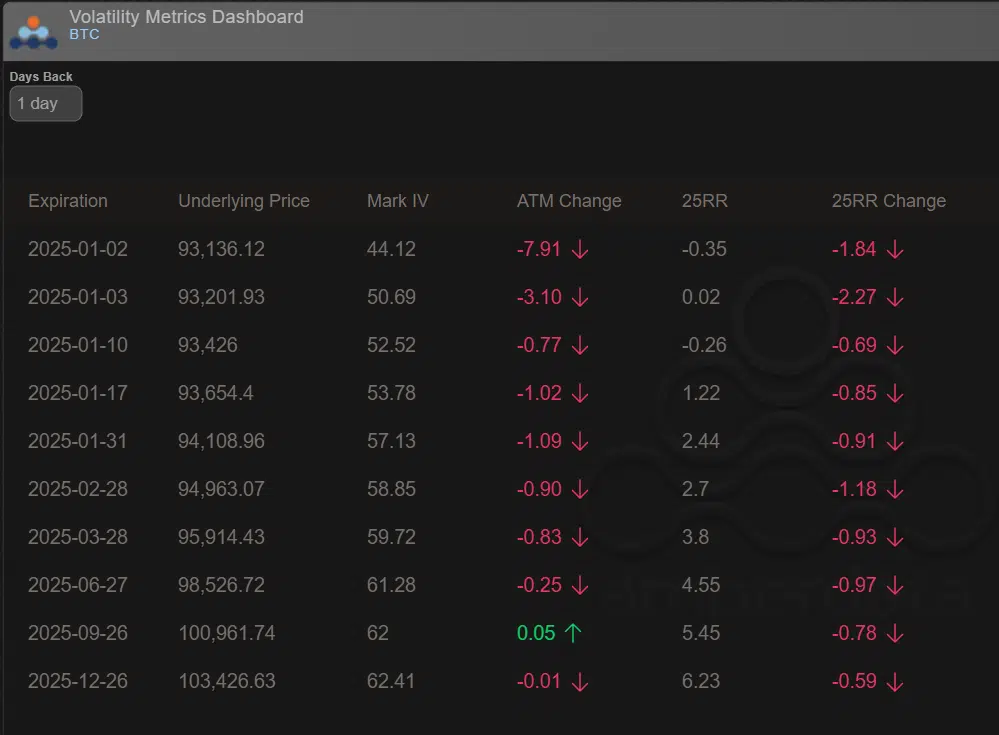

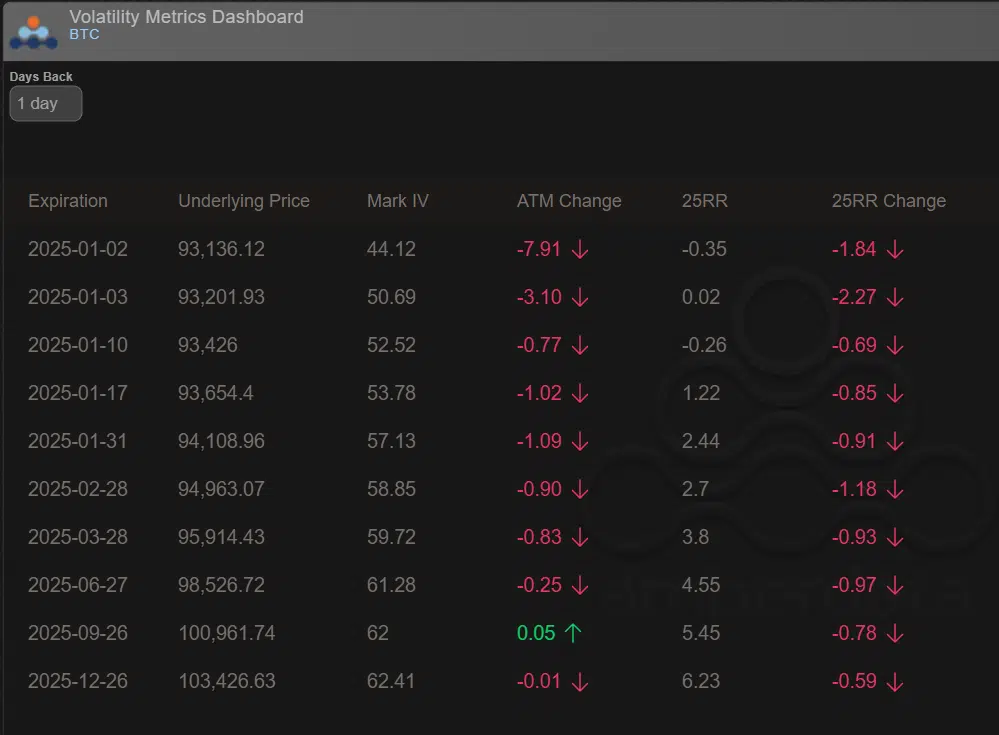

Interestingly, the options market was looking at a neutral to slightly bearish scenario for BTC during the first half of January. But the second half of the month turned out to be positive for the crypto.

This was illustrated by the 25 delta risk reversal (25RR), which tracks the implied volatility (future price fluctuations) between puts (bearish bets) and calls (bullish bets).

For the January 2, 3 and 10 expiries, the 25RR was neutral or negative (more puts than calls), suggesting a neutral position at one bearish bias.

Source: Amberdata

On the other hand, the 25RR for the deadlines of the second half of the month (17/31) were positive. This suggests greater demand for calls than puts later in January, underscoring bullish sentiment.

January’s positive outlook coincided with the post-Trump inauguration, perhaps indicating that the market could be slightly bullish after the event.

Source: BTC/USDT, TradingView

If options markets are to be believed, BTC’s short-term local bottom could be near Trump’s inauguration (January 20).

On the price charts, the largest digital asset was still in the $90,000 to $100,000 price range. But the daily RSI has struggled below the average level, highlighting the recent subdued demand for the asset.

Most analysts expect BTC to defend the lows of the range ($90,000) or $85,000. However, a fall below $85,000 could be catastrophic as it would trigger panic selling by short-term holders (STH).