Bitmin, the Crypto company led by Wall Street veteran, Tom Lee, has again expanded his treasure Ethereum, buying another additional ethful value through the over -the -counter office of Galaxy Digital (OTC).

The last acquisition brings Bitmine’s assets to around 1.95 million ETH, worth $ 8.66 billion, according to Arkham Data.

Blockchain transaction files show a series of large transfers made between Galaxy Digital and Bitmin in recent hours.

The regulations included 3,247 ETH (14.55 million dollars), 3,258 ETH ($ 14.6 million), $ 4,494 ($ 20.06 million) and 4,428 ETH ($ 19.77 million), totaling $ 15,427, around $ 69 million, in less than an hour.

The structured calendar suggests coordinated over -the -counter regulations, which allow institutional buyers to accumulate large quantities without disturbing open market prices.

Bitmin crosses 2m ETH, controls almost 2% of the Ethereum offer

The purchase highlights the aggressive Bitmine accumulation strategy. The data shows that Ethereum represents almost the entire portfolio of $ 8.65 billion, positioning the company as the largest holder of the ETH Etho of the Eth.

Other tokens of his wallet are negligible in comparison, including minor assets of the MKRDAO MKR and a handful of experimental tokens with only a few thousand dollars in value.

The latest Bitmine purchase has followed a series of substantial purchases in recent weeks. On September 11, the company received 46,255 ETH with a value of 201 million dollars in a Bitgo portfolio on three addresses. A week earlier, on September 4, Bitmin acquired 80,325 ETH worth $ 358 million in Galaxy Digital and Falconx.

These acquisitions have raised its total hiding place much greater than 2 million ETH in circulation, which is equivalent to around 1.8% of the entire supply of Ethereum.

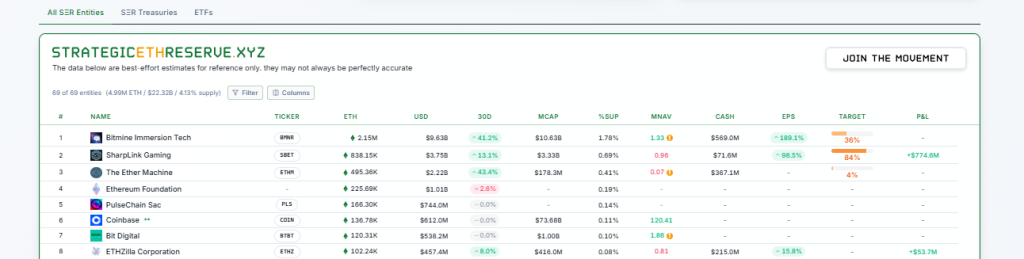

According to data from the Treasury reserve, corporate and institutional entities now collectively hold around 4.99 million ETH with a value of $ 22.2 billion, which represents 4.13% of the circulating token offer.

Bitmin leads this group with 2.15 million ETH, worth 9.59 billion dollars at cutting prices, followed by Sharplink Gaming with 838,000 ETH (3.74 billion dollars) and the ether machine with 495,000 ETH ($ 2.2 billion).

The Ethereum Foundation, in comparison, has around 225,000 ETH, while the Coinbase Treasury is at 136,800 ETH.

The scale of Bitmine’s assets has made comparisons with the long -standing Bitcoin strategy of the strategy under Michael Saylor, where the accumulation of large companies has become a story of the cornerstone for the institutional adoption of the BTC.

Bitmin seems to be positioning itself as equivalent of Ethereum, building an ethn of several billion dollars as a long -term cash reserve.

Ethereum himself exchanged under pressure despite the accumulation. At the time of writing the editorial staff, ETH changes hands at $ 4,465, down 2.8% in the last 24 hours and 4.2% compared to the week.

Ethereum treasury companies extend the assets in the middle of the offers and spacs

Competition between Ethereum treasury bills heats up as corporate strategies evolve under market pressure.

On September 17, The Ether Machine, a cash firm focused on Ethereum, filed a registration declaration project to the SEC to make public via a merger with SPAC Dynamix Corporation, listed at NASDAQ.

The agreement, announced for the first time in July, should conclude in the fourth quarter, pending the approval of the shareholders. The company built an important position of 495,362 ETH after adding 150,000 ETH in August.

At the same time, Sharplink Gaming announced the acquisition of 1 million shares at an average price of $ 16.67, which is part of his current buyback program.

Since the end of August, the company has bought nearly 1.94 million actions, citing the undervaluation as a driver. Sharplink declared a realization value of 3.86 billion dollars, or $ 18.55 per share, and confirmed that it did not carry any debt in circulation.

Analysts say that Ethereum has become the main beneficiary of the Boom of the Treasury of Digital Assets (DAT).

In this week’s report, Geoffrey Kendrick, a global standard for standard assets of Standard, argued that ETH treasure bills are better placed than their Bitcoin and Solana counterparts.

Unlike Bitcoin, Ethereum and Solana generate a standby yield, which supports higher evaluations and long -term sustainability.

Since June, Ethereum treasury bills have accumulated about 3.1% of the supply of token. With evaluations for numerous data under pressure, consolidation is expected, but companies focused on Ethereum seem to gain ground.

The position that Bitmin of Tom Lee still buys $ 69 million, holds a massive battery of $ 8.66 billion appearing first on Cryptonews.

Standard Charterd said that Ethereum took advantage of more than Bitcoin or Solana from the purchase of cash from digital assets, citing stronger stimulation yields.

Standard Charterd said that Ethereum took advantage of more than Bitcoin or Solana from the purchase of cash from digital assets, citing stronger stimulation yields.