Ethereum (ETH) remains under pressure, trading below $4,000 as bulls attempt to regain control after weeks of post-crash uncertainty. The sharp sell-off on October 10 not only emptied leveraged positions in the market, but also disrupted the uptrend that ETH had been building throughout the summer.

Since then, price action has weakened and momentum has shifted to the downside, raising fears among analysts that a deeper correction could occur if buyers fail to defend key demand levels in the coming days.

Related reading

Despite these technical challenges, on-chain and institutional flow data tell a different story beneath the surface. Large-scale investors – including crypto-native funds, companies, and institutions – continue to accumulate ETH during the drawdown.

The divergence between price weakness and institutional accumulation creates a crucial setup for Ethereum. If ETH manages to stabilize and reclaim the $4,000 threshold, it could restart the bullish momentum. But failure to maintain this support could open the door to further declines before a sustainable recovery emerges.

Bitmine Adds ETH as Institutional Accumulation Increases

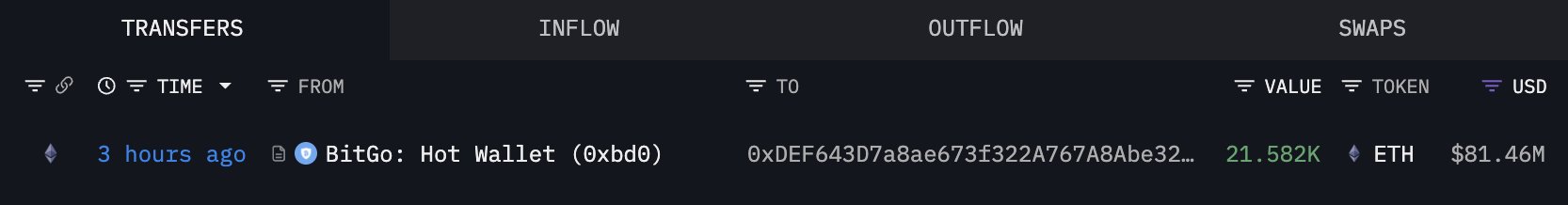

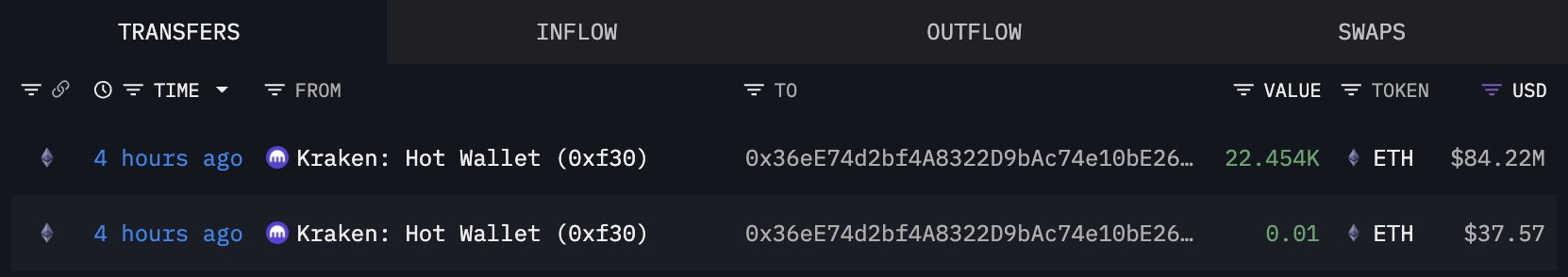

According to data tracked by Lookonchain, institutional player Bitmine continued its aggressive accumulation strategy. Purchased 44,036 ETH – worth approximately $166 million – during the recent market downturn.

This purchase brings Bitmine’s total holdings to approximately 3.16 million ETH, valued at approximately $12.15 billion, strengthening the company’s position as one of the largest Ethereum holders in the world. Such heavy buying activity during periods of price weakness highlights a notable divergence between institutional behavior and short-term market sentiment.

While retail traders and leveraged participants may be shaken by Ethereum’s inability to reclaim the $4,000 level, long-term buyers appear unfazed. For them, price declines represent an accumulation of opportunities rather than reasons for concern.

This duality is becoming increasingly evident in the market: spot capital inflows, FX outflows, and whale accumulation metrics all indicate increasing long-term conviction, even as the chart reflects hesitation and downward pressure.

This divergence highlights a familiar pattern in crypto market structure. Price action often lags underlying fundamentals, particularly during transition phases where macroeconomic catalysts and liquidity changes are still being digested. Ethereum remains structurally supported by growing institutional participation, growing demand for staking, and the expansion of layer 2 ecosystems, all of which reinforce its long-term investment thesis.

Related reading

Ethereum tests key support

Ethereum (ETH) is trading around $3,847, testing a critical support zone after failing to hold above $4,000 and rejecting the $4,200 resistance zone earlier this week.

The daily chart shows that ETH is below the 50-day (blue) and 100-day (green) moving averages, signaling weakening momentum and a shift towards a more defensive market posture. This breakout puts increased pressure on bulls to defend the $3,800 region – a level that has repeatedly served as a pivot point over the past two months.

If ETH loses this support, the next significant area of demand will be near $3,500, followed by the 200-day moving average around $3,200, which would serve as a new, deeper structural test within the long-term uptrend. However, for now, ETH remains above its long-term trendline, meaning the broader bullish structure is intact despite the near-term weakness.

Related reading

On the upside, bulls need to reclaim $4,000 and then $4,150 to $4,200 to reignite the bullish momentum and break the series of lower highs that have formed since September. In the meantime, price developments favor consolidation and caution. With ongoing macroeconomic changes and increasing institutional accumulation, Ethereum’s chart suggests a waiting phase, where maintaining support becomes crucial before any further upside attempts.

Featured image from ChatGPT, chart from TradingView.com