BitMine Immersion Technologies moved more than $1 billion worth of Ether into staking contracts in less than 48 hours, a move that draws new attention to how corporate staking activity is tightening the available supply of Ethereum.

Blockchain data tracked by Lookonchain shows the company staked 342,560 ETH in the two days leading up to Sunday, making it one of the largest short-term staking flows recorded this year.

Ethereum Staking Queue Swells as Locked ETH Overtakes Outflows

Staking involves locking Ether into Ethereum’s proof-of-stake system to help secure the network in exchange for a return that is typically between 3% and 5% per year, depending on network conditions.

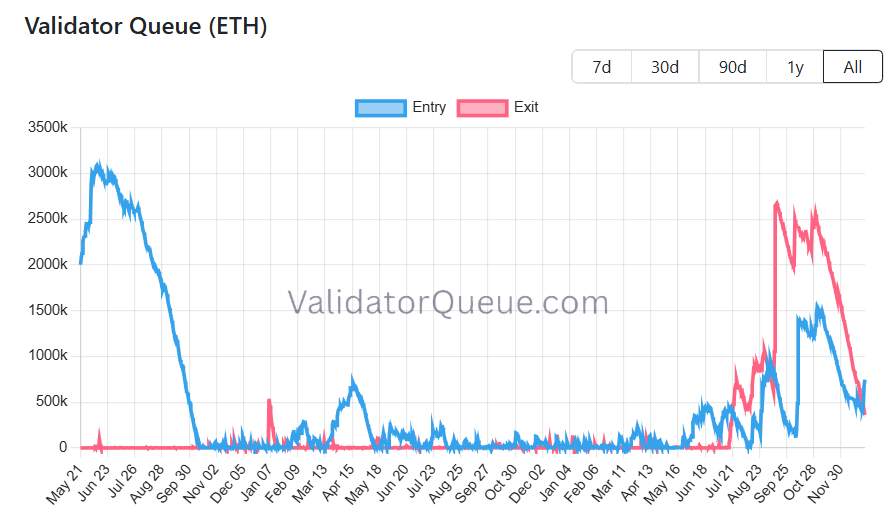

Once staked, ETH cannot be sold immediately and must go through a validator exit queue before becoming liquid again. BitMine’s latest move was reflected almost immediately in Ethereum’s validator queues.

Validator data shows that the entry queue has expanded to 12 days and 20 hours, with approximately 739,824 ETH waiting to be staked.

In contrast, the exit queue was six days and two hours long, representing approximately 349,867 ETH scheduled for withdrawal.

It was the first time in months that the number of validators queuing to stake on Ether was almost double those preparing to exit, a trend often associated with long-term positioning rather than short-term liquidity needs.

Locked ETH is quietly changing market dynamics

This imbalance is important because it indicates a potential tightening of supply. A supply squeeze occurs when demand for an asset increases while the amount available for trading decreases.

In the case of Ethereum, staking takes ETH out of the liquid market by locking it into smart contracts.

With fewer coins available on exchanges, even modest demand can have an outsized impact on price movements, especially during periods of tighter liquidity.

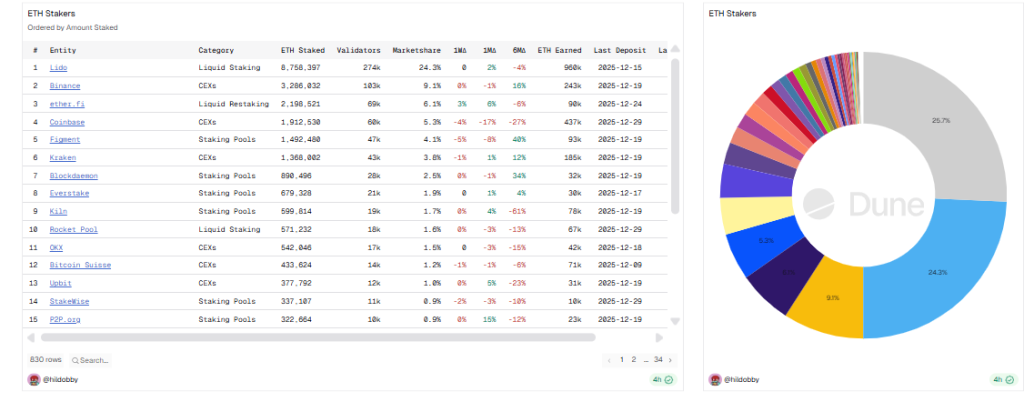

Ethereum is already operating in a tighter supply environment than in previous cycles. According to estimates as of the end of December, approximately 35.8 million ETH, or approximately 28.88% of the total supply, is currently staked.

New issuance has also slowed since the network’s transition to proof-of-stake, and the EIP-1559 fee mechanism continues to burn through some of the transaction fees, sometimes pushing net issuance into negative territory during periods of high activity.

Together, these factors mean that staking not only delays the sale, but can structurally reduce the amount of Ether circulating in the market.

As ETH Trades Below $3,000, BitMine Continues to Buy

BitMine’s aggressive accumulation adds another layer to this dynamic. The US-listed NYSE company has positioned Ethereum as its primary treasury asset.

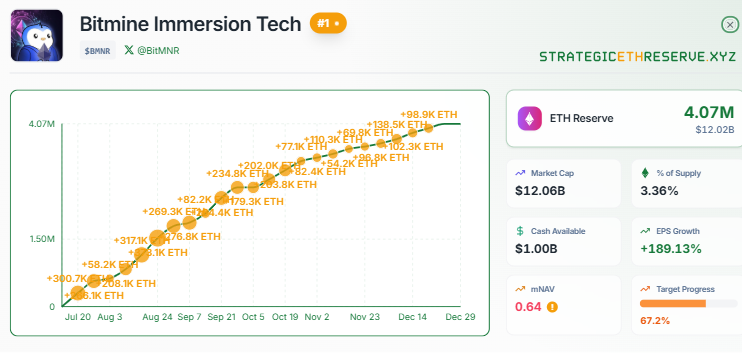

Data from StrategicEthReserve.xyz shows that BitMine now controls approximately 4.07 million ETH, worth approximately $12.15 billion, or approximately 3.36% of the total supply.

The company has publicly announced its long-term goal of achieving a 5% stake.

Recent on-chain data supports this strategy, as in December alone, trackers reported several large inflows, including approximately 29,462 ETH transferred from BitGo and Kraken wallets, valued at the time at approximately $88 million.

Previous disclosures showed that BitMine purchased more than $229 million worth of ETH in a single week and more than 407,000 ETH in the past 30 days, even as Ether traded nearly 40% below its cycle high.

Notably, other large holding companies are also putting most of their Ether at stake. SharpLink Gaming, the second largest holding company, said it staked almost all of its ETH and generated 9,701 ETH in rewards, worth approximately $29 million.

Ether Machine, the third largest holder, fully staked its $1.49 billion treasury and reported a consistent ranking among the top validators in terms of reward efficiency.

These moves come as Ether continues to trade below $3,000, hovering near $2,978 this week after a modest monthly rebound.

Article BitMine Locks $1 Billion of ETH in 48 Hours: Is a Supply Squeeze Imminent? appeared first on Cryptonews.

Tom Lee’s BitMine purchased approximately $88 million worth of Ether from BitGo and Kraken when ETH was trading near $2,978, bringing its holdings to approximately 4.07 million ETH, or approximately 3.36% of the total supply.

Tom Lee’s BitMine purchased approximately $88 million worth of Ether from BitGo and Kraken when ETH was trading near $2,978, bringing its holdings to approximately 4.07 million ETH, or approximately 3.36% of the total supply.