Bitwise, a leading issuer of exchange-traded funds (ETFs), has filed a proposal to launch a fund for companies with large Bitcoin reserves.

Dubbed Bitwise Bitcoin Standard Corporations ETF, the fund will focus on publicly traded companies holding at least 1,000 Bitcoins in their corporate treasuries. The move comes amid growing interest in Bitcoin among institutional players adopting what is known as “Bitcoin Standard.”

According to the Deposit of December 26Eligible companies must meet strict criteria, including a market capitalization of at least $100 million, average daily liquidity of more than $1 million, and a public float of less than 10%.

EXPLORE: 3 Experts Predict: How High Can Bitcoin Reach in 2025?

Bitwise ETF Prioritizes Bitcoin Holdings Over Market Cap

The ETF stands out by weighting investments based on the market value of a the company Bitcoin holdings rather than its overall market capitalization, capped at a maximum of 25%.

For example, MicroStrategy, which holds 444,262 BTC, would have a greater weight in the ETF than Tesla, despite that of Tesla A significantly larger market cap, as it holds a relatively modest 9,720 BTC.

The deposit coincides with Bitcoin recent uptick in performance, having crossed six figures for the first time in November before stabilizing around $95,800.

Bitwise files for Bitcoin Standard Corporations ETF…

Reportedly owns shares of companies that have adopted the “Bitcoin standard,” which they define as holding at least 1,000 BTC in corporate treasury.

The BTC cash trading virus is spreading. pic.twitter.com/me0XXX9a6g

-Nate Geraci (@NateGeraci) December 26, 2024

Companies like MicroStrategy have become synonymous with enterprise adoption of Bitcoin, while newcomers such as KULR Technology Group have joined the trend.having recently acquired 217.18 BTC for $21 million. This purchase led at a 40% jump KULR stock price.

The same day, Strive Asset Management, founded by Vivek Ramaswamy, filed for regulatory approval to launch an exchange-traded fund (ETF) focused on “Bitcoin Bonds.»

These links, as detailed in the Dec. 26 filing, include convertible securities issued by companies like MicroStrategy or others intending to allocate the proceeds primarily for Bitcoin purchases.

The Strive Bitcoin Bond ETF be actively managedoffering direct exposure to these bonds or through financial derivative products such as swaps and options. However, details regarding the management fees have not yet been communicated. been disclosed.

MicroStrategy, a key player in this trend, has spent approximately $27 billion on Bitcoin since 2020. as part of a corporate treasury strategy initiated by co-founder Michael Saylor.

This aggressive Bitcoin acquisition strategy has propelled MicroStrategy MSTR stock, to an extraordinary gain of 2,200%, outpacing almost every major public company except Nvidia.

Other companies have also adopted Bitcoin for their treasuries, with total corporate holdings now estimated at $56 billion, according to BitcoinTreasuries.net.

EXPLORE: 10 High Yielding Coins: Crypto Predictions 2025

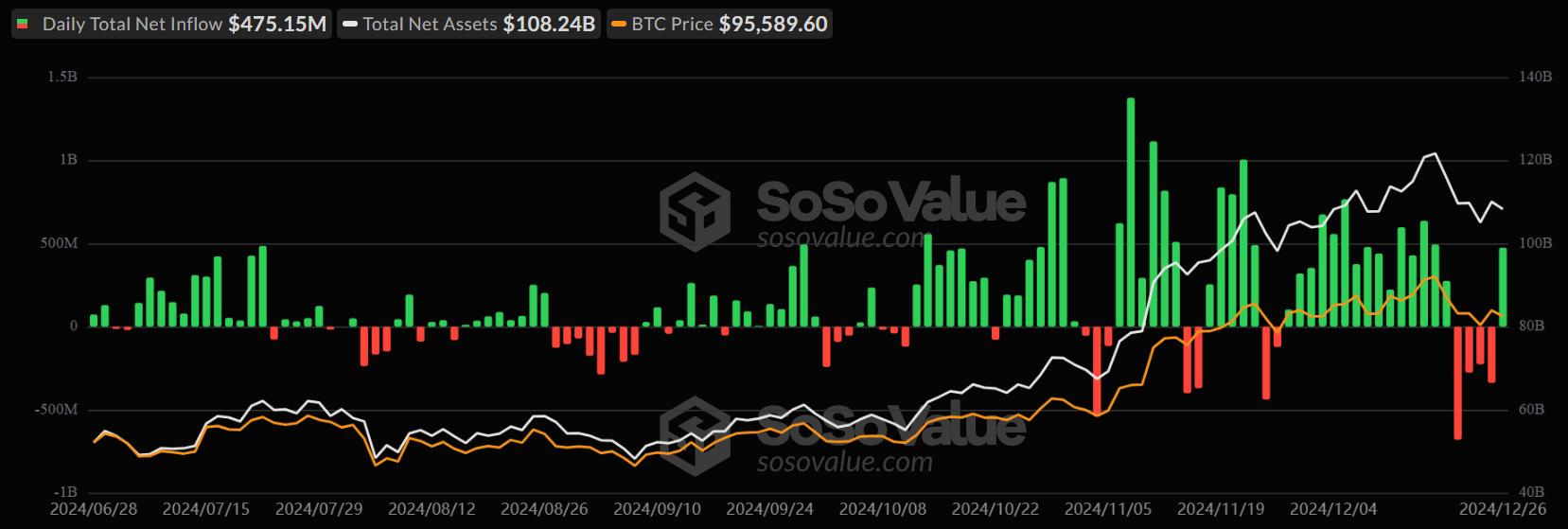

US Bitcoin ETFs see inflows of $475 million after four-day outflow streak

Spot Bitcoin exchange-traded funds (ETFs) in the United States saw a large inflow of $475.15 million on December 26, ending a four-day outflow streak that saw more than 1.5 billion dollars leave these funds.

(Source)

Data from SoSoValue shows that Loyalty FBTC dominated entries with $254.37 million, followed by ARK 21Shares’ ARKB, which raised $186.94 million.

Black Rock IBIT contributed $56.51 million, while smaller entries from Grayscale Bitcoin Mini Trust and VanEck HODL added to the positive momentum.

However, these gains were slightly offset by capital outflows Grayscale GBTC and Bitwise BITB, which recorded $24.23 million and $8.32 million in withdrawals, respectively.

EXPLORE: Could these 3 Altcoins change your life in 2025?

Join the 99Bitcoins News Discord here for the latest market updates

The post Bitwise Files for ETFs targeting companies with large Bitcoin holdings appeared first on 99Bitcoins.