Join our Telegram channel to stay up to date with the latest news

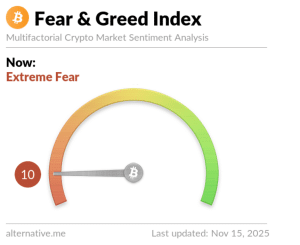

After a tough week for crypto, Bitwise says selling pressure is easing, offering investors a glimmer of hope even as market sentiment hit its lowest level since February.

Bitcoin fell below $96,000 and Ethereum,

Crypto Fear and Greed Index (Source: Alternative.me)

But Andre Dragosh, European head of research at Bitwise, said “sellers are exhausted and it shows,” suggesting the market could be stabilizing after a series of declines.

Although the company’s sentiment index remains bearish, it is “less so than previous corrections despite falling prices,” he said.

🔴UPDATE: Our Cryptoasset Sentiment Index also continues to show positive divergence.

Read: The sentiment index is bearish but less than during previous corrections despite the drop in prices.

Sellers are exhausted and it shows. pic.twitter.com/XxSeuo5Ewb

— André Dragosch, PhD⚡ (@Andre_Dragosch) November 14, 2025

Santiment says overleveraged long positions are largely offset

On-chain analytics firm Santiment echoed the same view, noting that liquidations were much smaller than in previous sell-offs and that overleveraged long positions had largely been liquidated. Retail portfolios, meanwhile, continued to accumulate even as large holders reduced their exposure.

“The market may have exhausted the supply of overleveraged long positions to liquidate,” Santiment said, adding that a change in portfolio behavior could mark a “real ground signal” for Bitcoin and broader crypto prices.

Liquidations in the last 24 hours exceeded $763 million, according to in Coinglass. Most of these liquidations ($580.39 million) involved long trades, which represent bets on rising prices.

This is well below the record $19 billion liquidated on October 10, and tThere appears to have been a shift in recent hours, with the market experiencing significantly more short sell-offs than long sell-offs during this period. For example, $1.38 million was wiped out of short positions in the last hour, while only $696.90 thousand was liquidated from long positions.

Santiment also pointed out that open interest in perpetual contracts is now just a fraction of what it was a month ago, suggesting that this could “change the internal dynamics of the market.”

He added that even though the largest Bitcoin holders, particularly addresses holding between 10 and 10,000 BTC, have steadily sold their holdings since BTC hit its all-time high in October, smaller retail portfolios “continued to accumulate during the decline.”

A “real ground signal” for the market will likely be if the dynamic between large addresses and small wallets changes, he said.

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news