In the latest 99Bitcoin documentary, we take BlackRock’s influence with a scalpel, peeling back the layers of market manipulation that have quietly shaped the financial landscape. Now that Donald Trump is in office and the bull run is back, Blackrock is once again taking MASSIVE action.

Over the past month, BlackRock’s 15th largest ETF saw inflows of 12,000 and 100,000 BTC, which is They now control $40 billion worth of BTC.

So what happens when all the bitcoins are owned by six powerful people?

This is the question we are going to answer today.

2. BlackRock’s plans for economics and crypto

BlackRock is the Orwellian Big Brother you didn’t know existed. In 2008, BlackRock was the company US government hired to repair the housing crisis. The entire US government depended on Larry Fink and BlackRock. This gave Fink power that other billionaires could only dream of.

In the early 90s, Larry Fink found his Holy Grail: Aladdin, BlackRock’s software titan. Armed with a network of 5,000 computers, Aladdin is an AI system that dissects markets and performs risk analyzes with pinpoint precision.

This system puts BlackRock two steps ahead of everyone else.

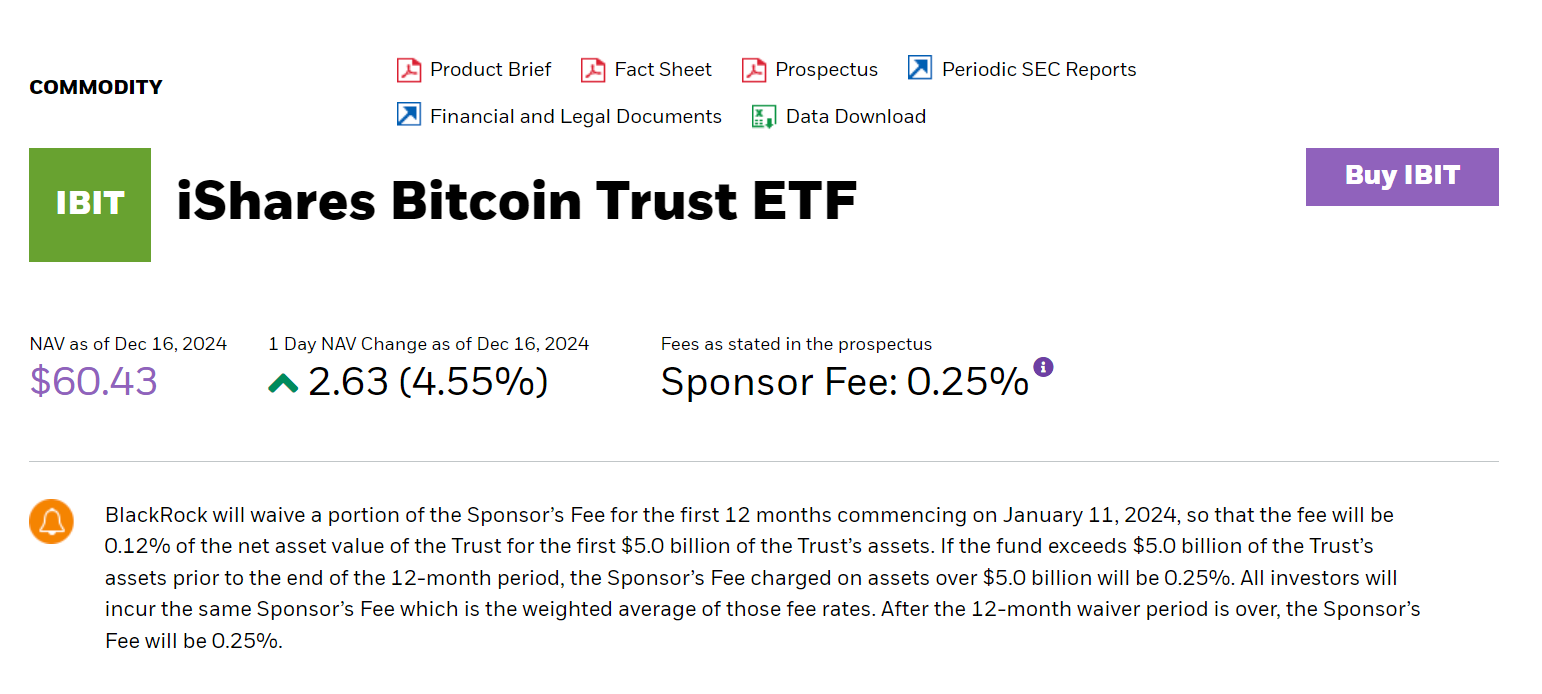

After Aladdin, BlackRock’s new plan for domination was to take over the cryptocurrency. Today they are the most recognizable ETF brand.

Technically, BlackRock does not own this Bitcoin; they manage it for their customers. When you buy BTC on their ETF, it’s technically yours, not theirs. Seems fair, right?

The problem is that having so much BTC under control has given Larry Fink and BlackRock four distinct advantages that will tip the scales of how Bitcoin works in the future. Here’s how.

How BlackRock manipulates the markets

Several economists have pointed out the games going on behind the scenes with ETFs. Here’s a conversation between former Goldman Sachs executive Raoul Pal and James Mullarney of Invest Answers on the subject:

“I am fascinated by these ETFs; I monitor them daily. Some people tell me they (ETFs) are bad for space. What worries me is if all of these ETFs have fully stacked portfolios.

“I did an analysis of this and there are at least four significant cases where the flows did not match the prices.”

Even when the market experienced its reddest days during the summer, BlackRock reported no ETF exits before Trump took office. This means that their customers strangely continued to buy even though the entire market was selling off. At least that’s what BlackRock wants you to believe.

We believe another part of the company is buying up Bitcoin, so it never hits the market. With this BTC they can shorten the market, as some have already pointed out.

It’s not like BlackRock is a benevolent Wall Street tyrant; they were caught trying to manipulate the markets before. A new player will now control the price of BTC.

Final thoughts on BlackRock

In their Global Outlook 2023 In its report, BlackRock said three trends will define the new era of investing: 1) An aging population will lead to increased government debt and deficits, leading to higher inflation.

2) Broken trust between global superpowers will lead to the proliferation of trade and currency warscreating volatility.

3) A digital economy, artificial intelligence and automation will transform business, investments and society in new and completely chaotic ways.

It’s strange to hear BlackRock talking like this.

This sounds more like an Alex Jones rant.

But that’s why BlackRock is more powerful than Vanguard

They woke up and smelled coffee. They know where the world is going.

Watch our full video BlackRock’s Secret Crypto Agenda EXPOSED

EXPLORE: Best RWA projects to buy in 2024

Join the 99Bitcoins News Discord here for the latest market updates

The post The Secret BlackRock Crypto Agenda EXPOSED – What We Know appeared first on 99Bitcoins.