Key takeaways

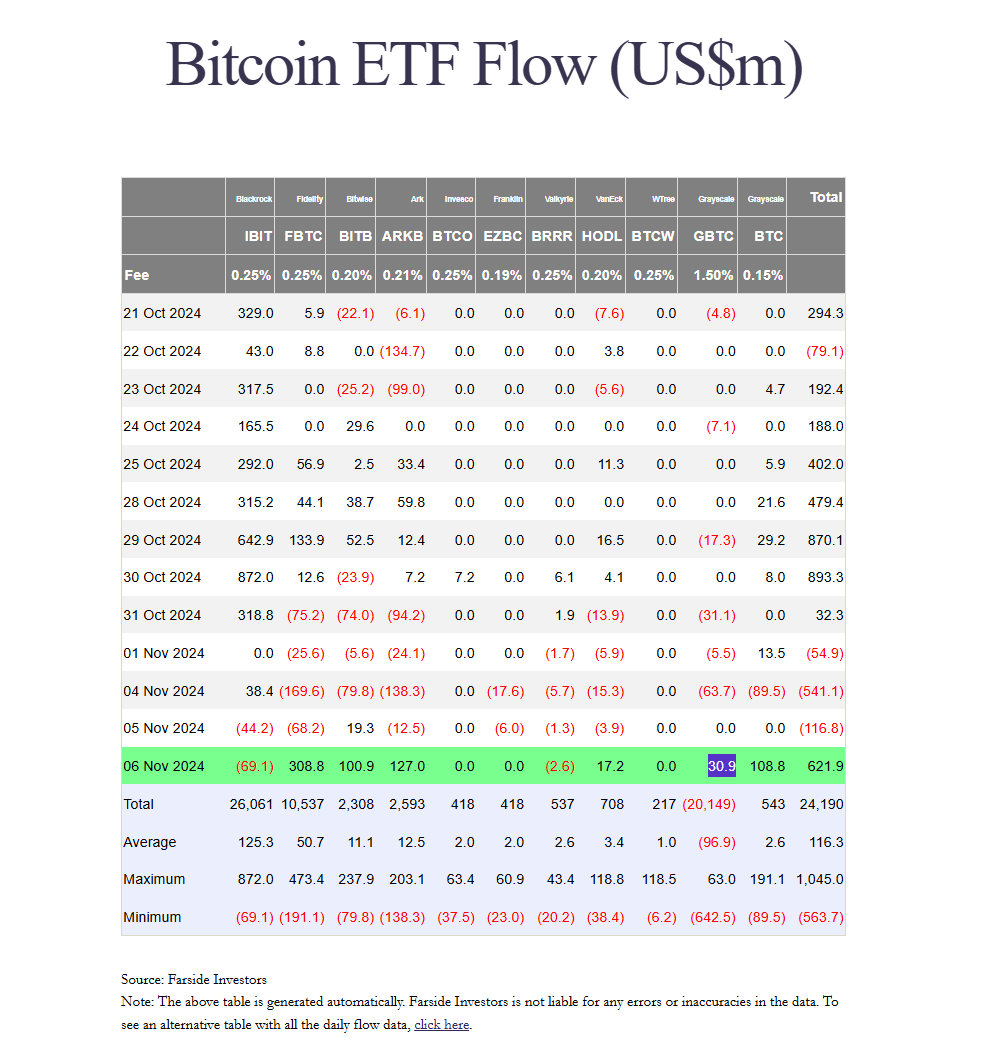

- US spot Bitcoin ETFs ended a three-day losing streak with $622 million in net inflows on November 6.

- Despite BlackRock IBIT’s biggest day of outflows, several ETFs, including Fidelity and ARK, led the gains with substantial inflows.

Share this article

U.S. spot Bitcoin ETFs attracted about $622 million in net inflows on Nov. 6, ending a three-day losing streak, although BlackRock’s IBIT saw its largest outflow on a day since its launch.

According to data from Farside Investors, the world’s largest Bitcoin ETF saw around $69 million in net outflows yesterday, while Valkyrie’s BRRR saw over $2 million in outflows.

IBIT’s loss was a surprise given that the fund got off to a strong start with more than $1 billion in shares traded in the first 20 minutes after the market opened. According to Bloomberg ETF analyst Eric Balchunas, IBIT reached its highest trading volume, reaching $4.1 billion.

“For context, this is more volume than stocks like Berkshire, Netflix or Visa saw today,” the analyst said. “It’s also up 10%, its second best day since launch. Some of this will turn into likely influxes Tuesday and Wednesday evening.

However, he has previously highlighted that considerable buying and selling activity does not translate into new investments or inflows into the ETF, meaning high volume can result from both purchases and sales.

Most ETFs traded at double their average volume, marking one of their best trading days since the initial January launch period, Balchunas said in a follow-up article.

As of Wednesday, Fidelity’s FBTC led the pack with nearly $309 million in net purchases, followed by ARK Invest’s ARKB, which raked in about $127 million.

Significant gains were also seen in Grayscale’s BTC and Bitwise’s BITB. The low-cost version of GBTC saw nearly $109 million in new capital, its second-largest daily inflow since its launch.

Meanwhile, the BITB fund recorded around $101 million, its best one-day performance since mid-February.

Grayscale’s GBTC reported net inflows of approximately $31 million yesterday, while VanEck’s HODL recorded approximately $17 million.

Share this article