Join our Telegram Channel to stay up to date on the coverage of information on the breakup

After the success of his Bitcoin spot and his ETHEREUM ETHEREM (Fund negotiated on the stock market), the giant of the BlackRock assets management would have sought tokensize SES ETF on the blockchain.

According to a Bloomberg report This has cited sources familiar with the question, the company plans tokenizing funds which offer an exhibition to active active world (RWA). However, this decision would be subject to “regulatory considerations”, added the report.

Blackrock Crypto ETF attracts billions of dollars at a record rate

Blackrock already offers several products related to cryptography. These include FNBs that follow the leaders in the Bitcoin (BTC) and Ethereum (ETH), the Ishares Bitcoin Trust and the Ishares Ethereum Trust.

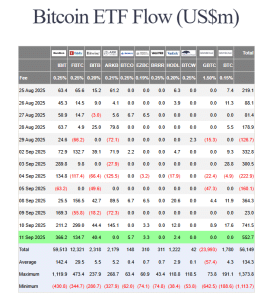

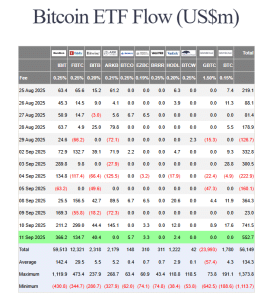

Farside investors’ data shows that BlackRock Spot Bitcoin ETF leads the market in terms of cumulative entries, its total flows to date located at $ 59.513 billion. It is considerably more than the second larger fund in terms of this metric, which is the FBTC of Fidelity with its 12.321 billion dollars in cumulative entries.

US BTC ETF Flows (Source: Farane investors))

While BlackRock’s Spot ETF ETF was the best performer of all ETF SPOT SPOT, he did not win as much traction as the BTC product of the active manager. To date, ETH ETF has seen 12.721 billion dollars in cumulative entrances.

The two Blackrock ETFs and the ETHEREUM SPOT ETF reached $ 10 billion in management in a year or less. This makes two of the three products of this type to take this step.

In addition to these ETFs, Blackrock also offers less known “thematic” funds such as the Ishares blockchain and the FNB Tech, which invests in an index of companies related to the crypto.

Blackrock already in the emerging tokenization space

The plans reported by Tokenize from SES ETF intervenes while Blackrock already manages the world’s largest monetary market fund in the world called the BlackRock USD Institutional Digital Liquidity Fund (BUIDL).

This fund has crossed the billions of dollars in March and now represents more than $ 2 billion in managed assets.

Tokenized actions, including actions and ETFs, are always an emerging market despite a recent increase in interest. While several major players such as Robinhood and Kraken are currently on the market, there are less than $ 500 million in these assets in circulation, data from Rwa.xyz shows.

In the past 30 days, there has also been a drop of more than 40% in the number of active active addresses to around 23,940. Monthly transfer volumes also slipped 22% during this period.

While BlackRock’s reported movement for Tokensize SES ETF will bring the chain funds, analyst Bloomberg Intelligence ETF Eric Balchunas questions “added value” for consumers.

In a post X, he said that tokenization could help make the “back office (plumbing)” in the traditional finance (tradfi) space “more efficient” thanks to the use of blockchain technology.

We must better define the trend: if by “Tokenization”, you mean that Tradfi’s (plumbing) back office will be slightly more efficient using blockchain technology? Then, well, very good, will probably not do it. What is implicit by the media is to have real investors sell …

– Eric Balchunas (@ericbalchunas) September 11, 2025

“What is implicit by the media threw is to bring real investors to sell $ Voo et al and buy a token in the way ETFs stole MF,” he wrote.

“I don’t see the value add for the consumer,” added Balchunas.

In a follow -up commentHe said that the BlackRock movement in Tokenize of SES ETF is still “a great elevator”, adding that it is logical of Tokensize things for people already in mind.

“But the PPL channel is such a small fraction of world money, which is why the media is sometimes too heavy for the impact (at least in the medium term),” he wrote.

Tradfi companies move to secure domination in the middle of the stable boom, a change in liquidity

Blackrock is not the only traditional financing company to increase its presence in the blockchain space.

In April, Depository Trust & Clearing Corporation (DTCC) announced a new innovative platform for tokenized collateral management using its appchain infrastructure.

A few months after that in July, Goldman Sachs and Bny Mellon joined forces to launch a monetary market fund solution.

Earlier this month, the NASDAQ also made a proposal to the Securities and Exchange Commission (SEC) of the United States to allow the negotiation of listed securities in its main market in the form of tokenized.

The thrust in the tokenization space is part of a broader effort of Tradfi companies to maintain their domination as the adoption of stablecoins increases and that liquidity begins to move in the head.

Related items:

Best wallet – diversify your crypto wallet

- Easy to use cryptographic wallet, easy to use

- Get early access to ICO to toys to come

- Multi-chaînes, multi-walk, non-guardians

- Now on the App Store, Google Play

- Pape to win the native token $ the best

- 250,000+ monthly active users

Join our Telegram Channel to stay up to date on the coverage of information on the breakup