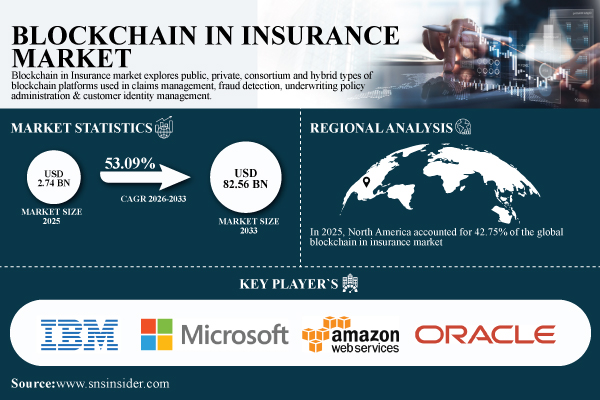

Austin, October 10, 2025 (GLOBE NEWSWIRE) — The Blockchain in the insurance market the size was valued at USD 2.74 billion in 2025E and is expected to reach USD 82.56 billion by 2033, growing at a CAGR of 53.09% during 2026-2033.

The market is expected to grow significantly through 2033 due to the growing need for digital transformations, fraud prevention and safe, transparent and efficient insurance procedures.

Download a PDF example of Blockchain in the insurance market @ https://www.snsinsider.com/sample-request/8575

The size of the US blockchain insurance market reached $0.86 billion in 2025E and is expected to reach $25.11 billion by 2033, with a CAGR of 52.46%.

Faster transactions and a growing need for risk prevention and fraud detection are hallmarks of blockchain expansion in the insurance industry. The highest market share is held by claims management (24%), followed by fraud detection and risk management (15%), underwriting policy administration (15%) and customer identity management (10%) in the same year. Insurtechs and insurers looking for scalable, secure and easy-to-integrate cloud-based blockchain technologies accounted for 5% of cloud deployments.

Key players:

- IBM Company

- Microsoft Company

- Amazon Web Services (AWS)

- Oracle Company

- SAP SE

- Consensys

- Deloitte

- Chain link

- Lemonade

- Nexus Mutual

- B3i Services SA

- AS guard time

- EtherRisk Ltd.

- Applied Blockchain

- Cambridge Blockchain

- Auxèse Group

- BitPay

- BlockCypher

- Bitfury

- Block Gemini

Blockchain in the insurance market Scope of the report:

| Report attributes | Details |

| Market size in 2025 | $2.74 billion |

| Market size by 2033 | $82.56 billion |

| CAGR | CAGR of 53.09% from 2026 to 2033 |

| Reference year | 2025 |

| Forecast period | 2026-2033 |

| Historical data | 2022-2024 |

| Scope and coverage of the report | Market Size, Segment Analysis, Competitive Landscape, Regional Analysis, DROC and SWOT Analysis, Forecast Outlook |

| Key segments | • By technology (public, private, consortium, hybrid) • By application (claims management, fraud detection and risk management, underwriting, policy administration, customer identity management) • By provider (Blockchain solution providers, technology providers) • By organization size (large companies, SMEs) • By end user (insurance companies, reinsurers, brokers, insurance companies) • By deployment mode (on-premises, cloud-based) |

| Scope of customization | Available on request |

| Prices | Available on request |

If you need any customization on Blockchain in the insurance market Report, Ifind out now @

Segmentation analysis:

By vendor, Blockchain solution providers dominated with a share of 60.15% in 2025, while technology providers are expected to grow at the fastest CAGR of 55.45%.

Blockchain solution providers are dominating the market due to the growing demand for customized blockchain frameworks that streamline claims management, policy validation, and underwriting processes. On the other hand, technology providers are growing rapidly due to the increasing availability of SaaS-based development platforms, middleware, and blockchain tools.

By technology, private blockchain held the largest market share of 28.50% in 2025, while hybrid blockchain is expected to grow at the fastest CAGR of 56.40%.

Private Blockchain solutions hold the largest market share, driven by the need for greater control, privacy and security over policyholder and claims data. Conversely, Hybrid Blockchain technology is gaining ground at an exceptional growth rate as it offers the dual benefits of transparency and restricted access.

By application, Claims Management accounted for the highest share of 30.20% in 2025, while Fraud Detection & Risk Management is expected to grow at the fastest CAGR of 57.35%.

Claims management remains the most important area of application, as blockchain enables secure, automated and transparent processing via smart contracts. Additionally, blockchain ensures immutable record keeping, which builds trust and compliance in claims operations. Meanwhile, fraud detection and risk management is emerging as the fastest growing application segment due to the growing threat of insurance fraud.

By organization size, large enterprises held the dominant share of 58.30% in 2025, while SMEs are expected to grow at the fastest CAGR of 56.75%.

Large enterprises are leading the blockchain adoption curve due to their greater financial capacity to invest in digital transformation initiatives. These organizations are integrating blockchain with ERP systems, policy management platforms, and regulatory databases to improve transparency and operational efficiency. In contrast, SMEs are rapidly adopting blockchain at a high CAGR due to the increasing availability of affordable Blockchain-as-a-Service (BaaS) models.

By end user, insurance companies held the dominant share of 62.40% in 2025, while insurance companies are expected to grow at the fastest CAGR of 58.25%.

Insurance companies represent the dominant market share as they process huge volumes of customer, claims and policy data requiring secure and transparent management. Insurtech companies are growing the fastest as they leverage blockchain to introduce innovative and decentralized insurance models.

By deployment mode, on-premises solutions captured 55.25% market share in 2025, while cloud-based deployments are expected to grow with the fastest CAGR of 57.10%.

On-premises blockchain deployment continues to hold substantial market share due to insurers’ preference to maintain full control over sensitive financial and political data. Concerns over data sovereignty and compliance with regional regulations, particularly in financial services, are further driving demand for on-premises systems. However, cloud-based blockchain deployments are growing rapidly as insurers increasingly seek scalability, flexibility and cost-effectiveness.

Regional overviews:

In 2025, North America accounted for 42.75% of the global blockchain insurance market, recording nearly 1.6 billion blockchain-based transactions. The region’s growth is driven by robust adoption by insurers, regulatory support and increased demand for secure, transparent and automated insurance services.

Asia Pacific blockchain in insurance market, the fastest growing region, is expected to grow at a CAGR of 54.72% through 2033. Strong regional growth will be a result of increasing digital insurance initiatives, insurance innovation, and favorable regulation.

Recent developments:

- In March 2025IBM has integrated its blockchain insurance solutions with Salesforce, improving claims management and policy administration for global insurers. Its platform has processed more than 500,000 insurance transactions, improving transparency, efficiency and fraud prevention.

- In October 2025Microsoft has launched Azure Blockchain for Insurance templates and APIs, streamlining claims processing and underwriting. The platform has supported 400,000 insurance transactions, enabling scalable, secure and automated workflows for insurers and reinsurers.

Buy the full research report at Blockchain in the insurance market 2026-2033 @ https://www.snsinsider.com/checkout/8575

Exclusive sections of the report (the USPs):

- ENTERPRISE BLOCKCHAIN ADOPTION – helps you understand the extent of blockchain integration across insurers, tracking adoption rates, share of blockchain-enabled claims, underwriting and policy operations, and year-over-year deployment growth.

- EFFICIENCY AND IMPACT OF BLOCKCHAIN – helps you measure operational benefits including transaction time reduction, fraud minimization, per-process cost savings, and automated smart contract execution.

- TRENDS IN INNOVATION AND COLLABORATION – helps you uncover emerging opportunities through adoption of blockchain-AI-IoT solutions, cross-industry partnerships and deployment of new protocols/platforms within the insurance ecosystem.

- COMPLIANCE AND REGULATORY OVERVIEWS – helps you assess how insurers are addressing regulatory challenges, investments in compliance-focused blockchain solutions, and legal or operational cost reductions.

- TECHNOLOGY ADOPTION RATE – helps you identify how quickly blockchain innovations are being implemented, particularly in smart contracts, claims automation and enterprise-grade insurance solutions.

- COST AND OPERATIONAL OPTIMIZATION – helps you assess the efficiencies and financial impact of blockchain adoption, including reductions in manual processing, overhead and fraud losses.

About Us:

SNS Insider is a leading market research and consulting agency that dominates the market research industry globally. Our company’s goal is to give our customers the knowledge they need to operate in changing circumstances. To provide you with current and accurate market data, consumer insights and opinions so you can make decisions with confidence, we use a variety of techniques including surveys, video conferences and focus groups around the world.