Anyway, here’s what I think: everyone in Web3 now understands that tokens and NFTs are cool, but they are just the tip of the iceberg. They are worthless on their own without a robust and reliable blockchain infrastructure.

This is why from now on, everyone who wants to build something serious, and not just follow a trend, invests in blockchain infrastructure for DeFi rather than commercially available solutions. The real value lies not in the fictional tokens, but in how everything is structured internally: protocols, nodes, network architecture, security, and all that.

Typically, DeFi projects invest in the foundation – their own or custom infrastructure – or depend on someone else’s rules, plans and technical solutions. So, essentially, the infrastructure decides whether a project will survive, before a DeFi token or features are even created.

Tokens are more of a complement than a foundation

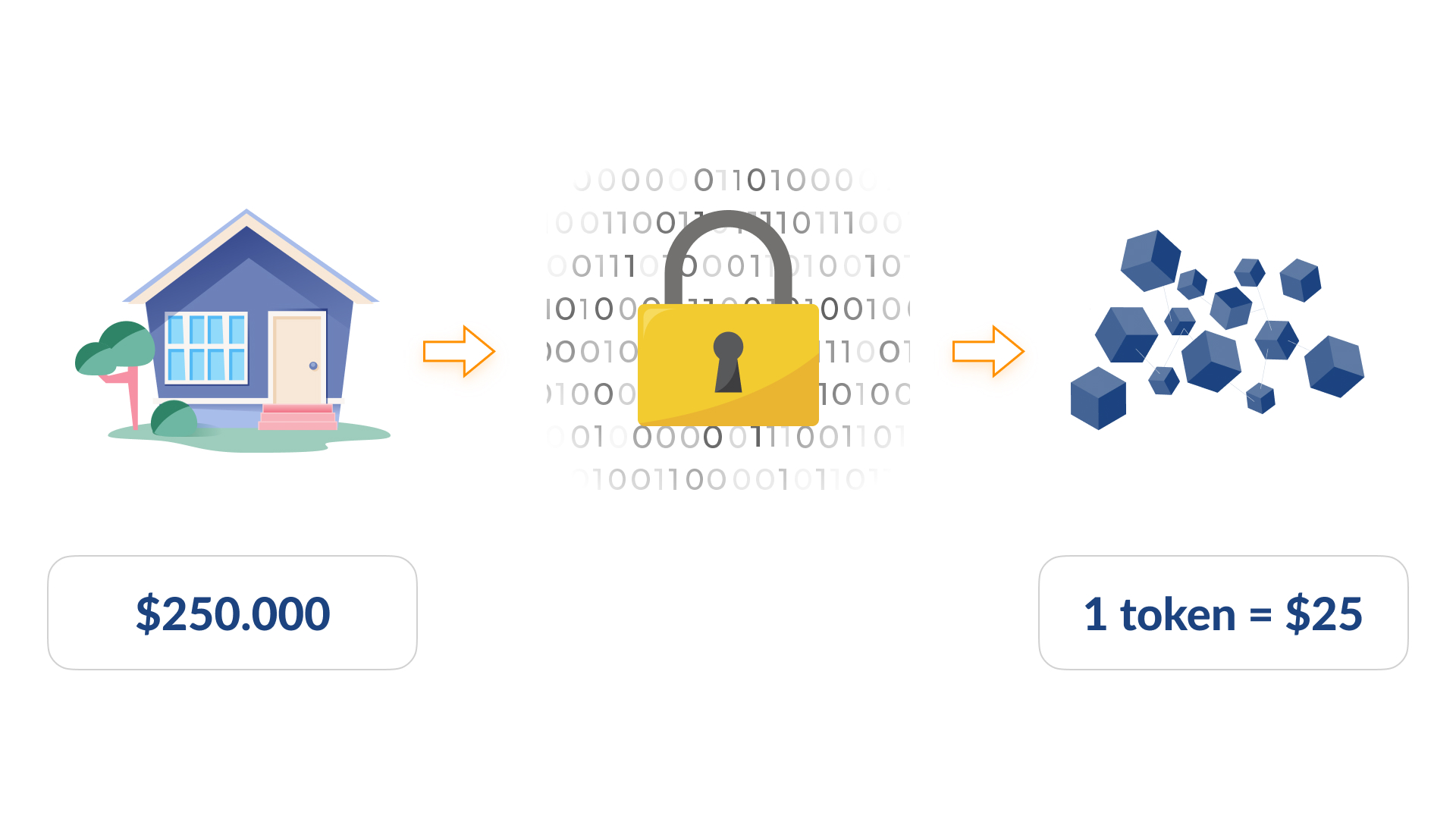

A token is like the key to a system; it can represent a value, motivate people or measure something. But on its own, it doesn’t solve the fundamental problems: how to trade, how much data to process, how to avoid outages, how to transact, how to protect against bad actors online. If the foundations are shaky, the token simply becomes a game, with no real backing. This is why many tokens do not stand the test of time in the market.

Examples of tokens:

-

Terra (LUNA) – this token was the centerpiece of the system, but something went wrong and the structure collapsed. The lack of safety and risk management mechanisms led to collapse, despite all the smart economies.

-

Eos (EOS) – they were really taken with the token and governance, but they ran into operations and resource issues. As a result, the token exists, but no one uses the network.

-

Solana (SOL) — infrastructure is key here. The token is secondary to the high-performance architecture, parallel execution, and development tools. Demand is supported by network usage.

-

Ethereum (ETH) — the value lies in the EVM, standards and a set of L2 solutions. ETH is like gasoline and an anchor for the economy, not an independent source of value.

-

Arbitrum (ARB) / Optimism (OP) — tokens serve governance, but network growth is determined by the quality of the deployment architecture, security and ease of integration.

Experience has shown that projects that prioritize tokens over a solid foundation quickly lose money, people, and trust. However, blockchains and L2 solutions that invest in protocol core, development tools, and reliable execution environments continue to grow even when the market is weak.

Does blockchain architecture affect value?

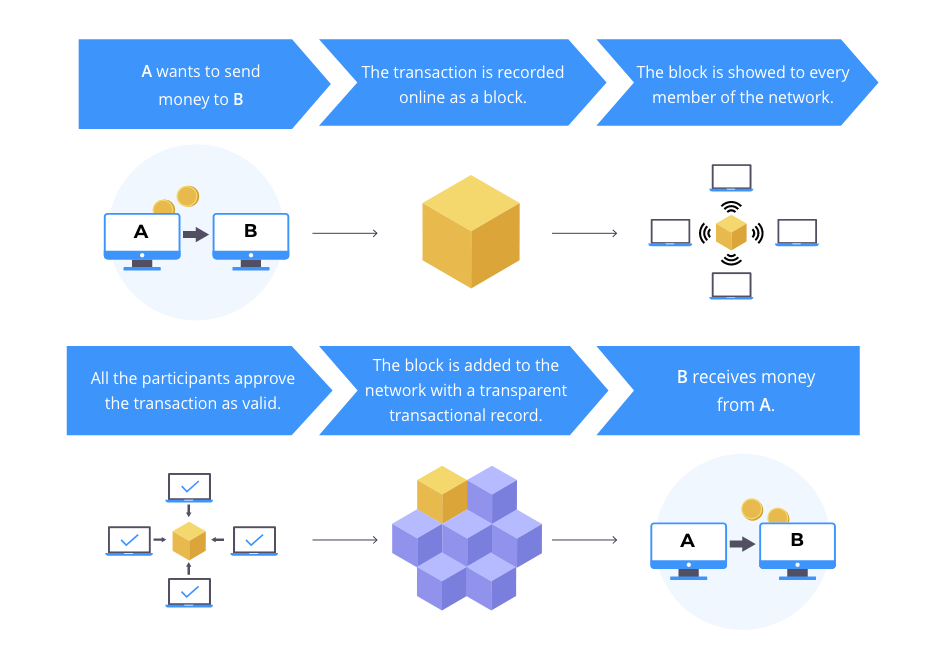

Blockchain is like a layered cake, where each layer is important for network stability, growth, and adoption. Compared to tokenomics, which is the icing on the cake, architecture is the foundation that determines whether blockchain can truly become the foundation of business, financial and digital platforms.

Security is not just a post-launch check, but an integral part of the design itself. It is important to clearly define rules, avoid relying on trust, isolate processes and work well with external services (bridges, oracles). MEV (mempool design, proposing-builder) is also worth considering. Separation and protection against value extraction directly affect the fairness and predictability of transaction execution.

For blockchain to be useful to businesses, it must be properly integrated. APIs, oracles, ID modules, cross-blockchain connectivity, and compatibility with popular Web2/enterprise systems (such as ERP, CRM, and banking) transform blockchain from a closed database into a part of the workflow. Access control, flexible authorization settings and compliance with laws are crucial here. This cannot be achieved without well-thought-out architecture.

When building a blockchain with a strong team like Mereheadyou have to make important decisions that will affect his future. Architectural flaws may increase as the network grows, while conversely, well-designed infrastructure will create more value over time. Therefore, the real value of a blockchain for businesses, investors and developers depends not on the token itself, but on the quality of the infrastructure design: reliability, scalability and integration.

Integrating blockchain into real-world businesses

Blockchain begins to be useful when it seamlessly integrates with regular business processes without disrupting the established order. This requires a solid foundation, not just fancy crypto numbers. Therefore, when blockchain is applied in real business, its true value is immediately clear: is it a solid tool or just a temporary toy?

It is important for any business to know who can do what with the data: Who sees, who changes, who confirms? This is determined by network design and access rules, not tokens. It is also important that blockchain is compatible with various software, such as ERP, CRM, banking and accounting. If its operation is unpredictable and does not fit into the traditional world, it only creates problems.

It is important that all transactions are transparent and completed on time, so that everything can be verified. If this is not the case, blockchain is not suitable for serious business.

And of course we need to think about the legal requirements now. Audits, controls and monitoring: all of this must be integrated into the blockchain from the start. Without this, blockchain remains an experiment and not a work tool.

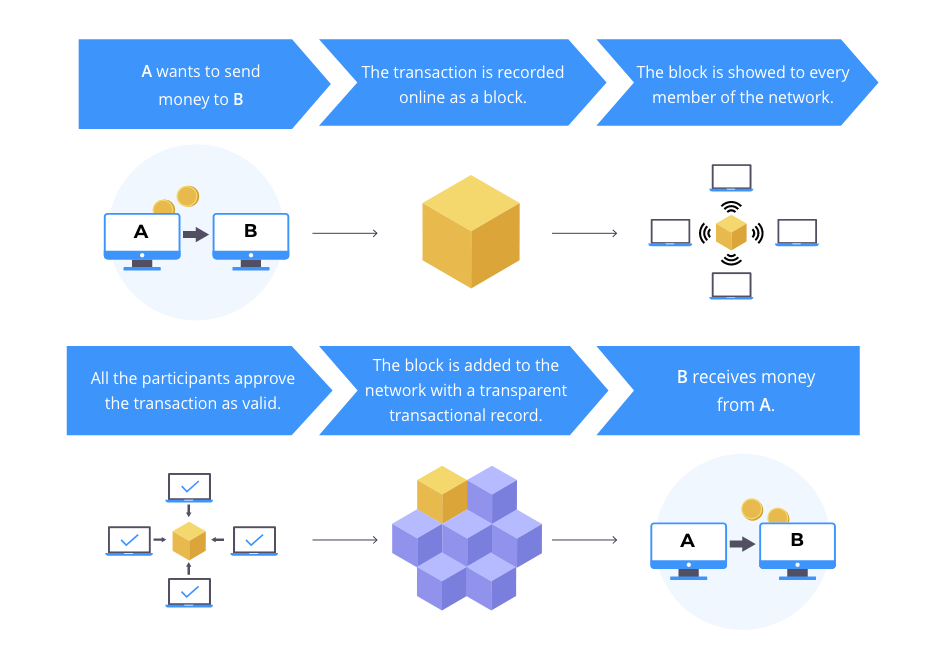

DeFi as a competition for architectural solutions, not tokenomics

In short, everything is changing in DeFi right now. Previously, everyone was chasing profit, but today the most important thing is how everything is structured. At the very beginning, everyone was only concerned with issuing tokens and making money with them, but now the coolness of your architecture is much more important. Now everyone is not looking at the symbolic price, but whether the system can withstand heavy loads, grow and continue to benefit real businesses.

The most important thing in a DeFi project It’s not how much money it collects, but how its core components work: how decisions are made, how everything is executed, how data is stored, and how everything interacts within the network. If the architecture is bad, no amount of tokens will be useful. They will only make things worse as the number of users increases.

Good DeFi platforms can handle traditional business, financial, and digital services. This requires them to work with existing IT systems, ensuring predictability and testability.

Conclusion

Today, the maturity of DeFi is not determined by how quickly tokens are issued or by their price; the quality of the design of the entire system is much more important. The foundation determines whether a blockchain can grow, how secure it is, how easy it is to update, and what applications it can be used for beyond cryptography. These elements cannot simply be added later; they are integrated from scratch and stay with the system forever.

If a blockchain platform is well designed, it becomes a valuable asset in the long term. It can handle growing workloads, integrate with existing businesses, and comply with regulatory requirements without breaking down.

The most important thing in DeFi right now is not a cool token, but a solid foundation. Projects that understand this have an advantage: they are not afraid of market ups and downs, businesses trust them, and they can thrive in the real economy. Everything else is less important.