Key notes

- AWS customers can now pay for their services using BNB through Better Payment Network built on the BNB Chain infrastructure.

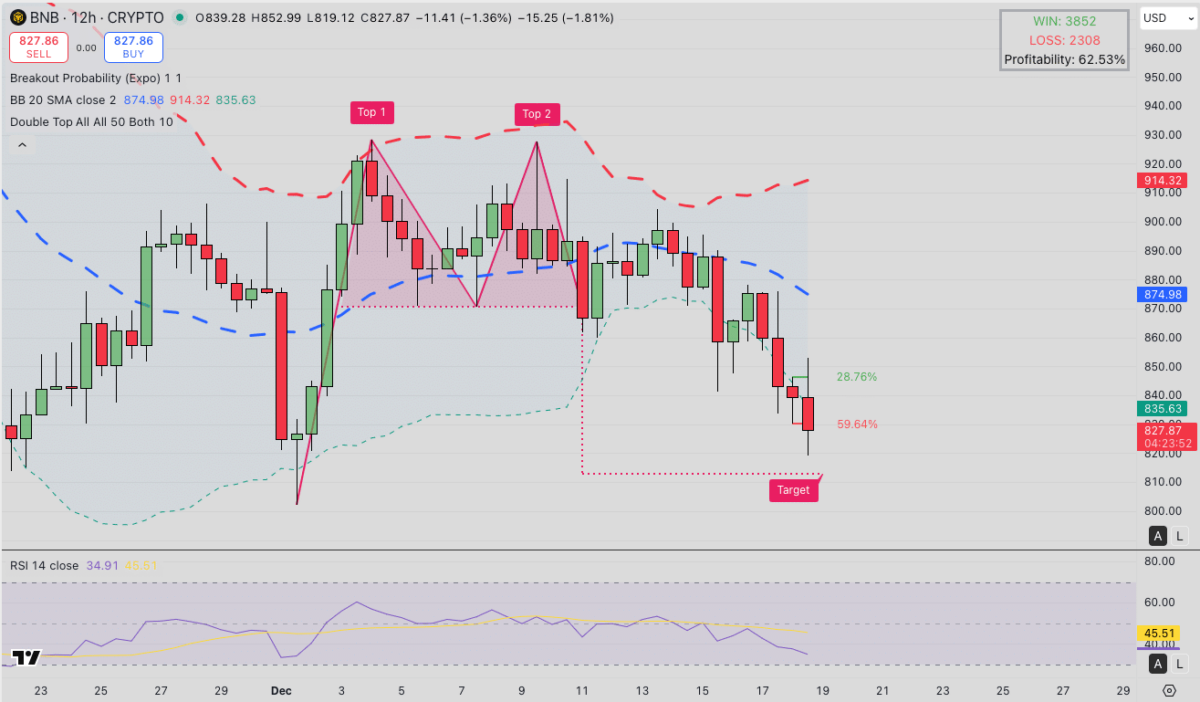

- BNB is trading below the $875 resistance after forming a double top pattern with the next support target at the $820 level.

- The integration aims to provide enterprise-grade payment channels with lower transaction costs for cross-border settlements.

BNB Chain announced on December 18 that AWS customers can now pay for their services using BNB through Better Payment Network (BNP), built on BNB Chain. The integration aims for faster settlement, lower transaction fees and simpler execution of cross-border payments.

According to the official press release, BNBChain is now positioning BNP as a bridge between digital assets and traditional financial flows for businesses.

It brings together regulated stablecoin issuers, financial institutions, DeFi sites and market makers. BNB Chain presented the partnership as a new step towards enterprise-grade on-chain payment rails.

Sarah Song, head of business development at BNB Chain, said the move expands the practical use of BNB, citing support for low-cost global payments for businesses integrating on-chain settlement into their operations.

BPN founder Rica Fu also said that “BPN’s architecture is designed to support secure and scalable transaction processing for institutional and retail businesses.” She added that integrating AWS billing presents operational efficiencies through digital asset payments.

BNB Price Forecast: Can Bears Extend Double Top Breakdown to $820?

BNB’s 12-hour price chart clearly shows a double top formation, with two failed breakout attempts capped at less than $940. The neckline area around $875 became resistance after the breakout.

BNB

BNB

$843.7

24h volatility:

1.1%

Market capitalization:

$116.35 billion

Flight. 24h:

$3.49 billion

the price is now trading below the 20-period base, near $875, and below the lower band, near $836. This placement indicates that sellers are still in control of the momentum, even if prices stagnate during the day. The RSI near 35 shows strong downward pressure, with conditions close to oversold over this period.

BNB Price Technical Analysis | Source: TradingView

If the bears keep BNB below $830 for consecutive sessions, the BNB price is likely to continue falling. The double top pattern is currently pointing towards the $820 level as the next downside target, with $800 as the follow-through risk.

Conversely, BNB must hold above $820 to maintain hope of a near-term rebound.

A bullish recovery case begins with reclaiming $845 and then closing above $875. Until then, rebound attempts could remain capped at less than $830.

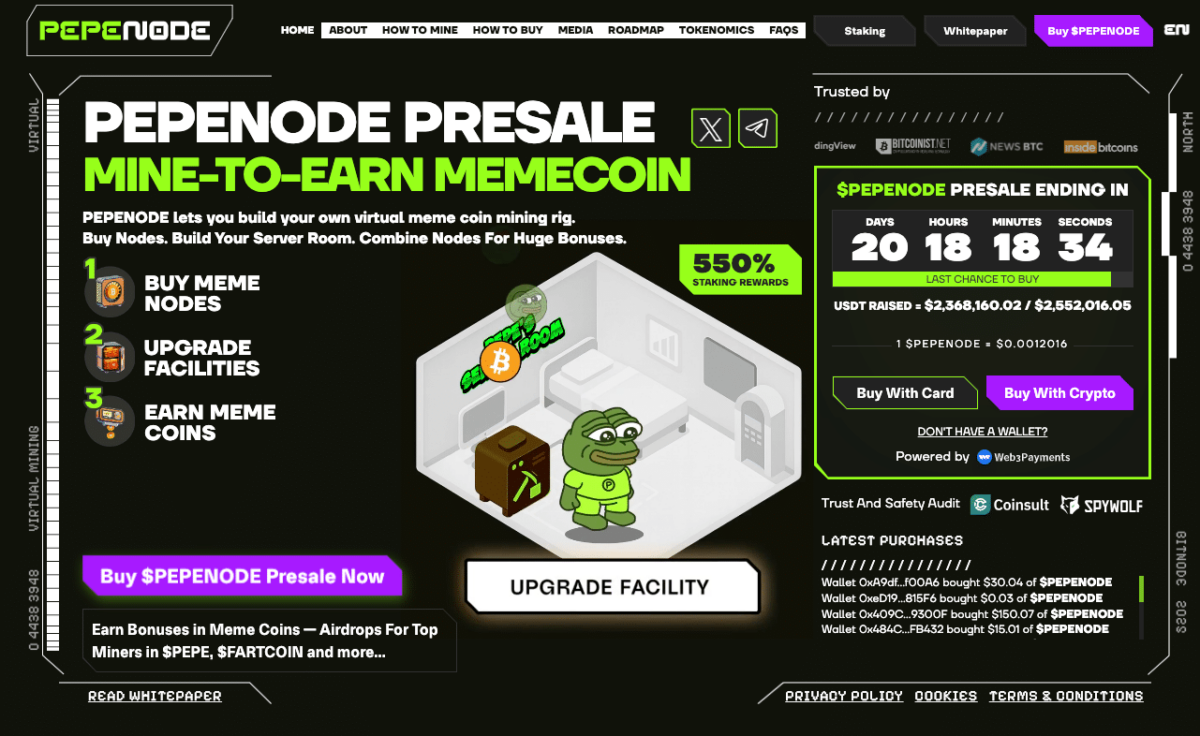

Traders on Alert as Pepe Node Presale Nears $2.6 Million Target

As the integration of the BNB chain into AWS drives crypto adoption in the United States, early-stage projects like PEPENODE are receiving speculative demand.

Pepe Node allows users to own virtual coin mining rigs, combine nodes for higher yields, and earn bonus rewards through participation in the network.

Pepe bow presale

Currently priced at $0.0012, the Pepe Node presale has already raised over $2.36 million of its $2.552 million goal. Investors can still register via the official Pepe Node website before the next price level is unlocked.

following

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article is intended to provide accurate and current information, but should not be considered financial or investment advice. Because market conditions can change quickly, we encourage you to verify the information for yourself and consult a professional before making any decisions based on this content.

I’m a research analyst with experience supporting Web3 startups and financial organizations with data-driven insights and strategic analysis. My goal is to help organizations make smarter decisions by bridging the gap between traditional finance and blockchain innovation.

With a background in economics, I bring a strong understanding of market dynamics, financial systems, and the broader economic forces that shape the crypto industry. I am currently pursuing a master’s degree in Blockchain and Distributed Ledger technologies at the University of Malta, where I am expanding my expertise in decentralized systems, smart contracts and real-world blockchain applications.

I am particularly interested in project evaluation, tokenomics and ecosystem growth strategies, as these are areas where innovation can have a lasting impact. By combining my academic foundation with practical experience, my goal is to provide meaningful insights that add value to the financial and blockchain industries.

Ibrahim Ajibade on LinkedIn