- BNB is trading on an upward trendline, with the potential to break the $615 resistance and climb to $700.

- Technical indicators such as the RSI and open interest suggest further price movements, signaling a possible rally ahead.

Binance (BNB), the native cryptocurrency of Binance Exchange, has been on an upward trend since early October. After facing fluctuations throughout September, including a drop as low as $477, the token has rebounded and is recovering its earlier losses.

This recovery was fueled by an uptrend that strengthened BNB’s position in the market.

Over the past two weeks, BNB has increased in value by 5.5%, with a 2% rise in the last week alone. However, despite this positive momentum, the token saw a 1.9% decline in the last 24 hours, bringing its current price down to $595.

Before that, BNB hit a 24-hour high of $610.

Despite this slight decline, the recent performance of the BNB market suggests the possibility of a rally stronger in the coming weeks.

Technical indicators point to a further rise

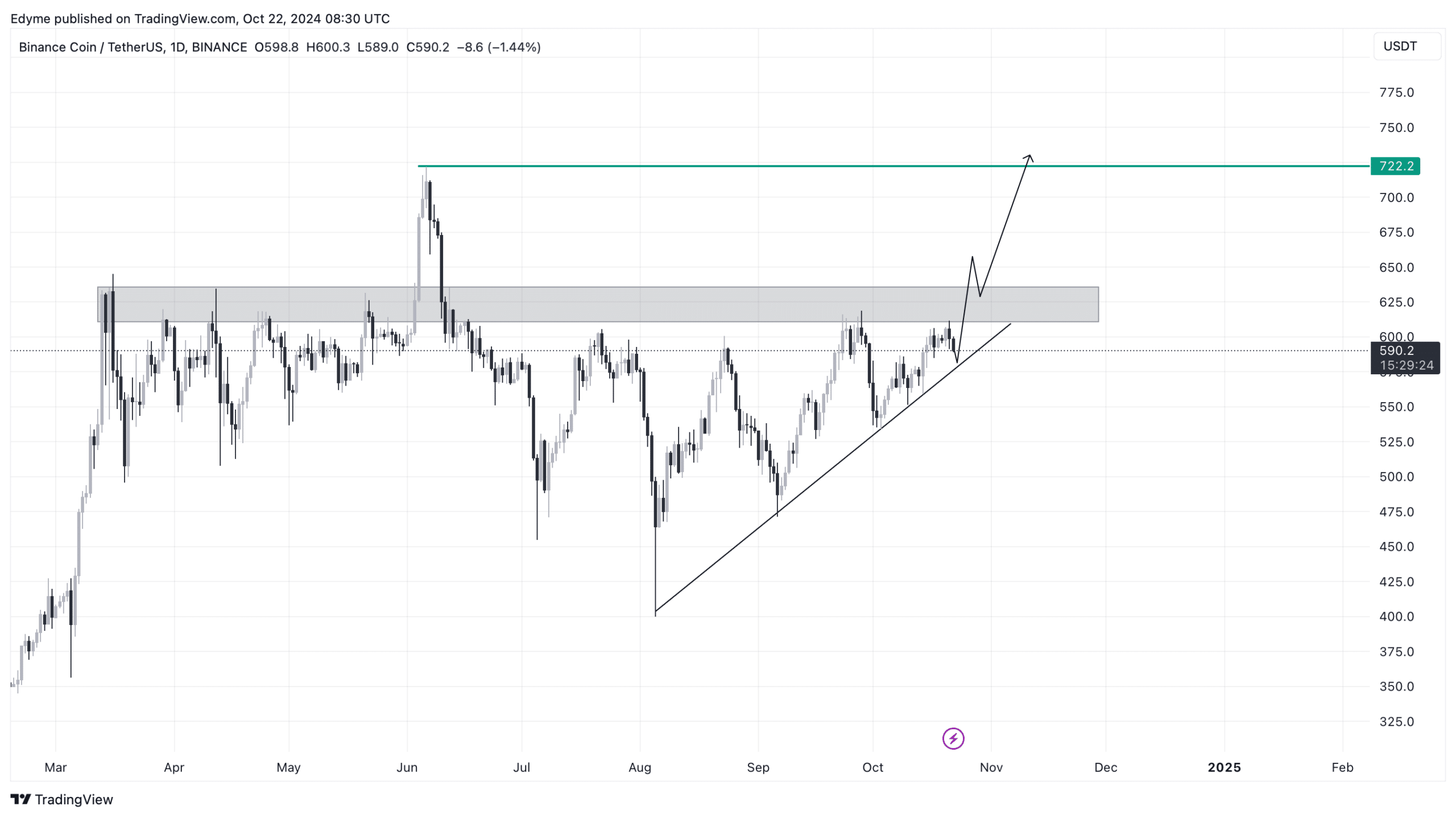

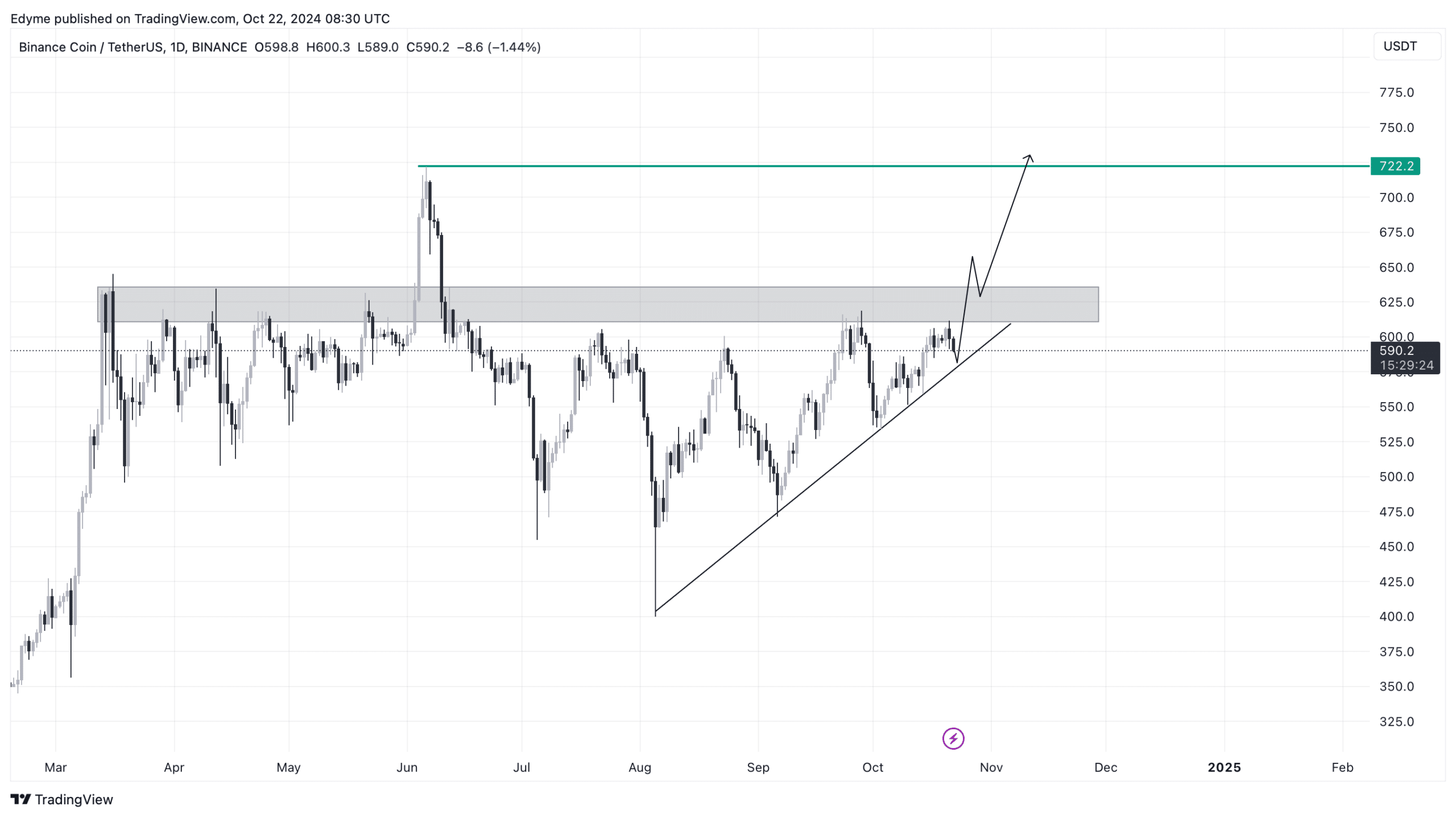

The daily price chart of BNB reported that the asset has maintained an upward trendline, which generally indicates continued growth. This trendline has been a strong support level, as BNB price has not fallen below this level in recent weeks.

If the asset maintains this trajectory, BNB could challenge its next major resistance level at $615, a critical zone where the price has already been rejected.

A successful break above this level could open the door for the asset to rise to $700, potentially regaining its June high of $722.

Source: TradingView

An upward trendline, like that seen in BNB’s current market behavior, is a key technical setup indicating a bull market. This reflects consistently higher lows, suggesting buyers are intervening at increasing price levels to support the asset.

When the price of a cryptocurrency consistently follows an upward trendline, it indicates that the asset is under sustained buying pressure, which could eventually lead to a breakout above resistance levels.

In the case of BNB, this trendline has been in place for several weeks, indicating the potential for continued growth.

BNB Fundamental Outlook

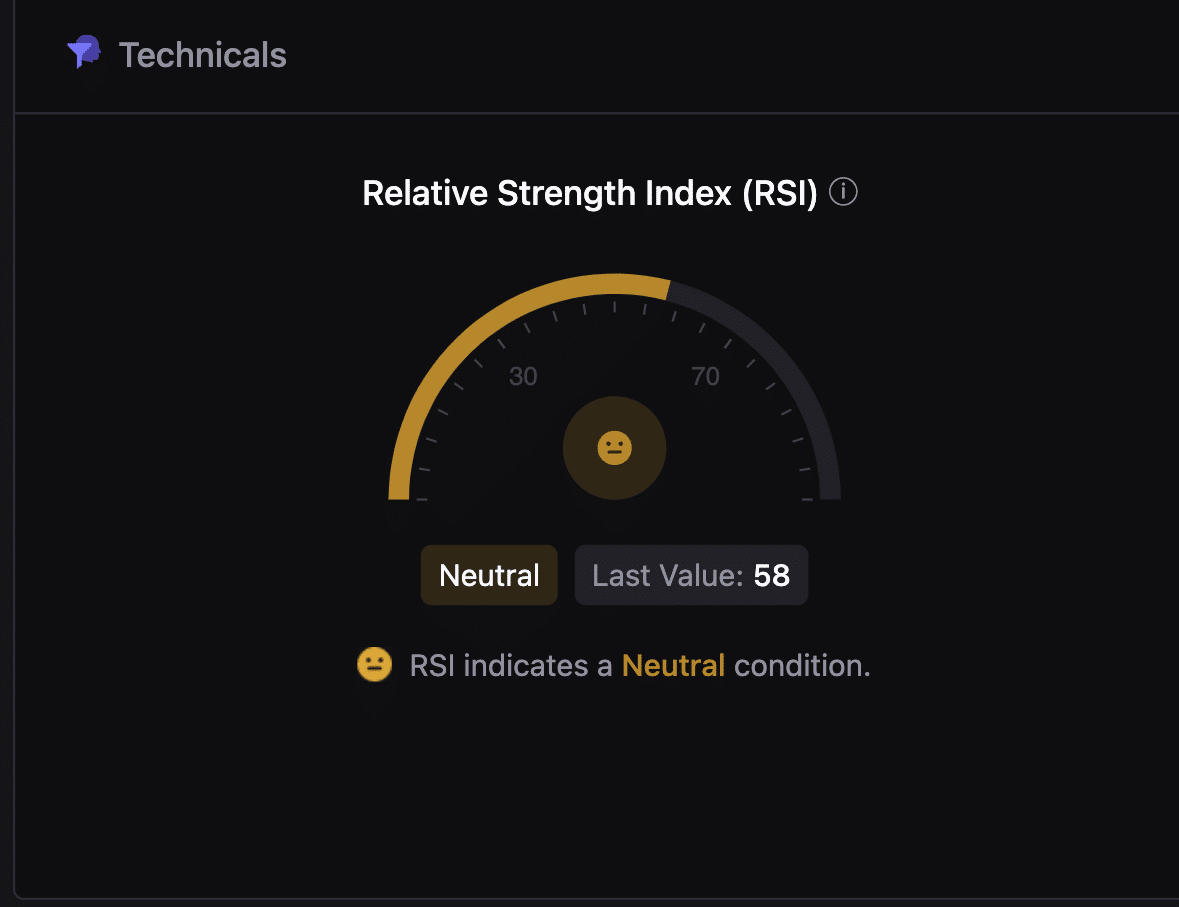

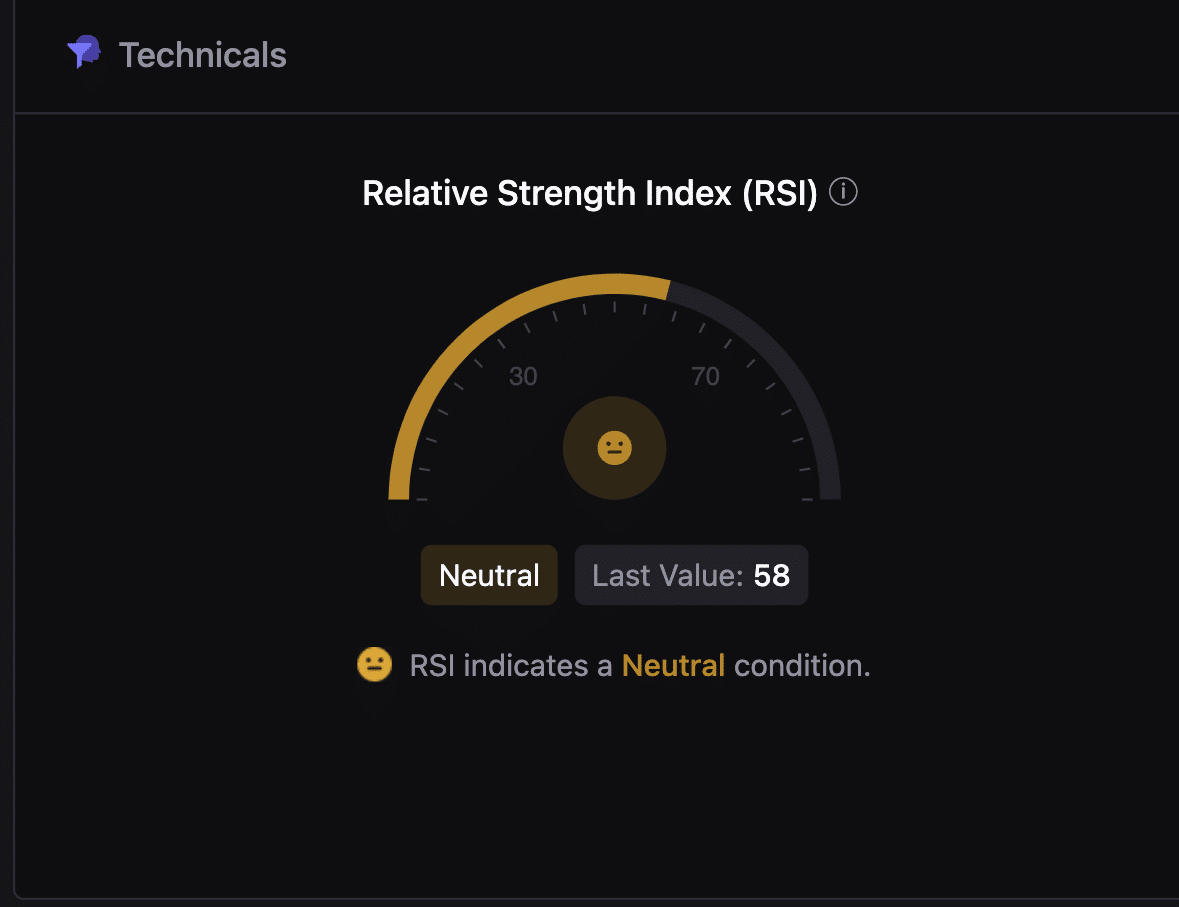

Besides technical trends, other indicators also highlight the potential for further gains. One such indicator is the Relative Strength Index (RSI), a momentum oscillator used to measure the speed and direction of price movements.

The RSI ranges from 0 to 100, with a reading above 70 generally considered overbought and a reading below 30 considered oversold. The current RSI of BNB, session at 58, suggests a neutral market condition.

This level indicates that even though Binnacle Coin is not in overbought territory, it still has room to rise without facing significant selling pressure.

Source: CryptoQuant

This positive outlook is also reinforced by data from Coinglass, which is showing mixed signals regarding BNB open interest.

Read Binance Coin (BNB) Price Prediction 2024-2025

While BNB’s open interest, which represents the total number of outstanding derivative contracts, decreased by 3.27% to $541.43 million, its open interest volume jumped by 38.94%, to reach $645.18 million.

This increase in open interest volume signals a growing number of market participants and increasing activity, suggesting traders are positioning themselves for possible future BNB price movements.