Key notes

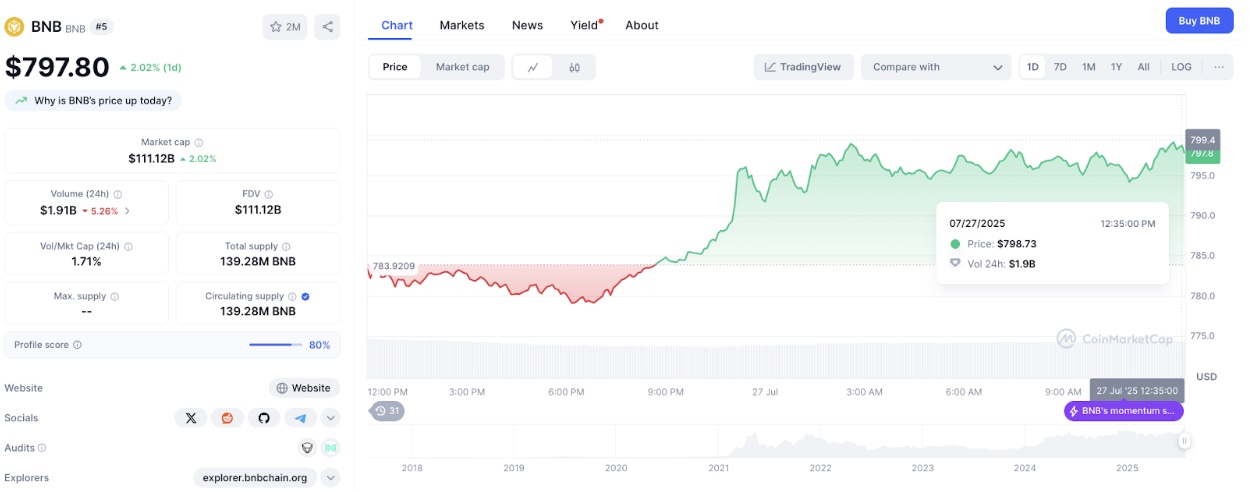

- BNB Price struck the $ 800 mark on Sunday, printing 7% of gains in three consecutive negotiations.

- The Binance Coin rally coincides with the Windtree Therapeutics listed in Nasdaq $ 520 million for its BNB corporate treasure on Thursday.

- Bollinger strips in ascending sloping signal the volatility of an intense purchase activity with $ 818 as the following resistance target.

BNB approaching new heights of all time in the middle of the $ 700 million entries in Windtree

BNB pushes to a new summit of all time after Windtree Therapeutics announced a major move from the corporate treasure. The Biotechnology Company listed at NASDAQ has revealed plans for a stock line in equity of $ 500 million and an additional $ 20 million action agreement to acquire BNB. If it is approved by shareholders, 99% of the product will go to the accumulation of BNB.

This strategy follows an increasing trend between public enterprises to adopt cryptocurrency for the diversification of the balance sheet. Windtree CEO Jed Latkin said the decision was to strengthen the position of the company’s digital assets. Meanwhile, Patrick Horsman from Build and Build Corp. Praised this decision as a prospective strategy to create a value for shareholders.

BNB had initially re -driven the record vertices of $ 809 recorded on Wednesday July 23 to reach lows around $ 742. However, just as Windtree’s announcement has become public, the profit took place while the market reacted positively, the BNB price reaching $ 798 on July 27, winning 7% over three days.

With the commitment of $ 700 million Windtree’s entries which revives the BNB record rally, traders are now looking closely if the bulls turn from last week from the resistance to support.

Can BNB price prediction: Can bulls return $ 818 in support?

From the point of view of technical analysis, Bollinger’s bands on the daily graph Bnbusd show a strong ascending momentum. As shown below, the bands are sloping upwards, a classic signal for increasing volatility, generally driven by purchase pressure. In addition, BNB has constantly closed above the intermediary band (20-day mobile average) since July 2, confirming the persistent demand that supports the upward trend.

In terms of short -term BNB price forecasts, the immediate bullish target is $ 818, highlighted at the top of the upper Bollinger strip. An escape above this level could trigger a price rally to the next psychological barrier at $ 850.

MacD (Divergence of Mobile Average Convergence) also confirms the bullish feeling. The Blue MacD line is well above the signal line and the histogram bars remain in positive territory.

Binance Coin (BNB) Price action | Source: Coinmarketcap, July 27, 2025

However, if BNB does not close above the top of all previous time at $ 810, short-term traders can resume profit. In this scenario, a correction lower than the Mid-Bollinger gang $ 730 could invalidate the upward configuration, potentially extending losses to the next level of psychological support price at $ 700.

BNB price forecasts | Source: tradingView

Solaxy prevented in full flight because BNB attracts capital entries

While new capital entries from companies like Windtree enters the cryptocurrency sector, newly launched projects like Solaxy are about to benefit from the delay effect. Solaxy is Solana’s first layer-2 project, with its current SLXY token in progress providing multi-chain DEFI access and high empty rewards.

Solaxy presale

The Live $ SLXY presale positions the first buyers to benefit from the current season in Altcoin, because the best projects like BNB are testing new heights of all time.

Visit the official Solaxy website to reach the presale.

following

Non-liability clause: Coinspeaker undertakes to provide impartial and transparent reports. This article aims to provide precise and timely information, but should not be considered as financial or investment advice. Since market conditions can change quickly, we encourage you to check the information for yourself and consult a professional before making decisions according to this content.

Ibrahim Ajibade is a seasoned research analyst with training by supporting various web3 and financial organizations. He obtained his undergraduate diploma in economics and is currently studying for a master’s degree in blockchain and distributed major book technologies at the University of Malta.

Ibrahim Ajibade on LinkedIn