- BNB, after surging 10.45% over the past 24 hours, has started testing the $491 resistance at press time.

- Netflow data suggests bullish holding behavior.

The cryptocurrency market has had a turbulent time in recent weeks, with Binance Coin (BNB) experiencing wild price fluctuations.

Binance Coin has shown exceptional resilience after falling 32% during the broader crypto crash.

In less than 24 hours, BNB has seen an impressive increase of 10.45%, so it should come as no surprise that traders and investors are showing increased interest.

The $491 Battlefield

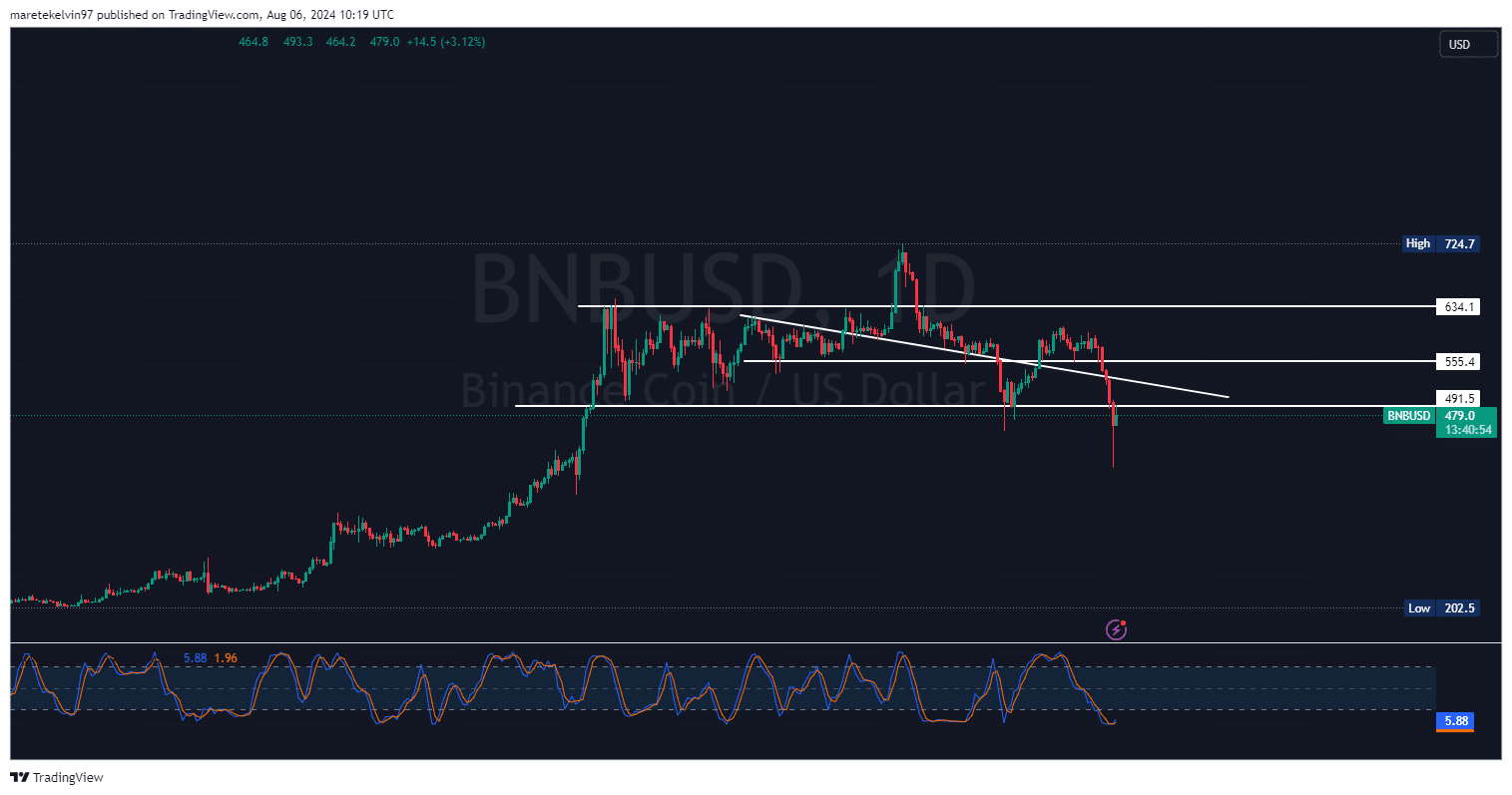

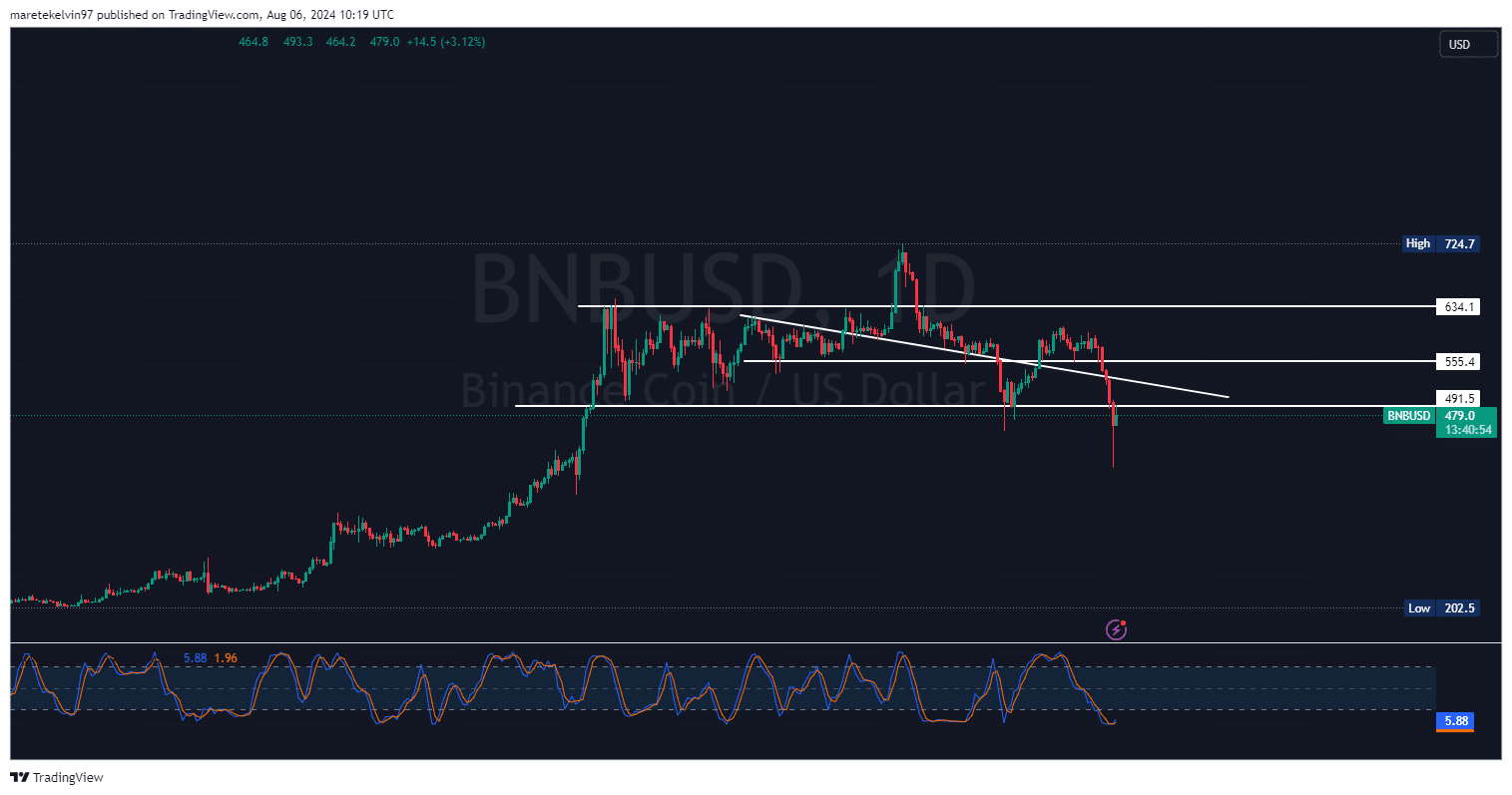

At the time of writing, BNB was testing the key resistance level at $491. This level is vital as a break above it could suggest further bullish momentum.

Recent price action shows growing bullish sentiment, but the question remains whether BNB can sustain this momentum and break above resistance.

Source: TradingView

The Stochastic RSI is in an oversold zone, suggesting a potential bullish reversal.

Liquidation landscape

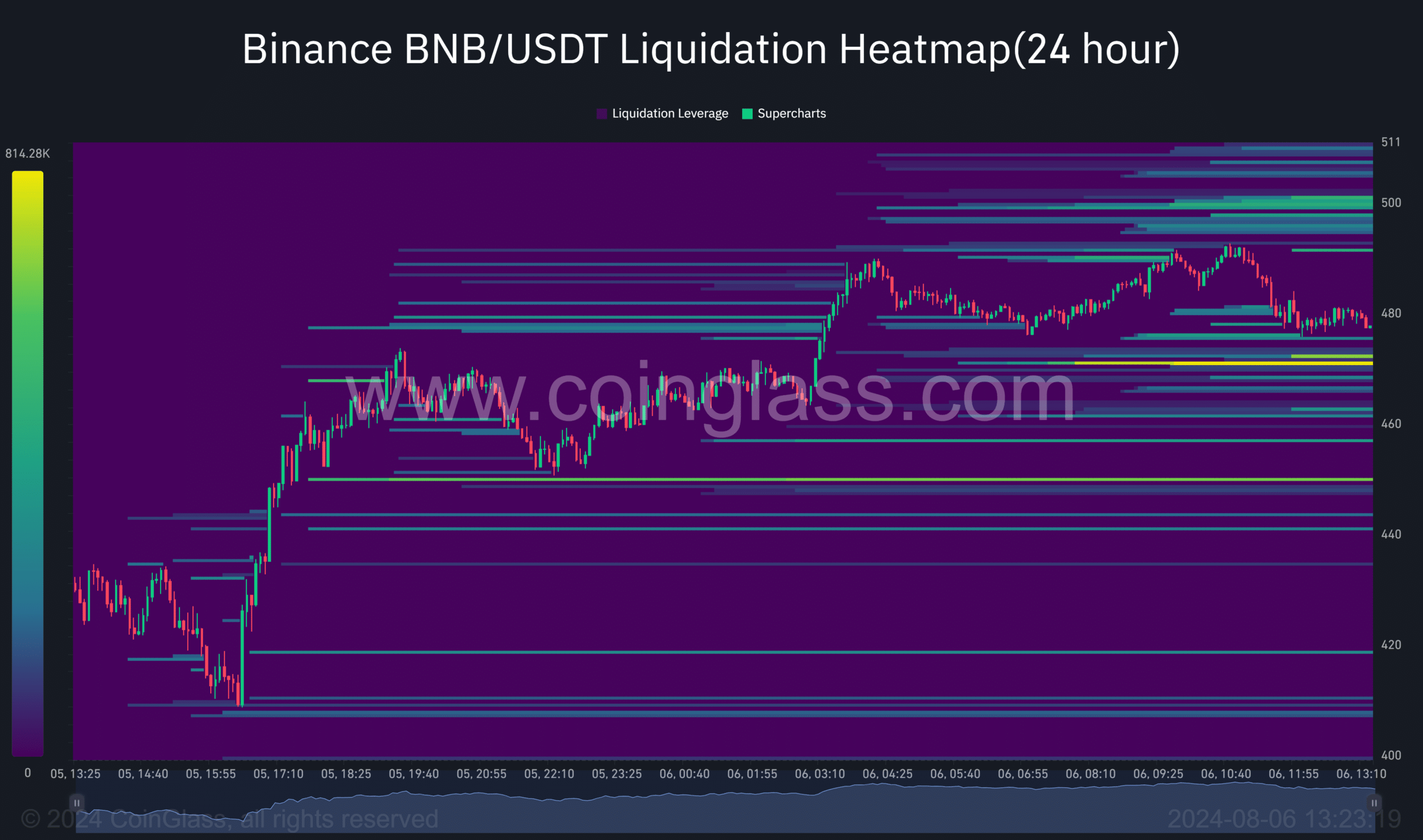

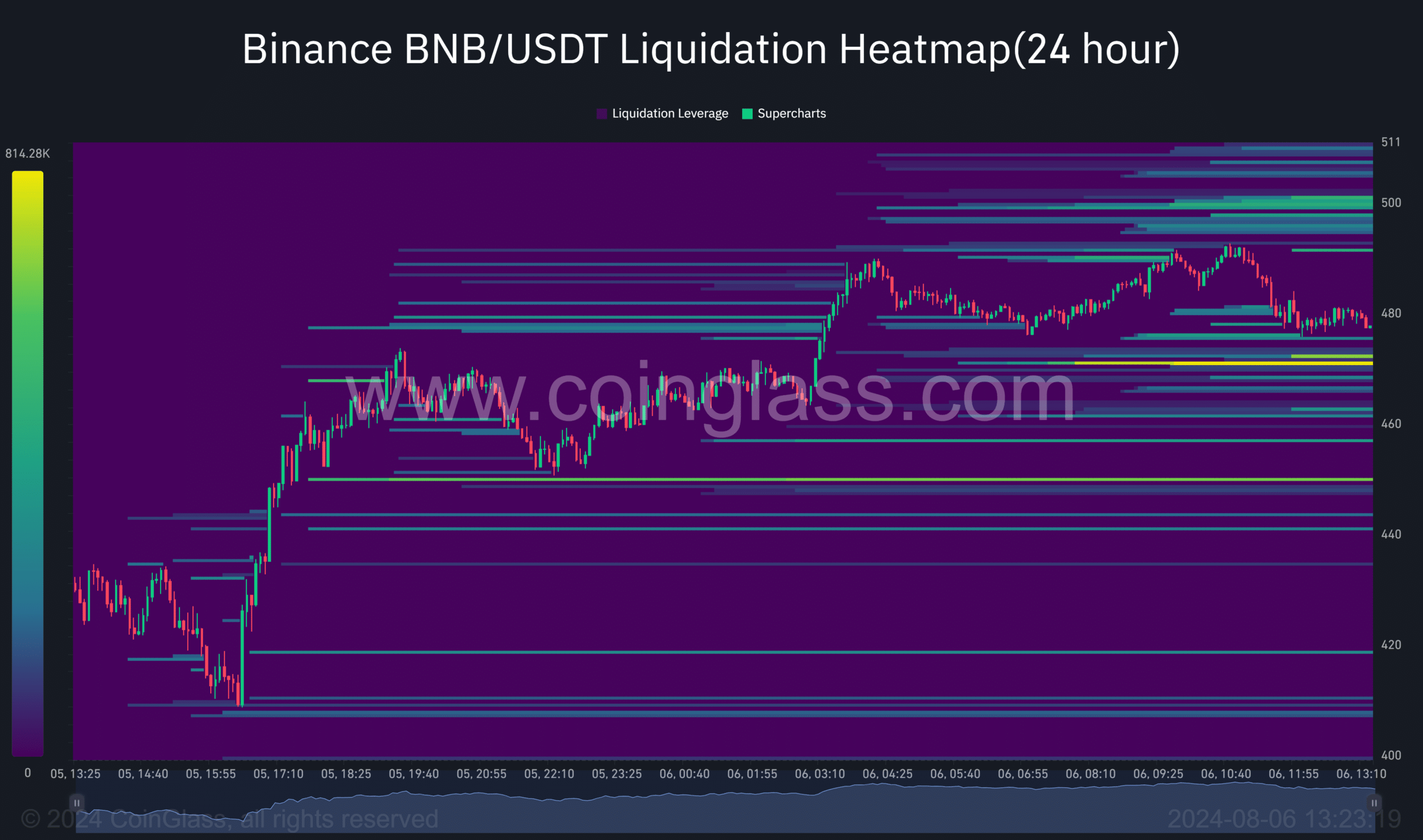

According to AMBCrypto’s analysis of Coinglass liquidation data, some significant liquidation levels are visible, showing that investors are actively positioning around key price points.

Such increased activity can increase volatility when prices approach critical levels.

The $584,000 liquidation pool at $472 may act as a price magnet, potentially pulling the price down for a short-term correction.

Source: Coinglass

Whispers about BNB net flow

AMBCrypto further analyzed data from Coinglass’ netflow exchange. The data revealed huge capital outflows, implying that investors are increasingly moving away from removing their BNB from exchanges.

This behavior typically indicates a custodial mentality as people move assets to private wallets for longer-term storage.

In most cases, this type of action supports the bullish sentiment, as it reduces the selling pressure on the stock markets.

Source: Coinglass

Although the current momentum appears bullish, breaking above the $491 resistance level is crucial to confirm a long-term uptrend.

Read Binance Coin (BNB) Price Prediction for 2024-25

A successful breakout could provide an opportunity for further gains, reaching previous highs.

However, failure to break above this level could lead to consolidation or a short-term pullback.