Join our Telegram channel to stay up to date with the latest news

Bitcoin (BTC), Ethereum (ETH) and

Beijing announced sanctions against the U.S. units of South Korean shipbuilder Hanwha Ocean and warned of further measures against the maritime sector, increasing tensions between the world’s two largest economies and deterring hopes of a near-term thaw.

Global stocks fell and the fallout rippled through digital assets, triggering a new wave of selloffs that pushed major tokens to multi-week lows.

( @realDonaldTrump – Social message of truth)

(Donald J. Trump – October 12, 2025, 12:43 p.m. ET)Don’t worry about China, everything will be fine! The well-respected President Xi has just had a bad time. He doesn’t want depression for his country, and neither do I. The United States wants to help… pic.twitter.com/30ot0cICw4

– Donald J. Trump Fan 🇺🇸 TRUTH POSTS (@TruthTrumpPosts) October 12, 2025

Crypto prices are falling with no resolution in sight

US Treasury Secretary Scott Bessent said negotiations with China were still ongoing, but uncertainty left a dark cloud hanging over the crypto market.

After taking a breather from the recent downtrend, cryptocurrency prices continued to fall over the past 24 hours.

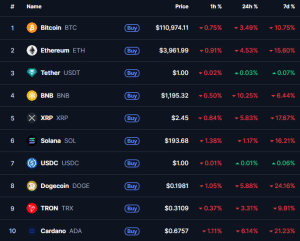

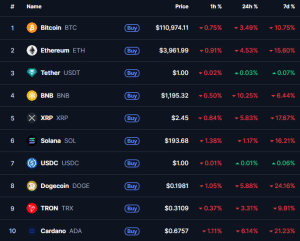

BTC and ETH fell more than 3% and 4%, respectively, according to CoinMarketCap data. Ethereum is now down over 15% in the last seven days and BTC is down over 10%.

Top 10 cryptos by market capitalization (Source:CoinMarketCap)

The ten largest cryptocurrencies by market capitalization also fell. BNB, which recently set a new all-time high (ATH), plunged 10%, marking the biggest loss in the top ten.

XRP and Solana (SOL) fell 6% and 1%, respectively, while Dogecoin (DOGE), Tron (TRX), and Cardano (ADA) fell 5%, 3%, and 6%, respectively. OhIn total, the crypto market cap fell by more than 3%.

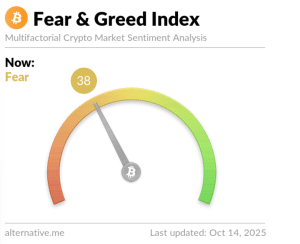

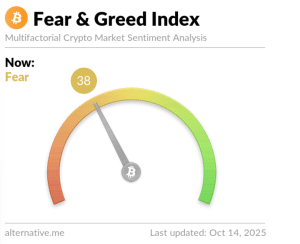

The Crypto Fear & Greed Index, a popular tool used to gauge investor sentiment, has fallen to a “fear” level of 38, from a “greed” level of 70 just a week ago.

Crypto Fear and Greed Index (Source: Alternative.me)

CoinGlass Data shows that liquidations in the crypto market exceeded $694.81 million in the last 24 hours, with long positions accounting for $511.80 million of the total. Some short traders were also affected, with $195.31 million liquidated following market-adverse trades.

The price of silver hits a record high, as does that of gold

The search for safe-haven investments propelled the price of silver to a record high of $53 an ounce, bringing its gains for the year to more than 85%.

Silver is often seen as a substitute for gold, which also hit a new all-time high earlier today.

Commenting on the performance of gold, silver and the crypto market, Bitcoin critic Peter Schiff warned that “crypto buyers are in for a rude awakening.” He also said crypto investors would learn “a very valuable but costly lesson.”

Gold and silver continue to melt while Bitcoin and Ether continue to melt. Crypto buyers are in for a rude awakening and will soon learn a very valuable but costly lesson. Fortunately, most crypto owners are young and have plenty of time to recover what they are about to lose.

-Peter Schiff (@PeterSchiff) October 14, 2025

That’s after he said Bitcoin’s flash crash last Friday “was not a buying opportunity but a warning.” He added that gold’s continued rise “exposes the fiction that Bitcoin is digital gold.”

Meanwhile, famous analyst Michael van de Poppe said that BTC’s recent correction is “nothing special” and predicted that “volatility will remain high before a new clear trend emerges.”

Related articles:

Best Wallet – Diversify your crypto portfolio

- Easy-to-use, feature-driven crypto wallet

- Get Early Access to Upcoming Token ICOs

- Multi-chain, multi-wallet, non-custodial

- Now on App Store, Google Play

- Stake to win a $BEST native token

- More than 250,000 active users per month

Join our Telegram channel to stay up to date with the latest news