Crypto is witnessing a sort of shuffling of the cards. Long-term Bitcoin holders have slowed their sales after months of steady reductions, while large Ethereum wallets have accumulated more tokens, according to recent reports.

Related reading

Traders remain cautious of price swings and data that gives mixed signals about where money will go next.

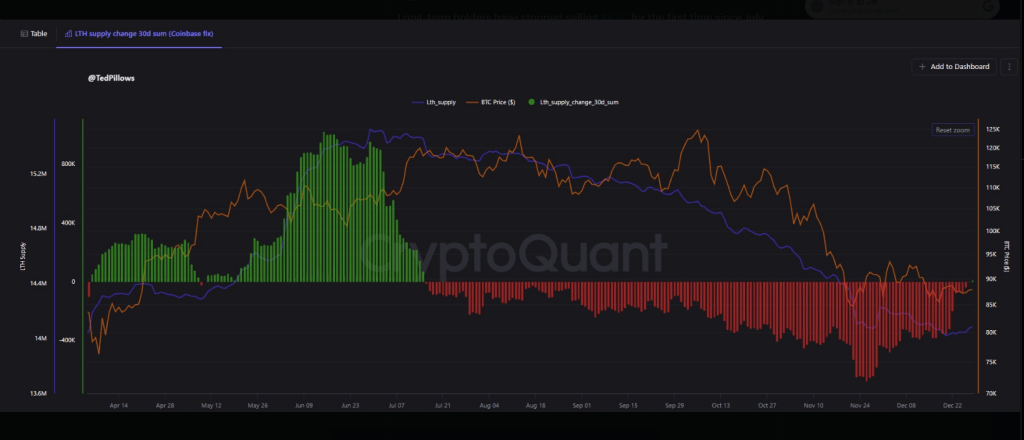

According to on-chain figures cited in market commentary, wallets that held Bitcoin for at least 155 days reduced their total from nearly 15 million coins in mid-July to just over 14 million in December.

Ether whales increase their holdings

Based on reports citing CryptoQuant and a crypto newsletter, addresses holding large amounts of ether have added around 120,000 ETH since December 26.

Milk Road analysts said wallets holding more than 1,000 ETH now control around 70% of the supply, and that share has increased since late 2024.

High concentration can indicate high conviction on the part of a few players, and it can also expose the market if those same portfolios decide to sell off. Both outcomes would shape liquidity and price fluctuations.

Long-term holders stopped selling $BTC for the first time since July 2025.

Things are looking good for a relief rally here. pic.twitter.com/t7Sl2hS9Ub

– Ted (@TedPillows) December 29, 2025

Long-term Bitcoin holders pause sales

Crypto investor Ted Pillows was quoted on

This change in activity is often interpreted as a sign of exhaustion after a long period of distribution. This may mean the sellers are done for now, but it does not guarantee a new uptrend.

Capital movements and market cuts

Garrett Jin, formerly of the BitForex exchange, suggested that some capital could shift from metals to crypto after a short squeeze in precious metals.

Reports reference silver and platinum gains as a backdrop. At the same time, bitcoin has been trading in a tight range recently, bouncing between $86,740 and $90,060 over seven days, a trend that has kept many traders on edge.

The price of silver has risen more than 1,570% this year, a figure that would represent an extreme move and will require independent confirmation.

Meanwhile, Bitcoin remains well below its all-time highs. Some analysts say tepid demand for ETFs and market mechanisms, including derivatives and liquidity models, play a bigger role in driving price action than general sentiment.

Related reading

Taken together, the data points to a market that is stabilizing rather than decisively recovering. Large ether holders are buying, long-term bitcoin owners have suspended sales, and US flows appear weak.

Featured Image from GaijinPot BlogTradingView chart