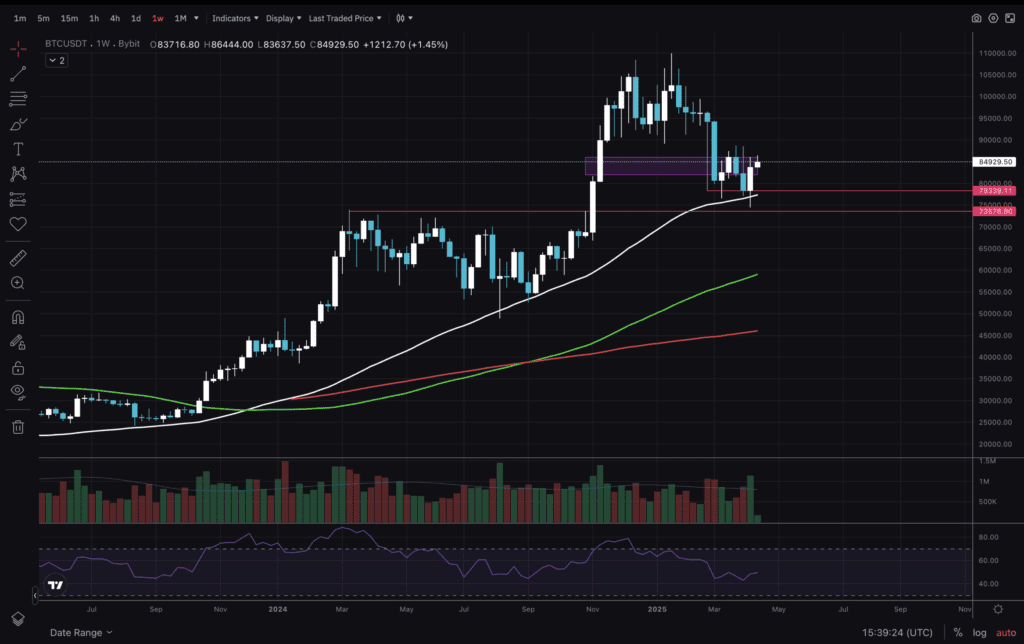

The USD BTC repels again, analysts highlighting an emerging reteeste of $ 90,000 on the cards. However, as the Bitcoin prices movements in 2025 continue to arouse an intense open interest of traders and investors. The data on Google Trends of yesterday underline a peak in research on the action of the price of bitcoin and technical analysis, reflecting a request for clear information on the market.

Highest ups and higher stockings.

Keep things simple.#Bitcoin pic.twitter.com/wv4fve3bhy

– Jelle (@cryptojellenl) April 15, 2025

This article explores the latest BTC graphics models, critical support and resistance levels and indicators like RSI and mobile averages. Whether it is negotiation or investment, this technical information offers a roadmap for the volatile cryptographic landscape.

Keeping simple is actually an important part of the technical analysis. The drawing of many lines only creates confusion and makes the decision of the entry much more difficult.

Discover: 20+ Next Crypto to explode in 2025

Bitcoin price analysis: Determine key levels for USD BTC in April

The best way to do business is to have clearly defined levels that we monitor and, when the time comes, takes action. Let’s look at some graphics and discover where the key levels are.

(BTCUSD)

On the weekly time, the price of Bitcoin is still in an upward trend. Last week, the MA50 was reserved and, in the same way, in the summer of 2024, it rebounded. So far, so good. There is also this first massive wick of the sales event in February, which is now filled. This is proof of market efficiency.

Discover: 9+ High risk crypto at high risk to buy in April 2025

(BTCUSD)

The graph of a day shows a slightly more detailed action. Where I drew the deviation below the line of $ 7,8339, a contested candle for a trained bullish swallowing. It was not a higher closure than the blue that touched the key level, but it had a higher volume and a larger body!

The MA50 has caught up now, and the price of the USD BTC is in and out of the key box identified in my article dating from December 2024. Finally, I expect that the medium -sized moving gather and start to look when the price breaks the structure of the market and the Bull Run continues.

(BTCUSD)

Finally, a quick glance at the time 4 hours – lower where we can identify the entries. As well as the first signs of trend reversal.

For the first time in Forever (it seems, haha), we broke above the 3 month downward trend line. Good entry points were the test of the red line or the divergence raised from the double bottom which formed during the gap.

Meanwhile, the RSI seems to need to cool a little. Now traders must focus on the following possible scenarios for the right entries:

1. Request of the trend line.

2. Place more than $ 86,000 and enter the Retest

3. Not desired, but a potential retain of $ 78,000.

Stay safe there!

Discover: the 12+ warnings of the hottest cryptography to buy now

Join the 99Bitcoins News Discord here for the latest market updates

The Post BTC USD draws a high because the analysis of Bitcoin prices reveals that new technical information appeared first on 99Bitcoins.