DUBAIUnited Arab Emirates, December 26, 2024 /PRNewswire/ — Bybitthe world’s second largest cryptocurrency exchange by trading volume, released the latest crypto derivatives analysis report in collaboration with Block Scholes, highlighting the market’s low volatility despite major options expiring on Friday. The realized volatility of BTC and ETH has increased, but short-term options have not adapted to this change. This indicates that even though spot prices fluctuate, the options market does not fully react to these changes, although BTC and ETH volumes showed slightly different trends.

With more than $525 million in BTC and ETH options contracts expiring on December 27The year-end 2024 options expiration appears to be one of the largest yet, but expectations for volatility have remained subdued. The report highlights an unusual reversal in ETH’s volatility structure, but BTC did not reflect the reaction. Additionally, a change in financing rates, which sometimes turn negative as spot prices fall, signals a new phase in the market. Notably, BTC’s volatility structure has been less sensitive to changes in spot prices, while ETH’s short-term options exhibit more visible fluctuations.

Main conclusions:

BTC options expirations:

Over the past month, BTC’s realized volatility has been higher than implied volatility three times, reaching a relatively calm equilibrium each time. Open interest in BTC options remains high, contributing to increased potential volatility as the end of the year approaches. Around $360 million The value of BTC options (puts and calls) will soon expire, which may affect price movements.

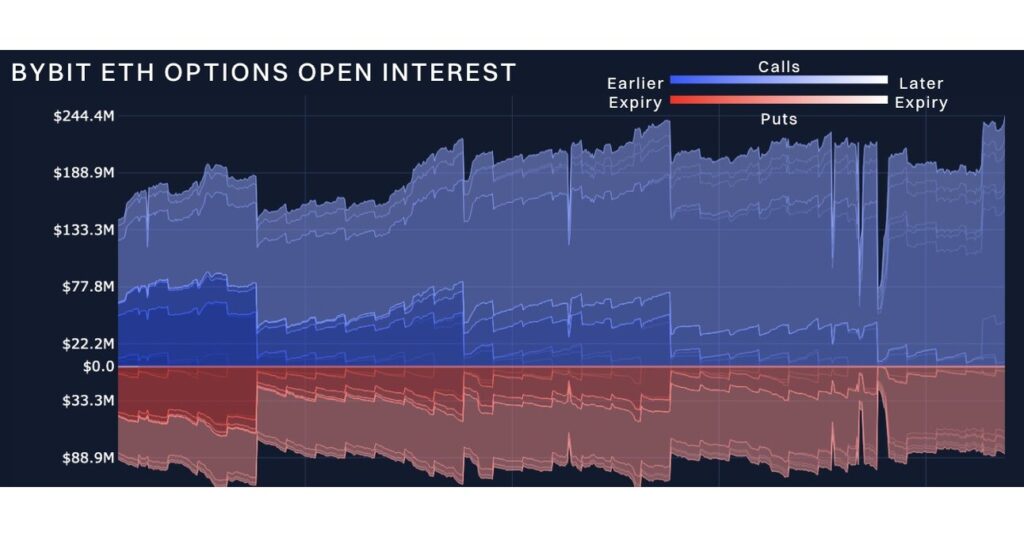

ETH Options: Calls Dominate

Despite a mid-week reversal, ETH’s volatility term structure has flattened, maintaining levels similar to those seen over the past month. During the last week of 2024, calls overwhelmed open positions in ETH options, although market movements and trading activity were more on the put side.

Access the full report:

Get deeper insights and explore potential impacts on your cryptocurrency trading strategies by downloading the full report here: Bybit X Block Scholes Crypto Derivatives Analysis Report (December 24, 2024)

#Bybit / #BybitSearch

About Bybit

Bybit is the world’s second largest cryptocurrency exchange by trading volume, serving a global community of over 60 million users. Founded in 2018, Bybit is redefining openness in the decentralized world by creating a simpler, open and equal ecosystem for all. With a strong focus on Web3, Bybit strategically partners with leading blockchain protocols to provide robust infrastructure and drive on-chain innovation. Renowned for its secure custody, diverse marketplaces, intuitive user experience, and advanced blockchain tools, Bybit bridges the gap between TradFi and DeFi, enabling builders, creators, and enthusiasts to unlock the full potential of Web3. Discover the future of decentralized finance on Bybit.com.

For media inquiries, please contact: (email protected)

For more information, please visit: https://www.bybit.com

For updates, please follow: Bybit Communities and Social Media

Discord | Facebook | Instagram | LinkedIn | Reddit | Telegram | TikTok | X | Youtube

Photo – https://mma.prnewswire.com/media/2587821/Sources_Bybit_Block_Scholes.jpg

Logo-